Asia’s Love of E-Shopping Draws Unhealthy Suitors — Criminals

Consumers in China, Indonesia and South-East Asia are creating a boom in online shopping and ecommerce transactions. A rising middle class, improved internet and logistics and wide…

Consumers in China, Indonesia and South-East Asia are creating a boom in online shopping and ecommerce transactions. A rising middle class, improved internet and logistics and wide-scale uptake of credit cards are driving this trend, with Asia Pacific set to overtake North America as the largest e-commerce market in the world. Research firm eMarketer estimates that B2C e-commerce sales in APAC this year will reach US$525.2 billion, versus US$482.6 billion in North America.

This honeypot has attracted organized crime. Criminals have been victimizing consumers who are new to ideas Westerners take for granted, such as protecting their credit card details, and regional banks that have not updated their security networks. In Asia Pacific, we estimate that fraud losses have reached US$420 million per year and are on the increase at a rate of 20-25% per annum. Increasing agility, leveraging analytics, avoiding data breaches and enacting customer centricity are key in the fight against opportunistic criminals.

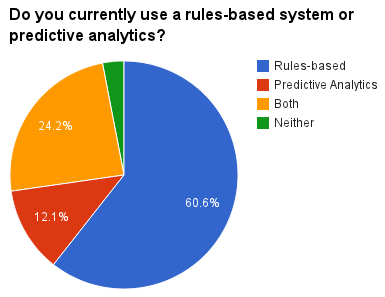

At our annual fraud forum in Singapore, the topic of ecommerce or card-not-present (CNP) fraud was a key concern. Thirty-six Heads of fraud from twenty-six banks were keenly interested in how new predictive analytic innovations rather than traditional rules-based systems can help defend customers more effectively. It is clear there’s an increasing need for a way to act in real-time across multiple channels.

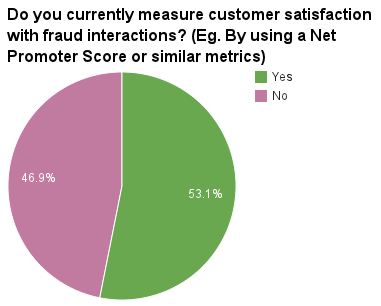

Senior fraud executives also told us they need to turn fraud from a cost center into a customer retention strategy. There was a lot of discussion at the event around the heavy impact of fraud on customer profitability and loyalty. Banks understand that consumers have so many choices these days that a badly handled fraud case can cause a customer to stop using its services entirely and move to another bank. Arresting this customer departure can involve banks demonstrating their proactive approach and involving customers by deploying real-time two-way communications, such as interactive SMS fraud alerts.

We ran an informal poll at the forum. Here are some of insights from key questions posed at the event:

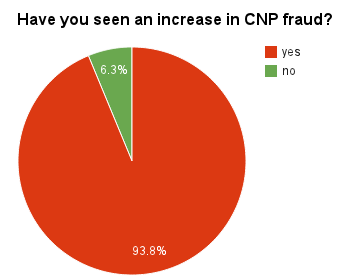

1) It was almost unanimous amongst APAC attendees that e-commerce fraud was growing as a proportion of total fraud.

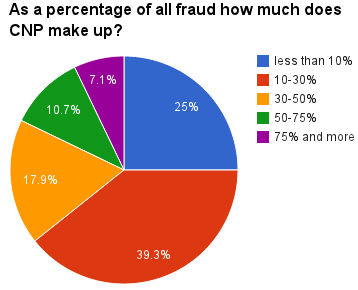

2) The percentage of e-commerce fraud varied, which is to be expected given that the participants represented a mix of under- and over-banked markets at different stages of development. For example, banks in Australia, where chip and PIN (the EMV standard) was made compulsory this year, have seen CNP fraud make up more than 75% of fraud.

3) The number of banks relying solely on a rules-based system is starting to shift. As APAC grows in value to criminals and EMV is adopted across the region, I am sure we will see the trend towards predictive analytics continue.

4) More banks are looking at fraud as an important customer experience touch point, and beginning to measure performance as a way to reduce customer churn.

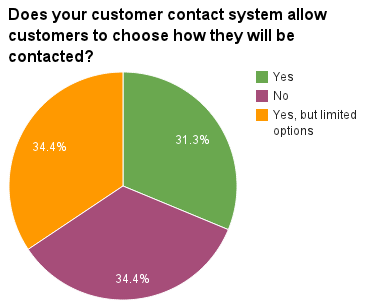

5) Contact systems at banks are still being rejuvenated to cope with the new ways that people want to communicate, from SMS to email, phone, social media or in-app responses.

The migratory nature of fraud has meant that APAC banks now have to contend with a growing problem in the CNP, e-commerce channel. This has changed how organizations view customers and their reaction to fraud and spending online in APAC. To keep people using their products and engender trust in the channel, banks are going to have to remain vigilant against new modes of attack from criminals. Seeing fraud as an opportunity to be more communicative and collaborative with the customer is becoming the go-to position for banks here.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.