Addressing Portfolio Risk in Economic Uncertainty: Part 4 (2022)

Building portfolio risk resilience into Collections & Recovery

Properly managed and strategized, the debt collections process can be an effective customer service asset and anti-attrition tool, in addition to being its classic role in portfolio risk management. Financial impairment resulting from unanticipated events is often temporary. Such events cast many borrowers into uncomfortable territory, creating what may be a defining moment in the relationship between them and their lenders. Lenders who get the strategy right may earn a loyal customer for life, while those who misfire risk cannibalizing valuable long-term relationships that often span multiple asset classes.

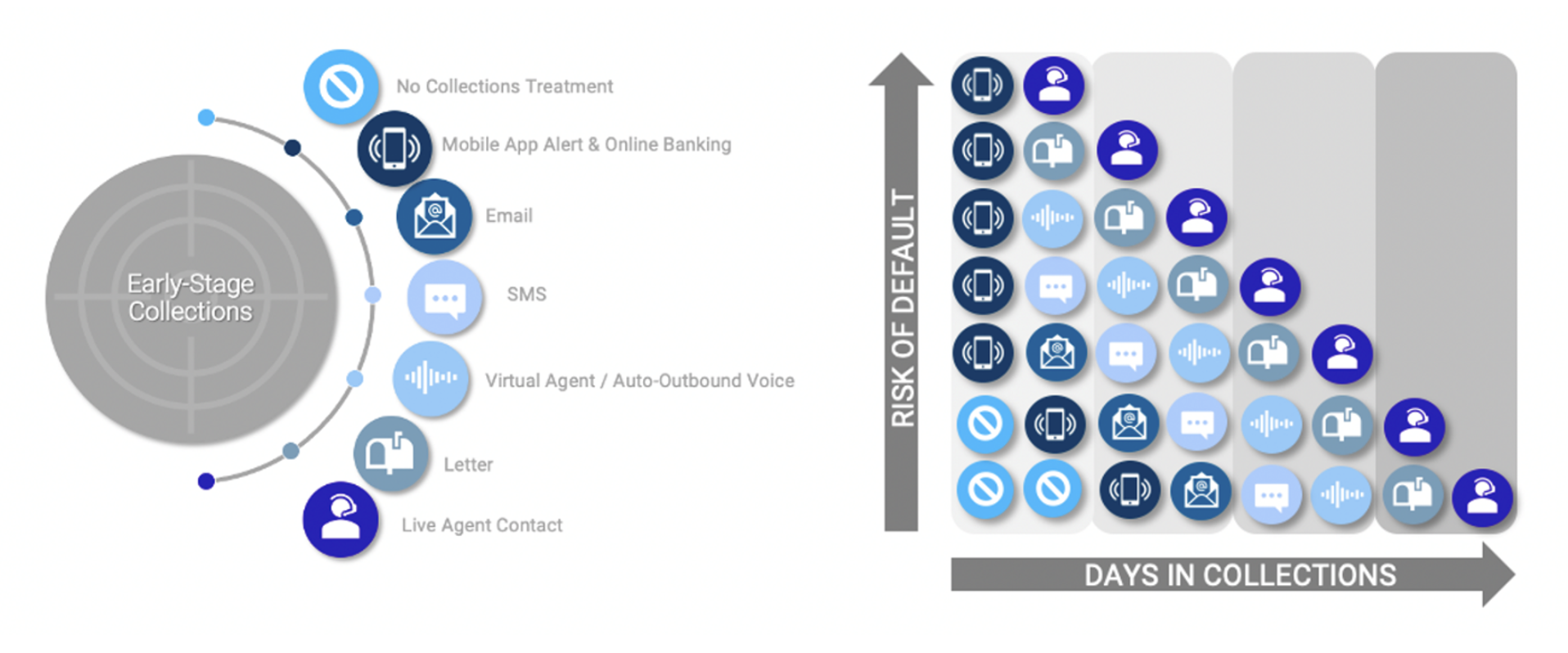

Nowhere across the consumer credit lifecycle are the stakes higher than in early-stage collections, where the uncertainty of outcomes and the range of treatment options is the greatest. Early-stage collections strategies offer a wide range of choices around contact channel as well as timing, tone, and intensity (i.e., penetration rate) of live-agent calls (Figure 1).

