Average U.S. FICO® Score Stays Steady at 716

Each year, we provide insight into the national average FICO® Score to help ensure consumers have a baseline measure of credit health standing

As the independent standard in credit scoring, FICO® Scores are the leading credit scores used extensively across the lending ecosystem ranging from originations, underwriting and account management to collections and asset-backed securitization. The introduction of broad-based FICO® Scores more than 30 years ago has transformed economic growth in the U.S. and globally -- making access to credit more efficient and objective, which has continued into the present day. FICO® Scores are dynamic and evolve as changes in consumer behavior are reflected in the underlying credit bureau data housed and managed by the three primary U.S. consumer reporting agencies (CRAs).

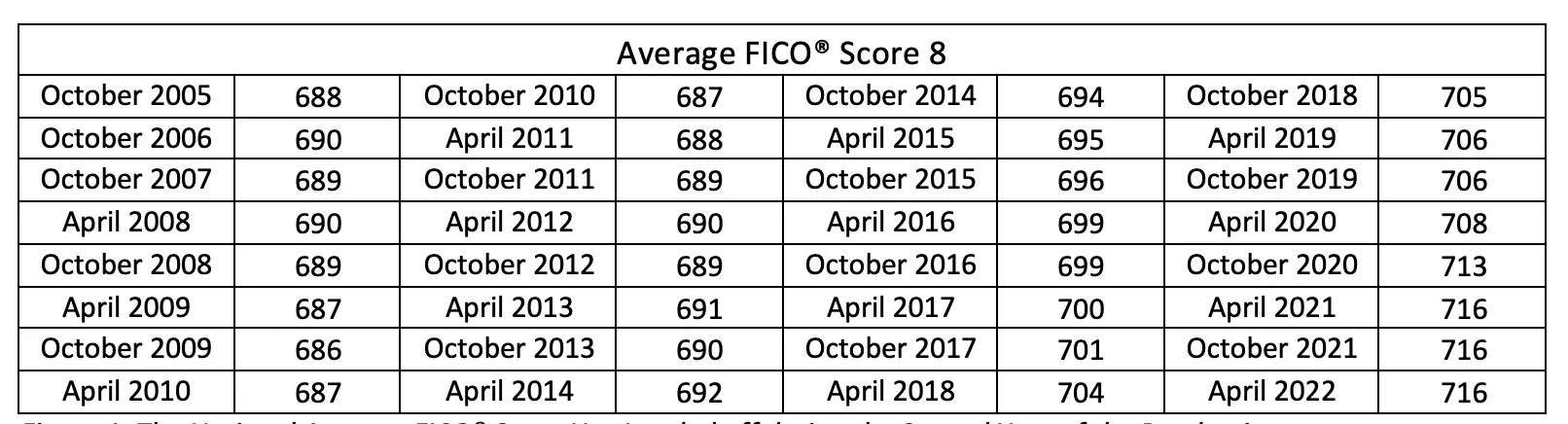

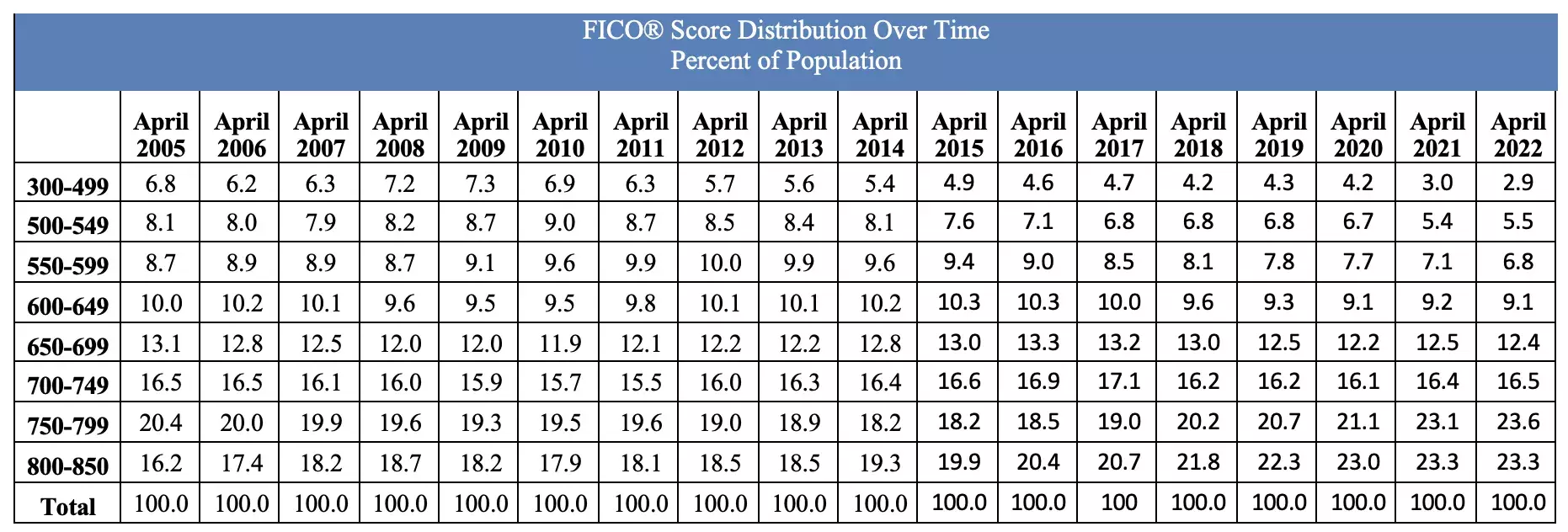

Each year, we provide insight into the national average FICO® Score to help ensure consumers have a baseline measure of credit health standing. We saw a substantial increase in the first year of the pandemic when the average