Advanced IFRS 9 Solution Launches in UAE

Organisations of all sizes can benefit from this service from FICO and the AECB

I recently had the opportunity to attend and present at the Al Etihad Credit Bureau launch event for their IFRS 9 solution at the Palace Hotel Dubai. The attendance for the event was fantastic, with more than 100 senior delegates representing 40+ banks and finance companies from the UAE.

The IFRS 9 solution builds upon the rich source of holistic data on consumers and businesses that is supplied to and hosted at AECB. It analyzes the data to develop highly predictive models that provide granular estimates of Expected Credit Loss (ECL) that fully comply with the principles of the IFRS 9 standard and meet the requirements of the UAE Central Bank. These models are then executed within FICO’s Impairment Management Solution, which can execute the complex calculations for the entire UAE credit market in a couple of hours and provide an extremely comprehensive reporting package to help understand the key drivers of Expected Credit Loss.

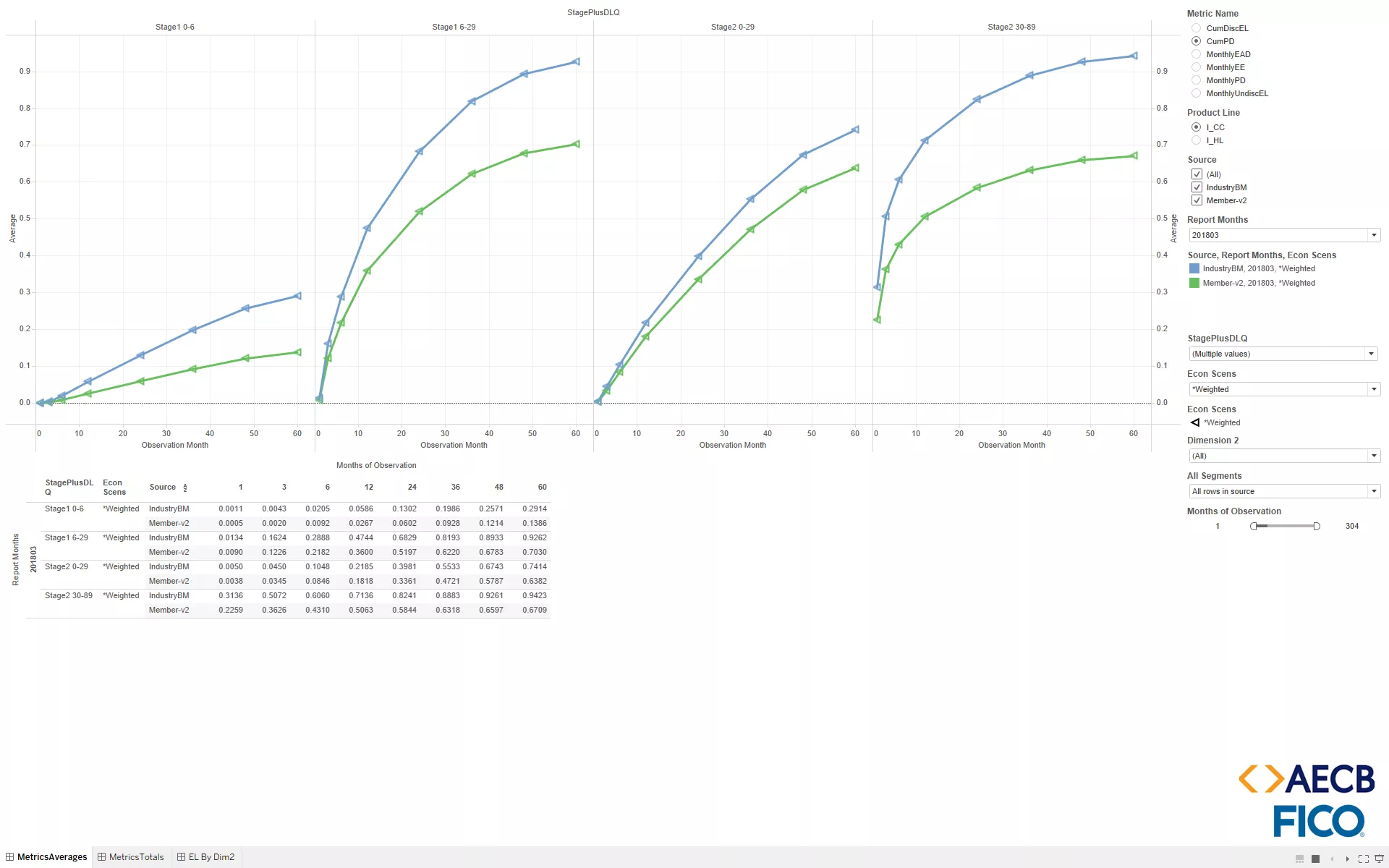

As someone who has been responsible for the production of IFRS 9 numbers, the level of detail provided in the reports package is something that I would have loved as a practitioner. The reports allow you to dissect the Expected Credit Loss amounts, rates and distributions by various segments, including IFRS 9 Stage, delinquency, product, vintage etc. The package also allows you to assess how all the metrics are impacted by the different economic scenarios and how they compare to the weighted scenario. You can understand the key drivers of ECL through the component package that provides the monthly curves and evolution of PD, EAD, LGD and Expected Loss, whilst the portfolio evolution can be interrogated through the monthly transitions and disclosures report package.

