Are Credit Standards Relaxing as the Housing Market Heats Up?

With some US housing markets heating up, new FICO research shows a potentially troubling trend: credit standards appear to be loosening, particularly in parts of California and Tex…

With some US housing markets heating up, new FICO research shows a potentially troubling trend: credit standards appear to be loosening, particularly in parts of California and Texas.

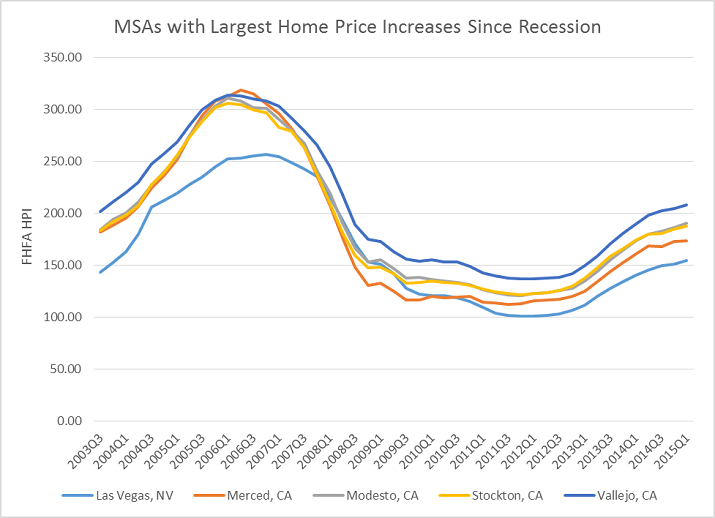

In this blog post, I’ll share key findings from this mortgage research study. First, we identified the cities experiencing the largest home price increases since the Great Recession – specifically, Q1 2015 home prices compared to the minimum home price since Q4 2009.

The chart below illustrates the Federal Housing Finance Agency’s (FHFA) House Price Index (HPI) for the five Metropolitan Statistical Areas (MSAs) with the largest housing price increases during this timeframe:

Las Vegas was one of the hardest hit cities during the recession. But what’s most striking about this analysis is the concentration of Central California MSAs among the top five. All of these cities saw severe home price decreases, but in recent years, it’s very much a story of recovery.

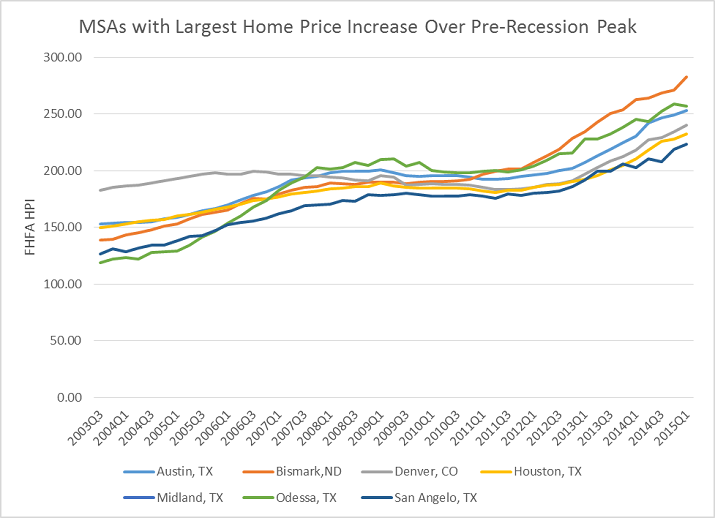

We see a very different story looking at regions with the largest home price increases over their pre-recession peaks – specifically, Q1 2015 HPI compared to the maximum HPI between Q3 2003 and Q4 2012:

I included the top seven here to illustrate the presence of additional MSAs in Texas. For these MSAs, house prices dipped little, if at all, during the recession, and then resumed their upward trajectories once the economy improved.

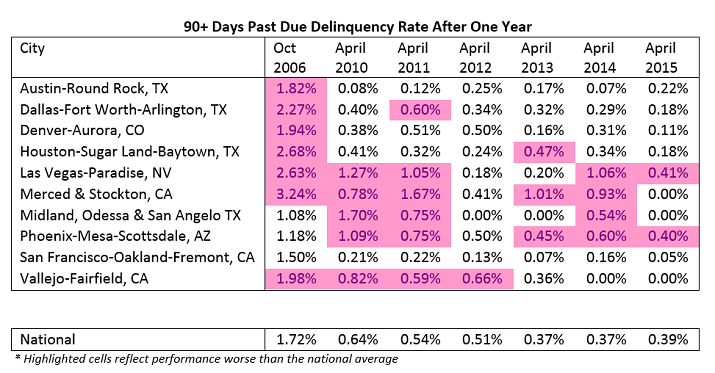

Next, we looked at delinquency rates of recently opened home loans in these two groups of cities. The following table shows the percent of consumers who opened a mortgage loan within three months after the date listed and went 90+ days past due or worse over the subsequent 12-month period. I’ve highlighted delinquency rates higher than the national average in each year:

Consider these numbers as benchmarks to illustrate trends, rather than absolute stats. We used a persistent 5% sample of the US population for our analysis, and as a result, the number of loans booked in these three-month intervals was sometimes small, particularly in the smaller cities. Furthermore, we combined results for Merced and Stockton, as well as for Midland, Odessa and San Angelo. These cities had low numbers in our sample, and they appeared to have related economic conditions.

Sufficient data exists to draw some definite conclusions. First, national mortgage delinquency rates have been trending downward for the past five years, and now clock in at less than 0.4% of newly originated loans. Also, despite notoriously high housing prices in the San Francisco Bay Area, consumers in this region have consistently paid their home loans at rates better than the national average. By contrast, Merced, Stockton, Phoenix and Las Vegas have consistently performed worse than the national average.

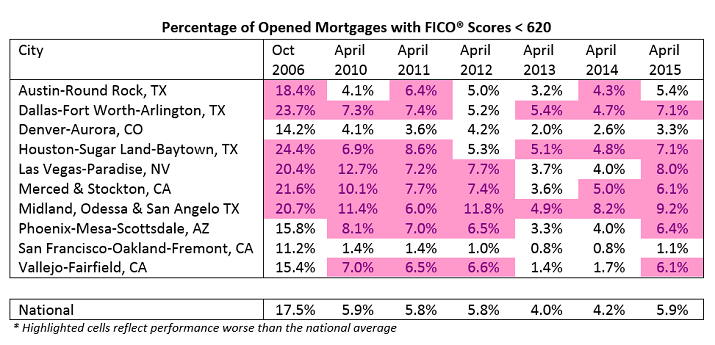

Finally, we examined these recently booked mortgages for signs of loosening credit standards. An interesting picture develops when we layer on the percentage of new mortgages granted to consumers with FICO® Scores less than 620:

The rate of mortgages to consumers with scores of less than 620 has been increasing nationally for the last two years. This could be a sign of a loosening in credit standards by mortgage lenders.

Moreover, of the cities that experienced the largest housing price gains, most have granted loans to low-scoring consumers at rates above the national average, except for San Francisco, Denver and Bismarck. These rates have increased significantly this year, compared to 2013. For the US as a whole, 48% more consumers with new mortgages have FICO® Scores less than 620. In some MSAs, the increase is much more dramatic, with Vallejo having more than four times as many such consumers. It should be noted, though, that none of these rates are, as yet, approaching what we saw in 2006.

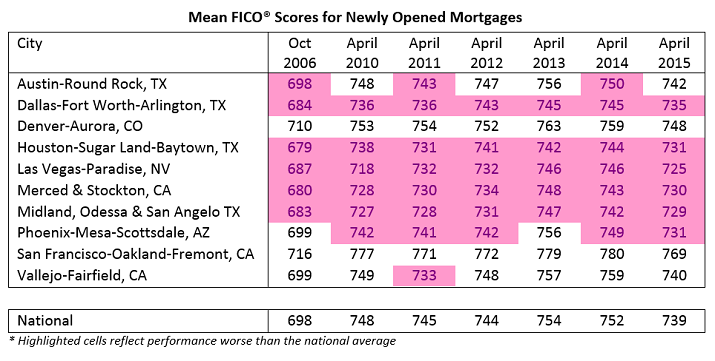

We also examined mean FICO® Scores for these newly opened mortgages:

Generally, mean FICO® Scores have been decreasing since 2013, with a large part of this decrease occurring in the past year – another potential sign of relaxing credit standards.

In summary, it appears that a few housing markets – particularly Texas and California’s Central Valley – are experiencing strong increases in housing prices along with a measurable loosening of credit standards. While credit performance remains quite good, both Texas and California are undergoing external economic stress that could be cause for concern; specifically, low oil prices are affecting the oil business in Texas, while sustained drought in California is straining its agricultural industry.

With multiple credit and economic factors at play, Texas and California may very well become a bellwether of sorts for the next housing downturn. As a result, we’ll continue to keep a close eye on credit performance of these regions in the coming years.

I’d like to gratefully acknowledge the help of intern Eric Yang in conducting this analysis.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.