FICO® Score rose five points from 708 to 713, due to the rapid recovery of the economy, government stimulus programs and historic levels of household saving, along with payment accommodation programs offered by lenders to help consumers manage their debts in the face of COVID-related income loss. Now, the average FICO® Score has leveled off during the second year of the pandemic. The national average FICO® Score currently sits at 716, the same as when we last reported on it a year ago.

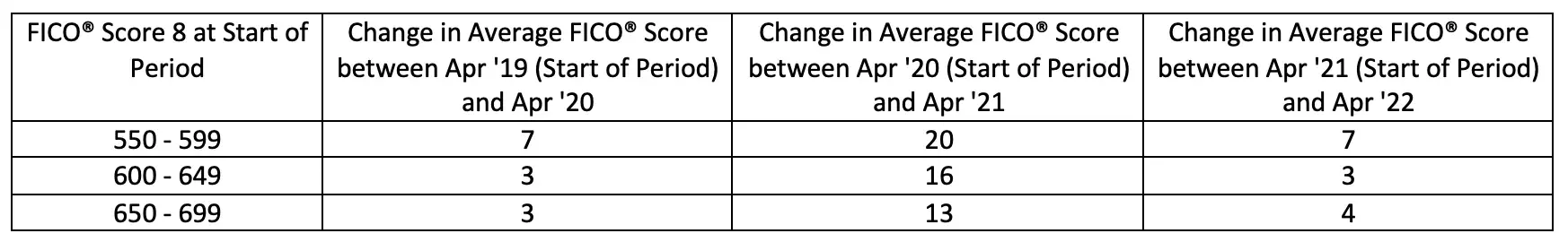

Looking back to 2020, the average FICO® Score increased most notably for consumers with FICO® Scores between 550 and 699. For example, consumers with FICO® Scores between 550 and 599 saw a score increase of up to 20 points from April 2020 to April 2021. In contrast, the uptick in the average FICO® Score by the same FICO® Score bands were much more muted during the second year of the pandemic. Those consumers with FICO® Scores between 550 and 599 as of April 2021 saw an increase of 7 points to their average score within the year span -- on par with the increase observed during the pre-pandemic period of April 2019 to April 2020.

