Agile Collections Strategies Can Protect Loyalty in Tough Times

As economic victims swell the collections queue, do you have the tools you need to differentiate them and apply the correct treatments to different cohorts?

As 2023 begins, it is clear many lenders are at a metaphorical fork in the road when it comes to devising smart, agile collections strategies that will safeguard their customers and cement long-term loyalty, simply by helping them ride out the impact of the ongoing squeeze on household incomes.

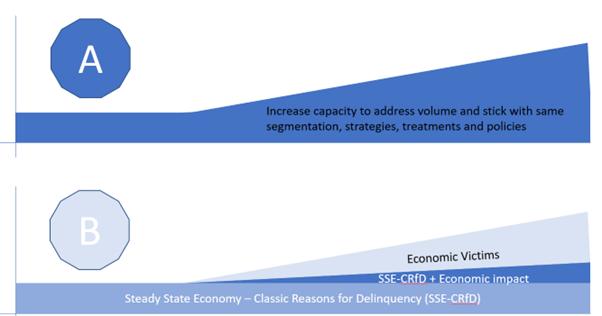

Let’s look at the two paths many lenders are taking:

Route A will take lenders down a dead-end road to mass collections and customer insolvency. It's a fixed and unyielding lending strategy based on simply increasing back-office capacity to tackle high volumes of pre-set segmentations, strategies, treatments and policies. It's also a fast route to sizeable delinquency, losses and write-offs.

Route B offers a far more agile and holistic route, it works by easing customers out of the current spending crunch. By analysing, calling out and catering for the differing ‘return to good’ profiles of the three headline cohorts, lenders can adapt treatments to best suit each segment.

For the two cohorts that have fallen foul of the current economic headache, smart treatments include adjusting default and write-off policies to ensure they get a chance to return to form, changing the terms and objectives of debt sale and contingency placement contracts, while also reviewing and aligning collection and forbearance solutions.

Managing expectations around the different impairment time series for each cohort buys more time to enable them to get back to a solid financial footing, rather than forcing them down a delinquents’ path of no return.

Experience also shows that setting targets for the retention of future good customers is a useful way to safeguard portfolios and win long-term consumer loyalty. In fact, near-term results should speak for themselves, with a timely contribution to successful mitigation of the cost of living and economic crises, suitably high ongoing balance sheet yields and a growing market share of satisfied customers.

Intuitive And Smart Collections Strategies to Offer Customer Safeguards

None of this thinking is revolutionary. There are really four factors shaping analytic insights, strategy, policy and execution when it comes to successful and agile collections.

During the last recession, we learned that customers who went into collections exclusively as a consequence of the economic downturn, had a dramatically different return to financial good (RtFG) of nine months, compared to the 2.5 years it took typical collections customers. It’s an area FICO has already analysed.

Consumers hit exclusively by an economic downturn – so-called economic victims - typically are embarrassed, concerned and object to being in an arrears’ situation. In fact, they will do whatever it takes to get back to their definition of ‘normal’. Once a route to creditworthiness is redefined, they are often reluctant to compromise on their pre-agreed financial plans.

Right now, it’s fair to say the vast majority of customers swelling the collections queue will also be economic victims. There’s an obligation to ask whether enough is being done to optimize collection strategies while putting in the work to support customers in a time of need. For instance, can you:

- Accurately profile and identify economic victims?

- Adjust policies, collection strategies and treatment paths to suit accordingly?

- Apply the right level of tolerance to consistently drive the right outcomes?

Don’t Let Credit Policy Become a Driver of Delinquency

There’s always been a need for policies, but they can also be used as a convenient cover for ignorance. If a lender is sufficiently well-informed about their customer, a better and more appropriate treatment should be available beyond the stringent guardrails imposed by an historic policy. Collections policies typically impose a combination of any of the following conditions:

- The customer must be able pay at least one full arrears instalment.

- Any promised payment must be made within 10 days.

- Repayment plans cannot exceed six months or more than one plan per year.

- A maximum three-month extension can only be offered as and when it’s appropriate.

- Only one payment holiday per year is allowed.

- A short settlement of a maximum 20% is acceptable.

