8 Success Tips for Debt Collection in the Pandemic

From identifying vulnerable customers to storing the right data, here are best practices for debt collection in the current pandemic

Across EMEA, most countries have now moved past the peaks of the COVID-19 driven lockdowns and restrictions, but the challenges of debt collection in the pandemic remain. In Britain alone the International Monetary Fund predicted Britons will have to borrow more than £400 billion in two years as the recession caused by the pandemic delivers a blow to the public finances. There are other factors that will now further stress consumers, including the effect of sanctions from the current crisis in the Ukraine.

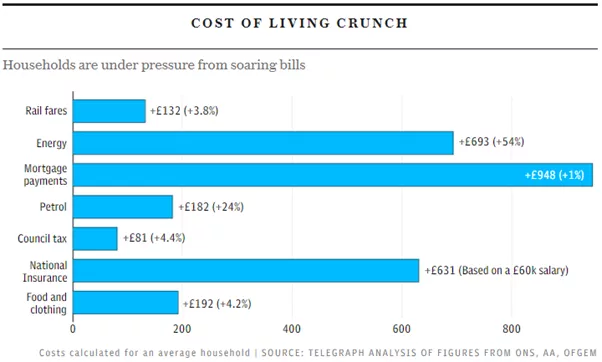

Collections departments have, for some time, been bracing themselves for a "debt tsunami" of people unable to meet their financial commitments. Whilst that peak did not appear — due to the combination of protected incomes, use of saving and a reduced spend on travel, luxury and social related discretionary expenses — financial vulnerability will become widespread in all markets as a consequence of inflation, increased tax and interest rates and skyrocketing energy costs.

Working with our clients across various sectors and geographies, we have seen first-hand what best practice in collections today looks like. I previously shared our top tips below to help everyone working in debt collection meet this unprecedented challenge.

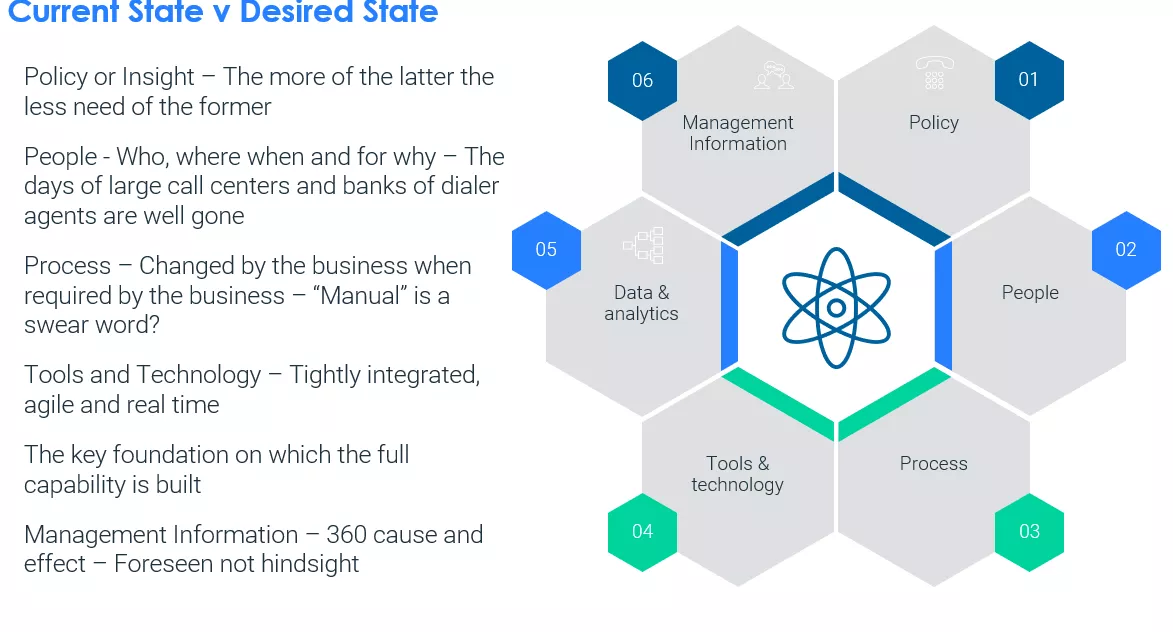

In order to enhance these capabilities, organisations have concentrated on three key pillars of capability:

- Advanced predictive and prescriptive analytics (decision optimisation) underpinned by the harnessing and orchestration of both internal and external data

- The ability to bring data-supported insights into strategies, treatment and customer interaction decisions at scale

- Bi-directional, omnichannel customer engagement facilitating customer auto-resolution 24/7

For many organisations these three pillars have been among the critical tenets of their digital transformation across the credit lifecycle.

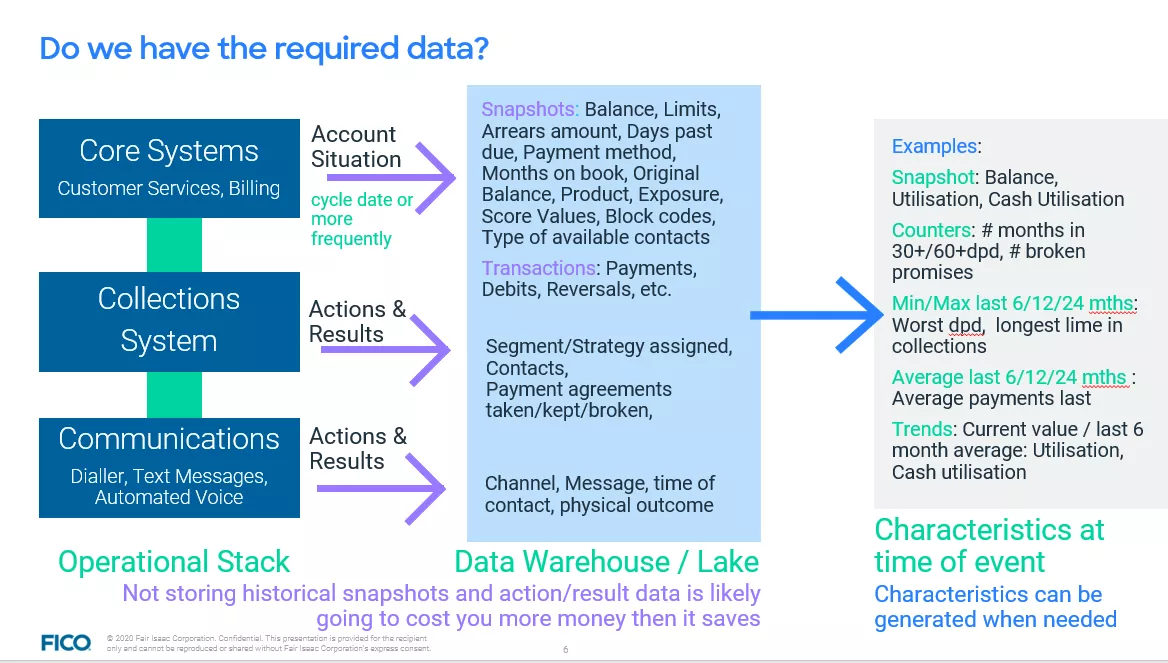

Tip 1 - What data do we need to identify the vulnerable?

It is essential to proactively identify the vulnerable. It is worth repeating that collections departments (both 1st and 3rd party, given the increase in early collections outsourcing) are now tasked with dealing with thousands of customers who are not in arrears due to the usual reasons and without the usual market data to help identify and segment them. For some customers, this resulted from a furlough with a rapid, surprising and significant reduction in income. Over the same period, we have seen a significant growth in BNPL borrowing. Both of these factors are considered somewhat invisible to the typical credit bureau.