With so much on the line, it creates a lender imperative to leverage a precise view of risk management profiles to best target customer treatments. Key questions include:

- Which borrowers in early-stage delinquency have a high likelihood to self-resolve with little or no collections intervention?

- To whom should we apply the least invasive initial collections efforts such as reminder emails, courtesy text alert and virtual agent (i.e., IVR) contacts?

- Conversely, which customer portfolio segments have an elevated probability of default warranting live agent contact, greater investment, and more forceful early intervention options?

Figure 1: Early-stage collections contact options and illustration of treatment prioritization by risk.

Managing the optimal collections investment strategy is a crucial aspect of portfolio risk management. Underestimating less resilient delinquent borrowers’ default risk under stress results in a reduced collections priority, allowing other creditors to compete more effectively for limited repayment resources. Conversely, overestimating more resilient borrowers’ credit risk at such times may drive unduly aggressive collections tactics that improve short-term debt collection for the portfolio but jeopardize the long-term customer relationship.

In this blog post, we examine how the behaviors of resilient and sensitive delinquent borrowers differ, and how FICO® Resilience Index can enable and manage a more efficient and effective collections strategy for lending portfolios that balances short-term cash portfolio risk management and longer-term customer relationship goals.

Sensitivity profile comparisons reveal value of FICO® Resilience Index in driving collections priority