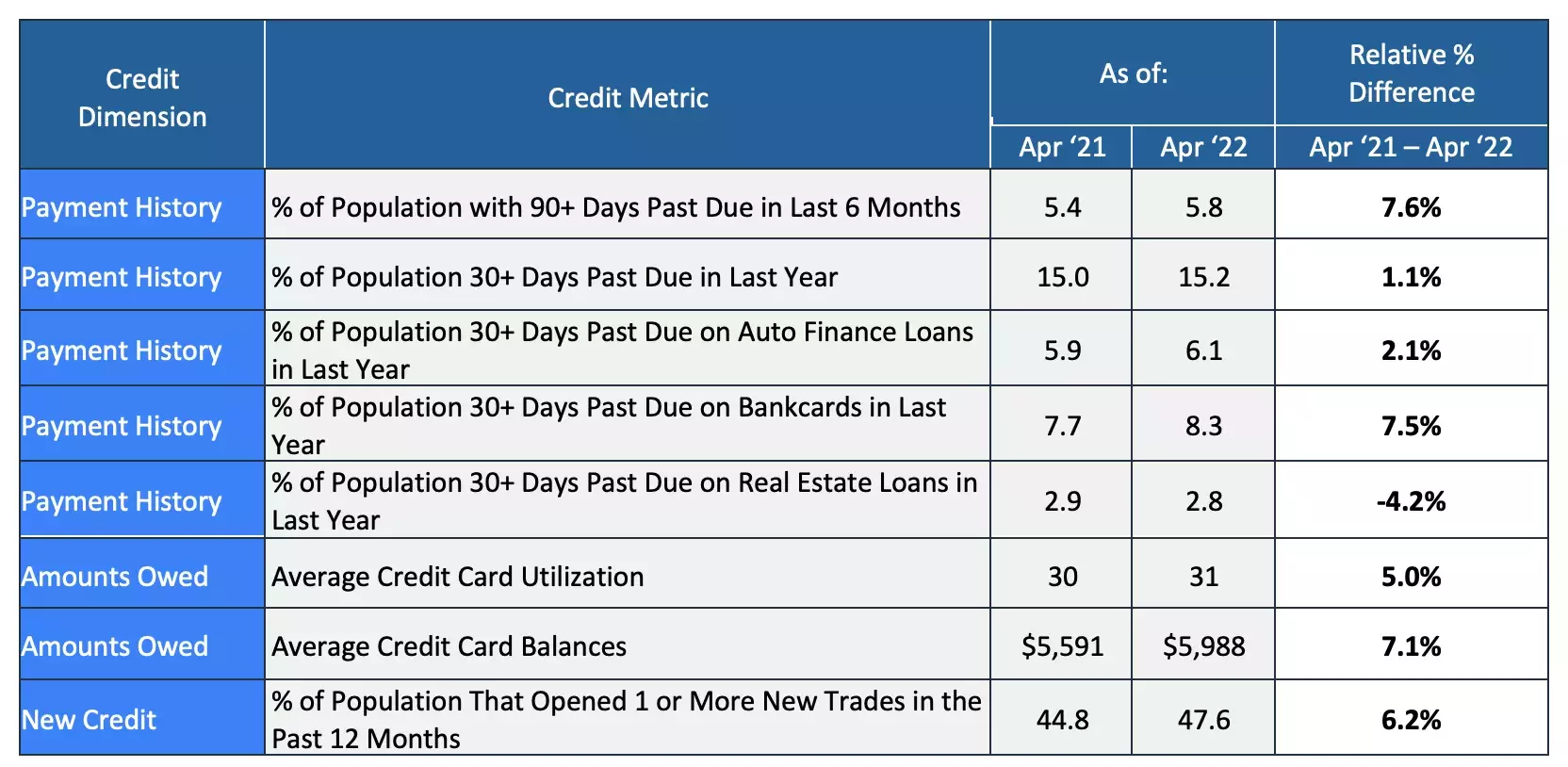

The leveling-off of the average FICO® Score this year has been driven by modest degradation in key metrics considered by the score: a small uptick in missed payments, slightly elevated consumer debt levels, and an increase in consumers obtaining new credit. Let’s dive into each of these trends in a bit more depth:

- Missed payments are on the rise: Missed payments reported in the credit file are up slightly. As of April 2022, just over 15% of the population has had a 30+ day past due missed payment in the past year. This is up by a little over 1% compared to April 2021. As shown in figure 4, recent missed payments are up most notably on bankcards, followed by auto loans. From April 2021 to April 2022, mortgage loan missed payment rates have remained stable likely driven by the continued home price appreciation and the higher payment accommodation rates for mortgage loans than those for bankcards and auto loans. During the first year of the pandemic, the combination of government stimulus programs such as the CARES Act and payment accommodation programs offered by lenders helped millions of consumers stave off missed payments. Government stimulus programs have been ramping down and payment accommodations reported in the credit bureau data have largely reverted to their pre-pandemic levels. For some consumers, this has caused a financial strain leading to missed payments. Staying on top of your bills can have a substantial and positive impact on your FICO® Score. In fact, this “Payment History” dimension of the credit file represents some 35% of the overall FICO® Score calculation.

- Consumer debt levels are increasing: While still below pre-pandemic levels, consumer debt levels have been increasing slightly over the last year. As of April 2022, the average credit card utilization was 31%. This is up from 30% as of April 2021, but still down from 33% as of April 2020 (which can be viewed as representing pre-pandemic levels as the effects of COVID and the accompanying financial strain had yet to meaningfully show up in the credit bureau data). The New York Fed’s new report provides insight that credit card limits sit at an all-time high exceeding $4 trillion. And the latest data from Federal Reserve indicates that revolving credit, which can be viewed as a proxy for credit cards, increased at an annual rate of 19.6% in April 2022. This suggests that consumers are not only obtaining new credit, but also using more of it, whether due to rising inflation rates, or simply due to having more opportunities to spend on discretionary items such as restaurant, retail, and travel during this period than earlier in pandemic. “Amounts Owed” comprises some 30% of the overall FICO® Score calculation and is heavily weighted towards credit card balances and utilization -- so the observed increase in credit card debt levels is contributing to the average score leveling off.