As an industry we have always been proactive about predelinquency. But now we need to dig deep across our organisations to capture data and find the vital information needed to clearly separate the economic victims from the steady-state collections customers. We are likely to enter a period when consumers find it harder to service debts as the cost of living, tax and other liabilities increases. Data, such as open banking transactional profiling, that gives unparalleled insight into a consumer’s changing spending behaviour, is already recognised as key.

In many markets, we have seen that few customers in collections consent to sharing their data through open banking. Organisations need to look at how they secure that consent much earlier in the credit lifecycle and definitely at the point of early warning / pre delinquency. Obviously, credit card issuers have an advantage in being able to monitor changes in card transaction, merchant, value and frequency.

The data is there — be it from call, collections or communications systems — and we need access to this information as it will inform how we talk to our customers who need to be segregated carefully.

- Information that tells us how reliant on credit the customer is, card utilization, renewal of UPLs

- Information that tells us about their financial morality – transactor not revolver, direct debit payer, early settlements of UPLs, takes advantage of interest-free offers, low LTV, lower than average balloon payment in terms, number of credit lines

- For issuers – the changes in card transaction spend type and velocity

- Credit stress – number of new applications for credit internally and at bureau, frequency and degree of overdraft facility

- Whilst rare, any information about their industry, occupation, earning potential, stability (number of address & telephone number changes)

Without much of the above, these customers will typically be classed as low-risk customers. There is a real urgency to understand the true degree of risk on these customers — on which you know little, as they are not normally a collections customer.

No matter the cause of an economic downturn, the ‘economic victim’ customers are different. We need to ensure we have or can capture at the earliest possible opportunity, in a format that enables empirical use:

- The reason for delinquency

- The duration of impact

- The disposable income

- Affordability over time

- Industry sector and role within

This additional information is necessary to help us understand not only the consumer’s position now, but where they are likely going to be for the rest of this year and beyond. These are customers we will communicate regularly with, to understand the changing nature of their personal circumstances. We should also be looking to encourage permissions for routine monitoring through open banking, and watching for early signs of financial distress.

Three distinct debt collection phases

There are three distinct unforeseen event-related collections phases — tactical, mid-term and the more strategic long-term. Each requires a different approach to customer segmentation and communication.

- Tactical Phase - Day 1-90: Capturing the correct data to ensure the unusual event is registered, as reasons for the policyholder being delinquent will be critical in relation to both near-term relief and impairment reporting later in the timeframes outlined. Examples today would be the difference between EU customers seeing a significant increase in inflation, interest, tax and gearing on the household income, versus, say, Australia, where regional flooding has decimated livelihoods

- Mid-Term Day - 90-180: As tactical phase payment holidays expire, customers will require a pre-contact to ensure the right options are put in place for their best outcome in the longer term. Interaction will be essential at this point and with better segmentation; the customer journey may change to either a standard collections solution discussion or longer-term forbearance options. In either case, validated affordability will be important.

- Long-Term Strategic - Day 180+: Multiple touch points with the customer will be required to validate their financial/personal wellbeing. Understanding the reasons for payment holiday/forbearance will be critical for regulatory reporting.

Volumes of consumers entering collections were not as high as expected during and following the COVID-19 pandemic peaks. However, there is early evidence of increasing delinquency in some markets and as of March 2022, certainly across Europe, we would expect to see the implications of sanctions and the energy crises causing financial stress on many.

Customer journeys will get more complex. There could be a bigger share of vulnerable customers needing forbearance. Four UK tier 1 lenders have announced an expected £20.2 billion increase on impaired loans. We expect an increased need for digital-led payment plans and a higher demand for loan modification, so the longer-term financial impacts can be worked through. Ultimately, companies will have to manage higher impairments and losses, which will attract C-level attention to the overall collections and recovery performance.

Tip 2 - How can we better assess affordability?