PD Monthly Evolution by Stage

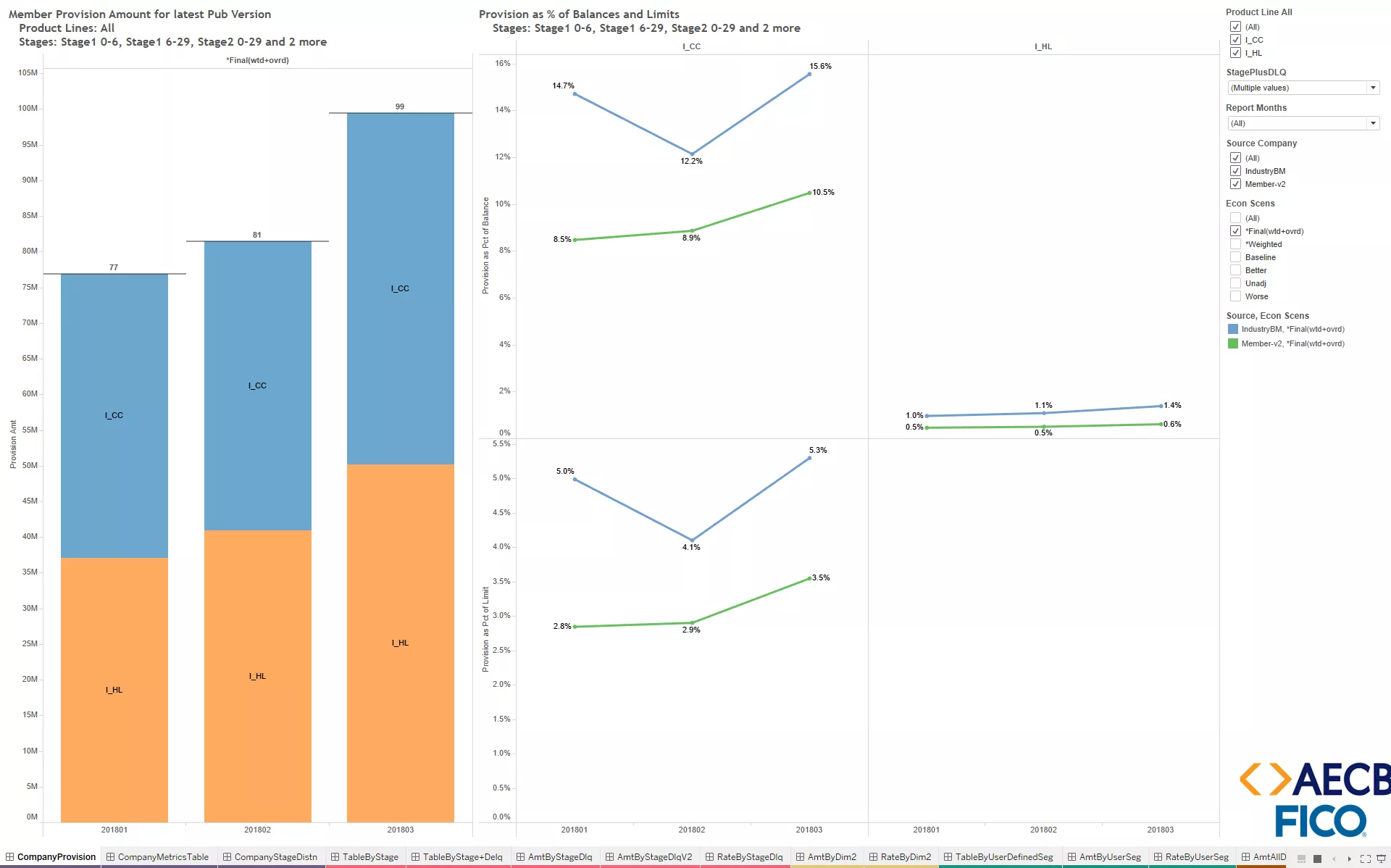

Members that sign up to this service will also receive benchmark reports that show a comparison of their portfolios to industry and peer benchmarks using a common set of models, assumptions and economic.

Provision Rate Comparison with Industry Benchmark

The discussions at our launch event really highlighted the need for this type of service, with smaller organisations getting access to more granular and sophisticated models than they could build using their own data, larger organisations leveraging the solution for some of their smaller portfolios, and other organisations leveraging the rich interactive reporting and benchmarking capabilities.

The IFRS 9 solution also offers a degree of customization. With many organisations now looking at second-generation models and more strategic deployments, discussions are quickly moving to how the platform can be used as a compliance service to reduce the cost of ownership.

It was a pleasure to be part of such a successful launch of an IFRS 9 solution that will bring long-lasting benefits to members. One of the major takeaways from me was a discussion I had with the Head of Impairment for a multi-national organization, who enquired if similar solutions were available in other jurisdictions. Given the varied benefits of this type of solution, I think it is just a matter of when, not if.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.