In fact, most of these policies simply fail to accurately fit the circumstances many customers find themselves in. While one customer might be able to afford half a contractual instalment, another can afford one and a half times their instalment. Another customer may only need a two-month extension, but another may need four months. One customer might be at the end of their credit term but have no future source of income while having other repayments fully up to date. Another might only have one product but be at the beginning of a long-term credit agreement — a 20% settlement for either of these is likely to be completely wrong in both instances.

Agility, Flexibility and Timely Communications Are Keys to Unlocking Success

Without accurate insights to determine the right outcomes policies simply become the default decision-maker. But policies drive the wrong outcome far too often.

Leveraging existing capabilities that drive the data and analytic insights needed for customer-centric decisioning is by far the most effective way to maximise the value of an agreed outcome for both the customer and creditor and to the satisfaction of the regulator. Timely, omni-channel communications will offer help to at-risk and stressed customers.

Regardless of whether a regulator wants to see evidence of right outcome, or the company’s boardroom wants to ensure the positive value of appropriate customer treatment, it will always be necessary to leverage the very best data, analytics, insights, decision execution and reporting capabilities that exist today. If it’s not possible to accurately identify and strategize for the treatment of financially stressed customers, then in all likelihood they are being lost at scale.

Bad Forbearance Costs

The global pandemic has clouded the clarity around customer risk that was expected to be provided in part through reporting under IFRS 9. In most markets, the response hinged on financial protection to both society and business. It ran for the first full period of reporting under IFRS 9, prompting many discussions about the real degree of risk.

But the widely predicted tidal wave of debt didn’t materialise, thanks to the financial protections that were granted to consumers, while collections portfolios were reduced as lockdowns limited discretionary spending, allowing a greater level of debt servicing.

Now, the emerging economic downturn is being aggravated by a combination of inflation, interest rates and rising energy costs. The fiscal protection will not be the same as provided during the pandemic. As a result, lenders’ collections’ books are already growing.

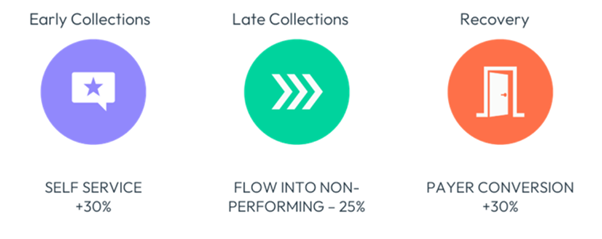

Creditors that don’t have scalable and agile orchestrated digital channels will struggle to manage the high volume of activity already emerging at the pre-delinquency and early collections’ stages. In fact, some customers will get pushed to Stage 2 and Stage 3, simply because the volume of late-payers simply cannot be effectively managed, rather than because the risk is greater for these customers.

Instances of customers being given the wrong collections or forbearance solution at the outset are likely to have a significant knock-on effect with higher volumes defaulting. It’s a situation that can only be resolved through the dynamic, appropriate and smart use of data, analytics and insights to help inform treatments. Those that fail to enable the required capabilities will not identify high-quality customers, will treat all in line with pre-set policies and will be unable to evidence or offer the right treatments.

Two-way digital dialogue is vital to helping customers steer clear of default and delinquency

Cost-Effective Collections Tactics

Volumes are unlikely to be well-managed at a reasonable cost if pre-delinquency and early collections are predominantly dealt with by call centres. The availability of bi-directional, omnichannel platforms and the very clear evidence of adoption by society really call into question any collections shop that still has a heavy reliance on an inbound line and outbound dialler; yes, they have their place, but they should be seen as serving a tiny minority of customers, with digital auto-resolution / self-service looking after the vast majority.

Organisations that are able to apply insights and determine appropriate action to ensure the right outcome for the numerous customer segments will have or be looking for more capabilities to ensure they can position collections as a competitive advantage.

When considering the go-forward segmentation, strategies, range of forbearance solutions and means to determine the right outcomes, reflecting on the past lessons learned will ensure more success.

How FICO Can Help with Pre-Collections and Informed Collections Strategies

- Read the blog Debt Collection: Have We Learned the Lessons of the Last Crises?

- Watch a video on why customer-centric debt collection is critical.

- Read the post Even in a Crisis, the Best Collections Strategy Is to Avoid Collections.

- Find out why digital-first collections means thinking like a marketer.

- Read more background to the IFRS 9 learnings on models and operations.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.