2013 Bank Priorities Are Remarkably Similar Worldwide

In our latest quarterly survey of US risk managers, we asked bankers about their institutions' priorities for 2013. Overwhelmingly we found that their top priority was increasi…

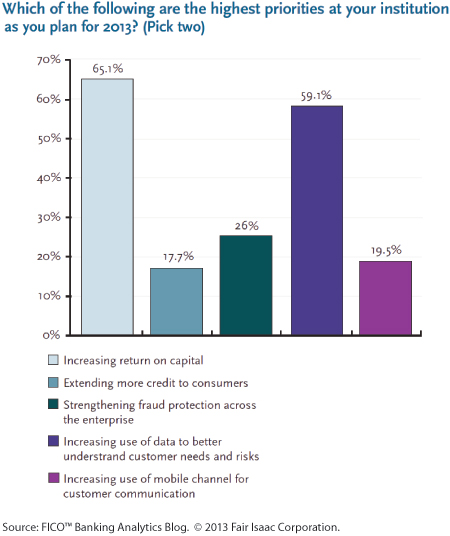

In our latest quarterly survey of US risk managers, we asked bankers about their institutions' priorities for 2013. Overwhelmingly we found that their top priority was increasing return on capital. Coming in as a close second was increasing their use of data to better understand customers.

It's a familiar tune—one we're hearing from banking institutions across the globe. In our last European Credit Risk survey, bankers there called out identical priorities for 2013, and I heard the same from Asian banking clients when I presented at last month’s FICO APAC Chief Risk Officer Forum. Last week, I was in China, and I’ve been reading the same thing in the Chinese financial press. Slowing growth rates, by their standards, and the threat of rising delinquencies are working to focus attention on return on capital.

There, as well as in the US and EMEA, this all translates into a better understanding of customers. The steps vary by market and the existing level of sophistication. It can mean something as simple as organising data better, to leveraging “Big Data” technology and tools to better understand customers, to complete reviews of process and changing the business metrics and organisation to be customer-focused.

What’s undoubtedly true is that this is a common trend. And just because the bank has been around a long time doesn’t mean it’s farther along!

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.