- New credit activity is back at pre-pandemic levels: More consumers are obtaining new credit at near pre-pandemic levels. As of April 2022, 47.6% of the population has opened at least one new account in the past year. This is up from 44.8% as of April 2021 and very similar to the 47.3% who had at least one new account on file as of April 2020. The increase from April 2021 to April 2022 is mostly concentrated in newly opened credit cards. As of April 2022, 24.4% of the population has opened at least one new credit card account. This is up from 18.1% as of April 2021 and up from 22.7% as of the most recent pre-pandemic period of April 2020. The “New Credit” dimension of the FICO® Score represents approximately 10% of the overall score calculation, and this growing appetite for more credit is another contributing factor to the leveling off of the national average FICO® Score that we have observed.

While the data we analyzed offers clear evidence of modest increases in default rates on certain products, re-leveraging of consumer debt and an uptick in new account openings, these emerging trends do not seem to be substantial enough in aggregate to materially move the national FICO® Score distribution downwards.

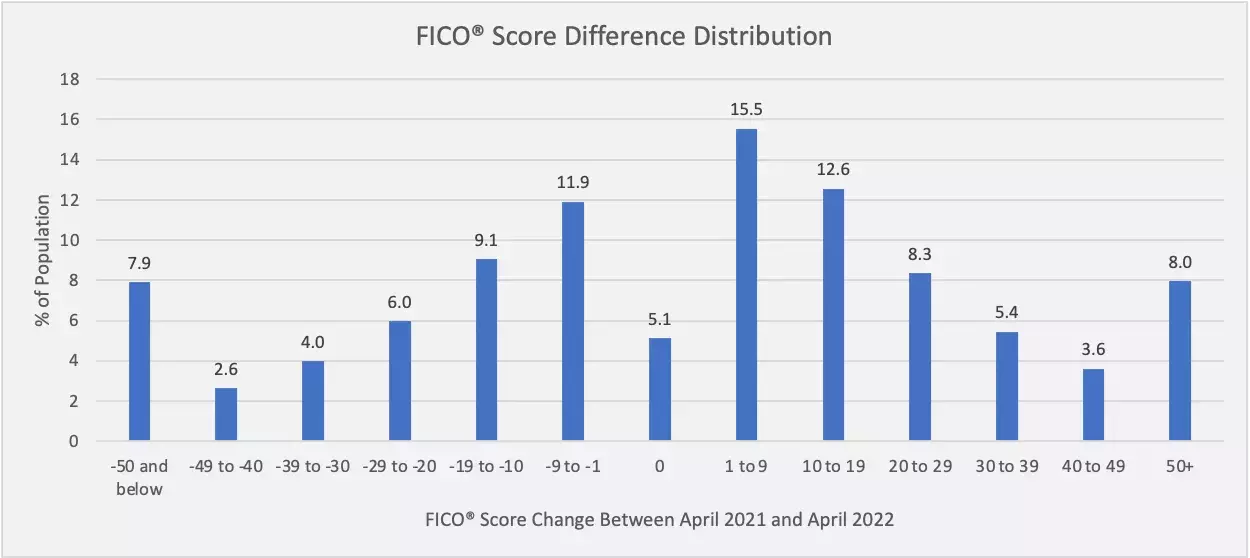

That said, it is certainly the case that there are millions of consumers who are currently facing financial distress. Some 20% of the FICO scorable population experienced a score decrease of at least 20 points between April 2021 and April 2022. This is up from 17% observed previously between April 2020 and April 2021. For many of these consumers, this decrease has likely been driven by the inverse of the trends that drove the national average FICO® Score up during the first year of the pandemic: a slow-down in economic growth, surging inflation, a decrease in household saving rates and ramping down of government stimulus programs. All these factors have led to missed payments and/or ramped up debt levels in 2022 for millions of consumers, including those who may be using credit cards and personal loans as a financial lifeline to cover living expenses.

Regardless of this uncertainty, FICO’s mission is clear: to help lenders understand the credit risk that each borrower represents and make better-informed lending decisions and to educate and empower consumers. Through portals such as myFICO.com and programs such as Score a Better Future and FICO® Score Open Access, we are committed to help consumers better understand their credit health. We will also continue to invest heavily into efforts to offer alternative data-driven solutions such as FICO® Score XD and the UltraFICO® Score to provide millions of consumers with an onramp to mainstream credit.

To learn more about FICO® Scores, check out these resources:

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.