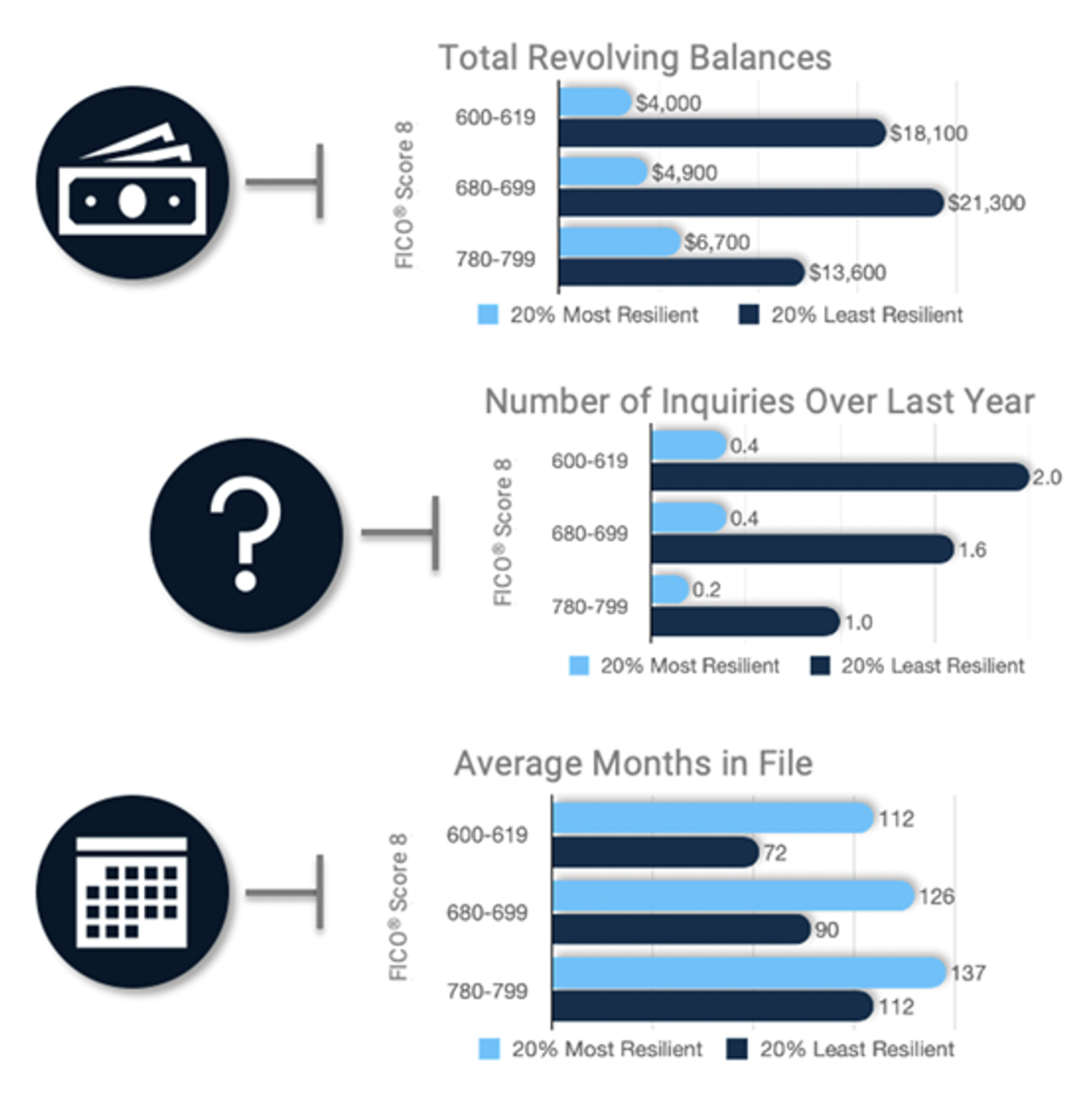

Comparing credit usage profiles of resilient and sensitive consumers in a portfolio with existing 30+ day delinquent tradelines highlights the value of FICO® Resilience Index to customize and manage collections treatments. As seen in Figure 2, the 20% least resilient delinquent borrowers in a portfolio carry significantly higher revolving balances, have more aggressively pursued new credit, and have markedly less credit experience as compared to the 20% most resilient counterparts in the same portfolio across the full range of FICO® Scores. Less resilient borrowers within a FICO Score band should therefore be prioritized during stressful times as both their probability of default and outstanding assets tend to be higher, resulting in larger overall credit losses.

Figure 2: FICO® Resilience Index delinquent consumer sensitivity profile comparisons.

Repayment performance for delinquent consumers post-recession

Our previous blogs about building portfolio resilience into customer acquisition and customer management confirmed that resilient consumer portfolio segments consistently outperformed sensitive ones within narrow FICO® Score bands as the economy transitioned from an unstressed to a stressed environment.