We need to triage assessment levels — we need to know the degree of assessment necessary for someone who feels a short-term collections solution will suffice versus the amount of validation required for a customer seeking a long-term forbearance solution. Dig more deeply into household balance sheets and cash flow. Where it is available, use open banking data to determine accurate affordability assessments. Credit bureau data and other behavioural indicators will signpost trouble with current debt, as will the use of forward-looking analytics to detect the effect of incremental debt on default risk. Important will be to get confirmation of any ‘out of sight’ future financial commitments, such as BNPL liabilities.

There isn’t a single generally accepted measure of over-indebtedness or affordability risk and a combination of criteria and approaches should be applied to evaluate whether a person is overindebted.

Again, economic victim customers are different, as we don’t usually know what caused this consumer to default. Credit scores don’t tell us, so we need to continue to collect more data to gain a deeper understanding of the household balance sheet and investigate past financial behaviour data for signs of affordability challenges.

Tip 3 - What data do we need to collect to manage performance and regulations?

The additional data to capture in context of economic downturn includes:

- Reasons for hardship: Unemployed, reduced income, medical, quarantined.

- Type of relief applied: Payment holiday, reduced instalment – what financial relief, if any, the customer has had and when did it stop.

- Industry sector, so you can estimate need for prolongation.

This is not a static process but a dynamic one. Communication is key to achieve an update on the customer’s circumstances and to segregate those who are falling into delinquency.

Tip 4 - What is the best engagement strategy?

The best engagement strategy should be led by the customer — so how open can you make your systems to customers?

The ideal is an omnichannel approach — contacting the right customer through the right channel at the right time. Can you change your contact strategies quickly to enable customers to auto-resolve on omnichannel platforms including auto voice, iSMS/WhatsApp, digital direct API, email, mobile app, online or through edocs?

Tip 5 - How should we manage payment holidays ending?

The key here is to keep reviewing, as the customer debt profile will change significantly. Economic downturn customers typically have a higher financial morality and will likely be uncomfortable being in debt, with a higher intent to maintain their standard of living and service their debts.

Review your restructure toolkit. Can you optimise the selection using the right tool for the right customer segment? For example, can you provide a temporary solution which can be automatically reviewed frequently and perhaps free up creditor teams to focus phone capacity on those with most need?

It is essential to maintain contact to understand situational change and generate monthly updates via open banking, or chatbot to identify any changed circumstances.

This is a balance as you don’t want to over structure your process. Ask yourself these questions:

- Is your process fit for purpose? Can you save consumers and creditors multiple calls whilst also ensuring appropriate forbearance that enables continued debt servicing, which in turn will mitigate the long-term impacts on individuals, businesses and the economy?

- Can you protect consumers’ credit ratings during a crisis to enable access to credit? When the crisis ends, can you prove validity of credit scores and plan for a controlled way to enable people to return to “normal”?

- As we move past the crisis, can you offer an updated budget to enable a seamless transition into mainstream creditor repayments?

- Finally, for those with longer-term financial stress, can you enable a seamless digital transition into debt solutions through a virtual agent? In other words, can you take all the data insights, information validation and decisioning into your customer auto-resolve tools? Can you do so to the satisfaction of the regulator, the customer and your portfolio performance?

