5 Scam Protections Customers Want from Their Bank

Learn the top five ways customers expect banks to improve their defenses against authorized push payment fraud and scams

Improving fraud detection in the face of a new wave of real-time payments (RTP) scams is becoming an imperative for banks — and consumers — around the world. In the 2023 FICO Global Scams Survey, we asked consumers worldwide what they think banks could do better to combat scams and create a better customer experience for victims.

Their top five responses provide a blueprint of customer-friendly steps banks can take to counter RTP scams and improve customer experiences when scams occur. For banks, bringing these steps to life is straightforward – below are the responses and actions you can take:

1. Implement better fraud detection

Survey responses: More than three-quarters (77%) of consumers worldwide believe their banks could provide better fraud detection to protect against scams. In the Philippines, this figure rises to 88%, though in the US just 64% of customers believe this is needed.

Action: Detecting a scam as it unfolds in real-time is the ideal way to stop scams from happening. Financial institutions (FIs) can use new artificial intelligence (AI) models, machine learning (ML) tools, and scoring methods, including retail banking models with a scam detection score. The right technology can help detect scams sooner and drive real-time actions, such as sending live warnings or pausing /stopping fund transfers.

2. Offer more warnings about emerging scams when making payments

Survey responses: Most consumers — 65% — would prefer to receive a timely reminder about emerging scams while making payments as a way to educate against them. In India and the Philippines, 70% or more of consumers would like to receive such warnings.

Action: When customers are aware of fraud schemes and how they work they are less likely to fall for them, but reminders or alerts are helpful. Banks should use real-time communications capabilities to send key messages throughout the customer lifecycle, which can include alerts when customers make unusual or non-routine payments.

3. Provide more warnings while making payments

Survey responses: More than half of consumers worldwide (57%) would like to see more warnings about scams while making real-time payments. In some markets, like Malaysia and Indonesia, this figure exceeds 75%, though in Germany only half of consumers agree.

Action: Real-time communications can also apply during the payment process. For example, a transaction that is flagged by real-time fraud detection as risky can trigger a real-time notification to the customer of a likely scam. Just 16% of customers have continued to send an RTP after this type of notification.

4. Engage in more collaboration between banks and other stakeholders

Survey responses: Just under half of all consumers overall (46%) think better collaboration among banks, telecoms, and other stakeholders could help to stop scams at the source. This sentiment varies widely by region. For example, 63% of consumers in the Philippines think this type of collaboration would help, while only 41% of consumers in Brazil and 34% in the USA agree.

Action: To combat fraud, collaboration should include live data exchanges. Telecom, cloud, social media, and financial service providers collectively possess a holistic view of the fraud environment. More data shared, analyzed, and incorporated into fraud management means better results and improved customer experience.

5. Use a “cool off period” for large payments

Survey responses: Nearly half (45%) of consumers worldwide think enforcing a “cooling off period” for larger payments is an improvement banks could make to combat scams. In Indonesia, Malaysia, and South Africa, however, 54% or more of consumers like the idea.

Action: Using analytics-based decisioning and rules-driven workflow automation, banks can trigger holding periods for payments above a specific threshold (such as those exceeding a percentage of the available balance) to allow customers to reconsider, or for further fraud investigation.

As my colleague Adam Davies, vice president of fraud and identity solutions here at FICO recently noted, “Banks can avoid reputational and regulatory impacts by using the latest in fraud prevention technology, such as the FICO Platform, which can help identify and stop existing and emerging threats before they can impact customers.”

What About Declining High-Risk Payments Outright?

From a traditional perspective, if a transaction such as a credit card charge or bank transfer is flagged as high risk, it is usually declined outright. The same rules do not apply to a RTP customer experience, however, because most consumers like real-time payments for the speed (87%) and ease (77%) with which they can transfer funds versus other methods. Declining or delaying a payment undercuts these very valuable benefits.

When asked how they would feel if their bank stopped a payment because it was likely to be a scam, however, 70% of consumers worldwide say they would feel positive. This figure hits 81% in India and 88% among consumers in Turkey.

The ability to stop a high risk, real-time payment infers both real-time detection and action, two fraud management capabilities that have become increasingly necessary as a result of authorized push payments fraud (APP fraud), AKA scams.

How Do You Deliver the News?

As important as detecting a scam is communicating it to customers. It should happen, ideally, before a loss occurs, but rapidly and thoroughly should the scam unfold. Real-time, two-way communication is necessary, as is personalizing and prioritizing that communication based on the customer’s most preferred channels.

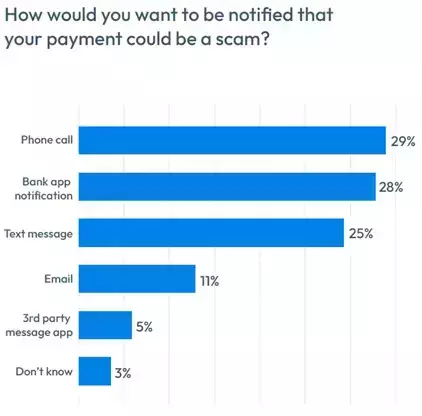

Worldwide, 84% of all consumers prefer three primary channels for receiving notification that a payment they have made or are in the process of making is likely to be a scam: phone, banking app, and text message.

- 29% of consumers worldwide would prefer a phone call to alert them to a scam.

- 28% prefer a message or notification from their banking app.

- 25% prefer to receive a text message.

These averages do hide some geographic nuances. In Indonesia, for example, 21% of customers prefer to receive a scam alert through a 3rd party messenger like WhatsApp, and just 11% prefer a text message. In the US, by contrast, 46% prefer a text message and just 1% or less prefer a 3rd party messenger.

Worldwide, just 11% of customers prefer to receive real-time fraud alerts via email, and only 5% by 3rd party messaging app. The preference for primary, real-time communication channels — phone, text, and app notification — align with the immediate and digital nature of real-time payments. Real-time payment scams require immediate real-time action.

How FICO Can Help You Fight Scams and Protect Your Customers

- Download the 2023 Global Scams Impact Survey

- Use real-time, two way omnichannel communications to confirm transactions in real-time with your customers.

- Read how FICO’s award-winning retail banking and scam detection model can help identify and stop potentially fraudulent RTP transactions.

- Explore FICO Platform for fighting fraud across the customer lifecycle.

- Join us at FICO World 2023 for insightful and engaging sessions about the global impact of RTP and scams. Register now!

Follow me on LinkedIn for more information about FICO’s innovative fraud fighting efforts.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.