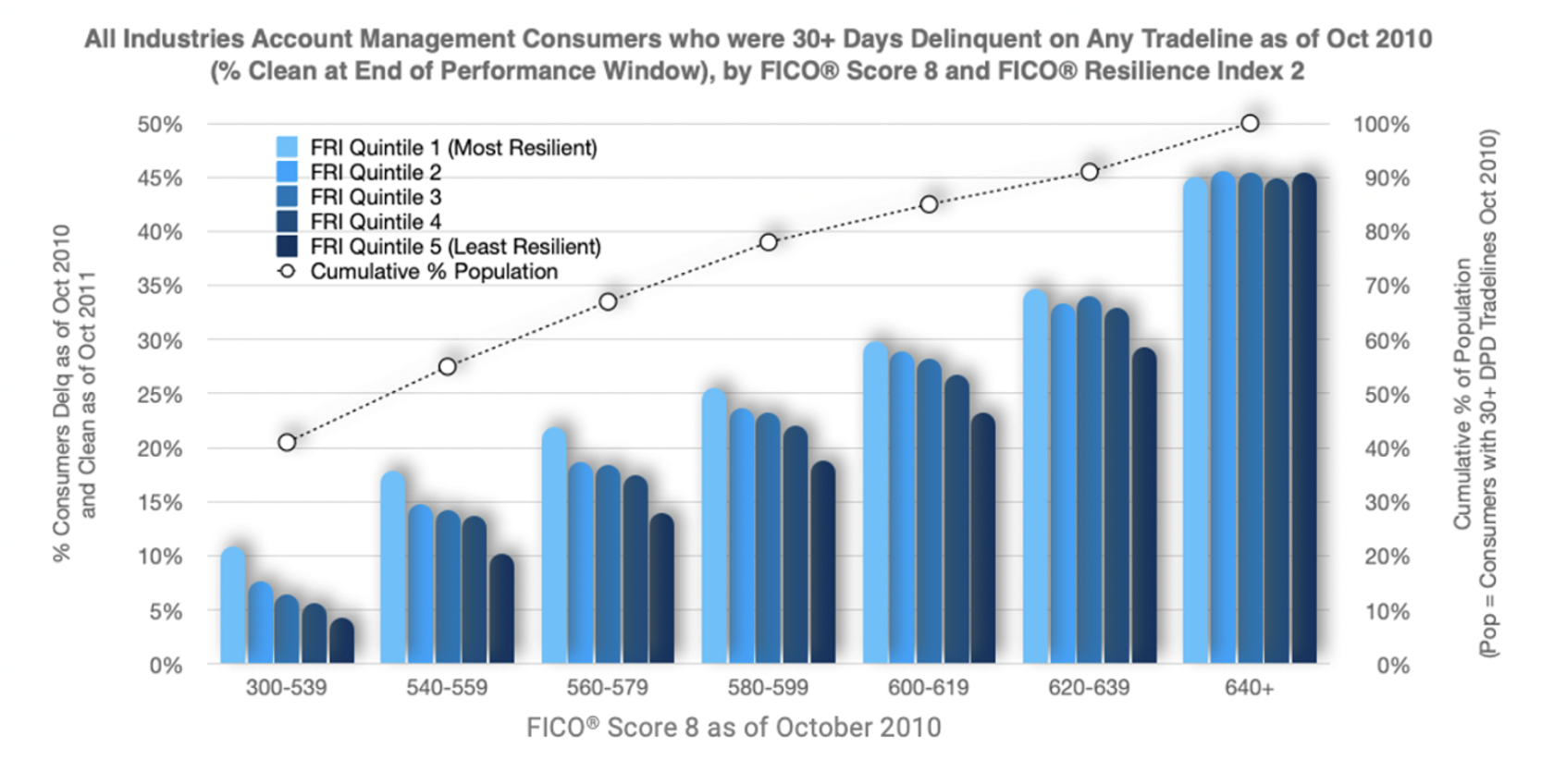

But what can we expect within less resilient delinquent consumer portfolio segments as the economy begins to recover from a downturn? Using the period following the Great Recession as a point of reference, we isolated consumers in October 2010 with 30+ days past due delinquent tradelines and analyzed their ability to return to current status, as well as their likelihood of experiencing new serious delinquencies, over the year of economic recovery that followed.

Figure 3 shows the percentage of these delinquent consumers who had clean credit files (i.e., no 30+ day delinquencies) a year later. Within FICO® Score bands below 640, which collectively represented 91% of the delinquent population, FICO® Resilience Index quintiles (reverse) rank-ordered borrowers’ ability to “bounce back” as the economy recovered from its prolonged disruption, especially in the lowest FICO Score ranges where more delinquent consumers reside. For example, in the sub-540 FICO Score population, which alone captures 41% of the existing delinquent borrower population, the most resilient consumers are 2.5 times more likely to become clean than the least resilient consumers (10.9% versus 4.3%, respectively).

Figure 3: Percentage of consumers with 30+ day delinquent trades as of October 2010 and no delinquent trades by October 2011.