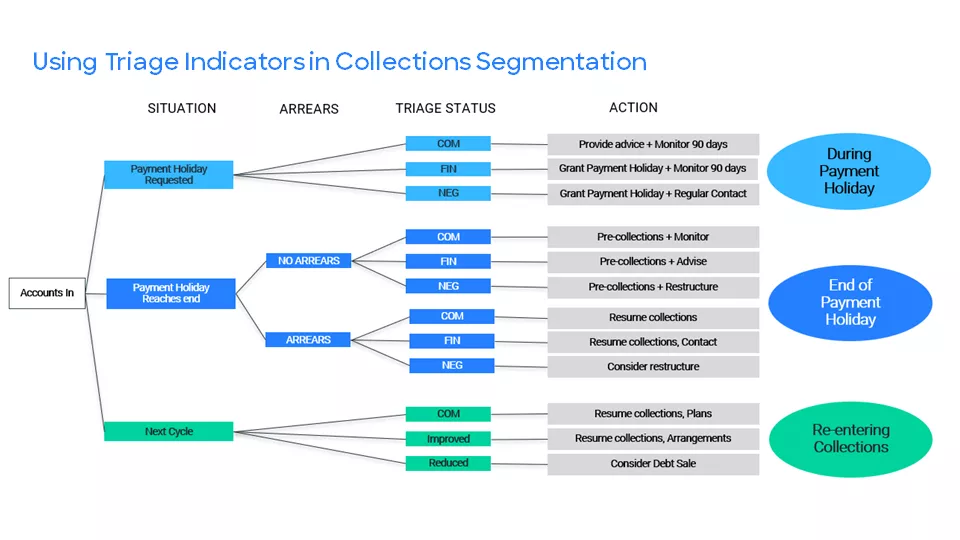

Tip 6 - How can we better segment customers for treatment?

Segmentation is a vital dynamic process. We need to look at pre-delinquency segmentation, payment protection segmentation and post-payment protection segmentation, and monitor how the segments change across these categories. Our decision science teams need to provide regular insight as to what they are seeing and how these insights should influence customer treatment decisions.

In the segmentation below, we can see how, as the phases progress, we are segmenting not necessarily by risk but more specifically by who we can let run with no need for help, who we need to assist or provide advice and stay close to, and who we need to assist and periodically monitor. This is about really strong prescriptive analytics.

Tip 7 - Advanced: How do we use data-driven strategies?

The current economic outlook provides the perfect opportunity to use mathematical optimization, which has long been available to debt collectors but too rarely used. This is the most sophisticated analytics available to determine decision strategies and specific actions that will best meet objectives given all the data available, and the prevalent constraints.

Optimization in collections can be applied across the different stages of the C&R lifecycle to solve different problems at each stage by defining the decisions that need to be made. Optimization helps evaluate and discover successful decision strategies which meet your business objective and cater to the conflicting constraints.

It can be used to explore different analytic techniques varying in sophistication, but it is vital to capture the right data for each technique and overlay decision modelling to optimize collections actions.

In early-stage collections, the key objective is to prevent accounts or consumers from rolling forward by being laser-focused on high-risk but collectable accounts and identifying low-risk self-cures for relaxed or no-action.

So in early stages, collections treatment strategy is about optimizing which channel, channel timing and channel messaging should be most suitable to which account to achieve your objectives, whilst also knowing who will accept and pay using the auto resolve channel, and who will go outside the channel. Also, who will not accept and roll forward?

In late-stage collections, the focus is more on collections forbearance and debt resolution, whilst assuring the right outcome for all parties. Management of non-performing loans and the identification of consumers that require related restructure / settlement is a key focus in this stage.

You need to design the process around the decisions. Optimization of restructure and settlement offers will include reviewing take-up, expected level of default and the aggregate impact on portfolio quality.

Post charge-off, the objective is to maximize recoveries by determining which accounts to work, which to place and which to sell. Keep your lens on assuring the right outcome for all parties.

When it comes to third-party placement, optimization can be used to determine which accounts to best place to which agency, in order to maximize recoveries. The optimisation is based on how each agency performs on different quality and types of debt placed with them, and the commission rates charged.

Optimization can also assist in strategies to determine which accounts are best to be worked internally vs accounts that should be placed or sold keeping in mind the expected value of the account, the probability to pay and the cost to work or place the account.

Tip 8 - What should we look for in a review of our operations?

A comprehensive analysis of policy, insight, people, processes, tools, technology, data, management information and data and analytics and strategy will deliver the path from current state to desired state. One of the best examples of operational negation is when analytics insight is ignored in order to gain operational efficiency — for example, ignoring the risk segmentation of accounts to build a larger dialing campaign! There are many common areas of poor practice because few organizations really have sight of policy, process and execution from data to insights, through workflow into operational execution and performance measurement.