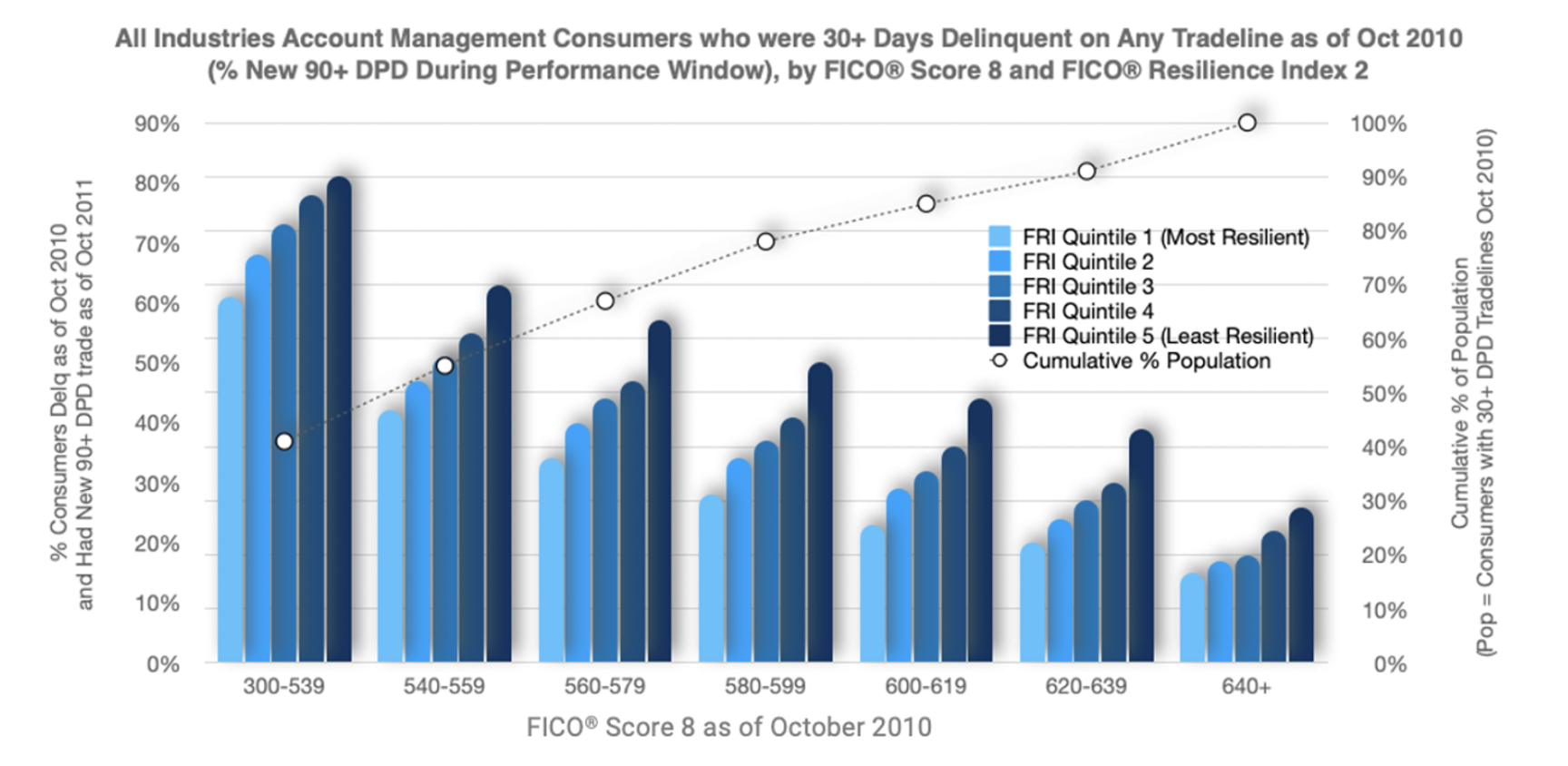

Similarly, we studied the ability of FICO® Resilience Index to rank-order delinquent borrowers’ rate of new defaults in a portfolio in the aftermath of a recession. For this same population of already delinquent borrowers in a portfolio as of October 2010, we analyzed the rate of new 90+ day delinquencies in the following twelve months (Figure 4). Within each FICO® Score band, FICO Resilience Index rank-ordered the risk of new post-recession defaults, which remained elevated despite an improving economy. In the same sub-540 FICO® Score segment, the least resilient consumer portfolio segment had default rates 33% higher than the most resilient portfolio segment (81% versus 61%, respectively). The rank-ordering was evident across all FICO Score bands.

Figure 4: Percentage of consumers with 30+ day delinquent trades in October 2010 and new 90+ DPD trades as of October 2011.

Summary

Responsible borrowers never intend to enter collections, but some economic situations can have unexpected impacts on personal portfolios and assets making delinquency unavoidable. FICO® Resilience Index uncovers hidden risk patterns that allow lenders to develop targeted strategies to support portfolio risk management while simultaneously promoting the best customer collections experience possible, especially in the fragile early stages of an economic recovery. Prioritizing and tailoring treatments of early-stage delinquent customers based on their resilience can thereby lead to more efficient collections and stronger long-term customer relationships.

Please visit the FICO Blog to find all four parts of this series and to keep up to date on all of FICO’s latest insights and offerings.

To gain more background about the FICO® Resilience Index, please visit https://www.fico.com/en/products/fico-resilience-index.

This blog is co-authored with David Binder, Senior Director of Scores Product Management.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.