Given the cost of bad debt on the balance sheet, it is still surprising how many organisations do not do a full annual assessment of their C&R capabilities and actual vs. potential performance to plan & forecast.

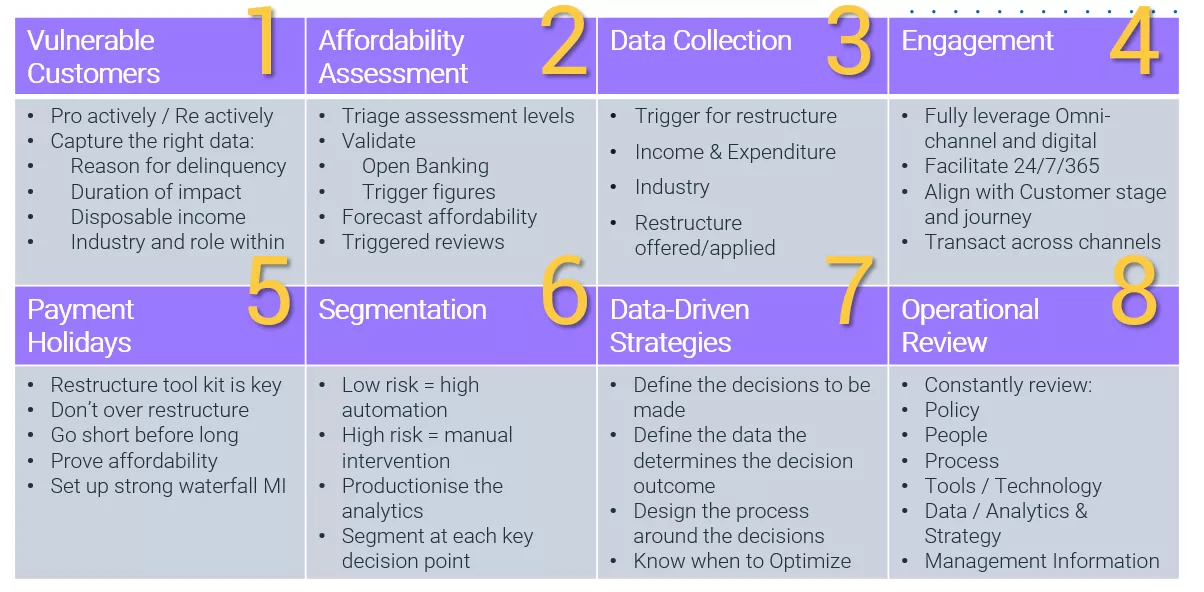

Here is a “cheat sheet” of the 8 steps I presented.

Final note: In the past two years not only have capabilities advanced, so has the industry jargon. In most markets, the recognition that good customers enter bad circumstances (and as underlined by the pandemic, in situations outside of their control) has caused organisations to change the vocabulary they use when it comes to in arrears customers. ‘Debt collection’ has become ‘debt resolution’, ‘financial difficulty’ to ‘financially vulnerable’, ‘can’t pay / won’t pay’ to ‘forecasted affordability’.

These words are not just semantics, they are drivers of capability change. In order to amicably resolve credit repayment due to financial vulnerability, creditors need to have strong assessments of current and future affordability, robust customer profiling and an understanding of customer behaviour both past and prescriptive.

For more information, see this video recorded in July 2021:

You can also review other posts on this topic:

- Debt Collection Approaches For The Covid-19 Recovery

- Debt Collection and COVID-19: A Phased Approach

- Debt Collection and COVID-19: What Past Crises Can Teach Us

- Is Your Collection Operation Stepping Up to the Pandemic Challenge?

How FICO Can Help You Manage Debt Collection

- Explore our solutions for debt collection and recovery

- See our solution for customer communications with borrowers

- Watch the webinar with Bruce Curry and Matt Higginson of McKinsey on digital-first collections

This is an update of a post originally published in July 2020.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.