BNPL in Credit Reports: How Could This Data Impact FICO Scores?

Key findings from FICO research suggests how the inclusion of Buy Now, Pay Later (BNPL) loan data in consumer credit report files could affect FICO Scores

Buy Now, Pay Later (BNPL) plans allow shoppers to make purchases and pay for them in installments over a defined period. According to the research from Cornerstone Advisors, these point-of-sale short-term installment loans with low credit amounts have been increasing in popularity during recent years for retail purchases like clothing, household goods, electronics, and more. BNPL loans are cited as a potential driver of greater financial inclusion, both in terms of consumer access to the BNPL loan themselves, as well as access to credit products that could enable unbanked and underbanked consumers to establish (or re-establish) their credit histories with one or more of the Consumer Reporting Agencies (CRAs).

As BNPL loans become a more commonplace form of credit used by consumers, these loans could also become an important factor in consumer credit reports, and by extension, in the FICO® Scores based on those credit reports. While the BNPL product offers consumers some attractive features, it is essential that both lenders and consumers alike understand the potential impact these BNPL loans could have on consumers’ FICO Scores. All FICO Score versions can consider BNPL data, provided that the information is reported and made available to be incorporated into the algorithm.

But what might be the impact of BNPL accounts being included in the credit report and the FICO® Score calculation? There are several key factors to consider:

- BNPL reporting approach: How a BNPL lender reports these accounts to a credit bureau can materially influence the impact these loans ultimately have on the FICO® Score. BNPL loans reported to the CRAs as a revolving debt are likely to have a more substantial effect (in either direction) than BNPL loans reported as installment loans, mainly because the credit utilization ratio on revolving accounts is an important factor for FICO Scores.

- Overall credit profile: Where a consumer is along their credit journey is another important consideration as far as how the inclusion of BNPL data might impact their FICO® Score. Consumers with a history of missed payments in their credit report may benefit from the inclusion of BNPL loans that offer new evidence of on-time payments being made. Credit builders with thin or new-to-credit profiles might also be impacted more significantly by the inclusion of new data coming from a recently opened BNPL loan.

- Payment behavior on BNPL accounts: Consistent with all types of lending products reflected in the consumer credit file, the inclusion of BNPL loans that demonstrate on-time payment data and/or low utilization will be more likely to support a higher FICO® Score.

Our two-part blog series will discuss our initial insights into how this emerging BNPL credit product could impact the FICO® Score and its predictive power. In these blog posts, we will share our key findings from our research on consumer credit files with recently opened BNPL loans:

- BNPL accounts reported as installment loans in the credit file generally yielded a modest score change within +/- 10 points, with a slight trend toward lower FICO® Scores.

- The impact of the inclusion of the newly issued BNPL account data on the FICO® Score is similar to the effect on the score observed from other newly issued credit products such as personal loans and credit cards with comparable payment data.

- Consumers with sparse credit files and no FICO® Score may start building their credit history with the inclusion of the BNPL data in their core credit bureau files. Once their credit file has been built up to the point it satisfies the minimum scoring criteria, they will receive a valid FICO Score.

Our Initial Insights from the First FICO-Conducted BNPL Research Study

As noted above, the precise effect of BNPL accounts on the FICO® Score will come down to key factors such as the BNPL reporting approach taken by the furnisher, the overall credit profile of the consumer(s) in question, and those consumers’ subsequent payment behavior on the BNPL loans. Let’s explore the impact of these key factors on the FICO Score.

For this research, we worked with our partner Experian to get some early data supplied by a major BNPL provider in the U.S. market. Our analysis focused on a sample of roughly 600,000 consumer credit profiles with at least one BNPL account issued during the three-month window from July to September 2020. The BNPL accounts in question were reported as installment loans to Experian. As mentioned earlier, an account reported as installment vs. revolving/line of credit is an important distinction regarding the potential impact on the FICO® Score.

For our analysis, we calculated the FICO® Score as of September 2020 both with and without the recently issued BNPL data included. An important point to highlight here is that the BNPL provider in this study performed a soft credit check for loan requests. As soft inquiries do not affect the FICO Score, our research focused solely on the impact that the BNPL account-level data could have on the score.

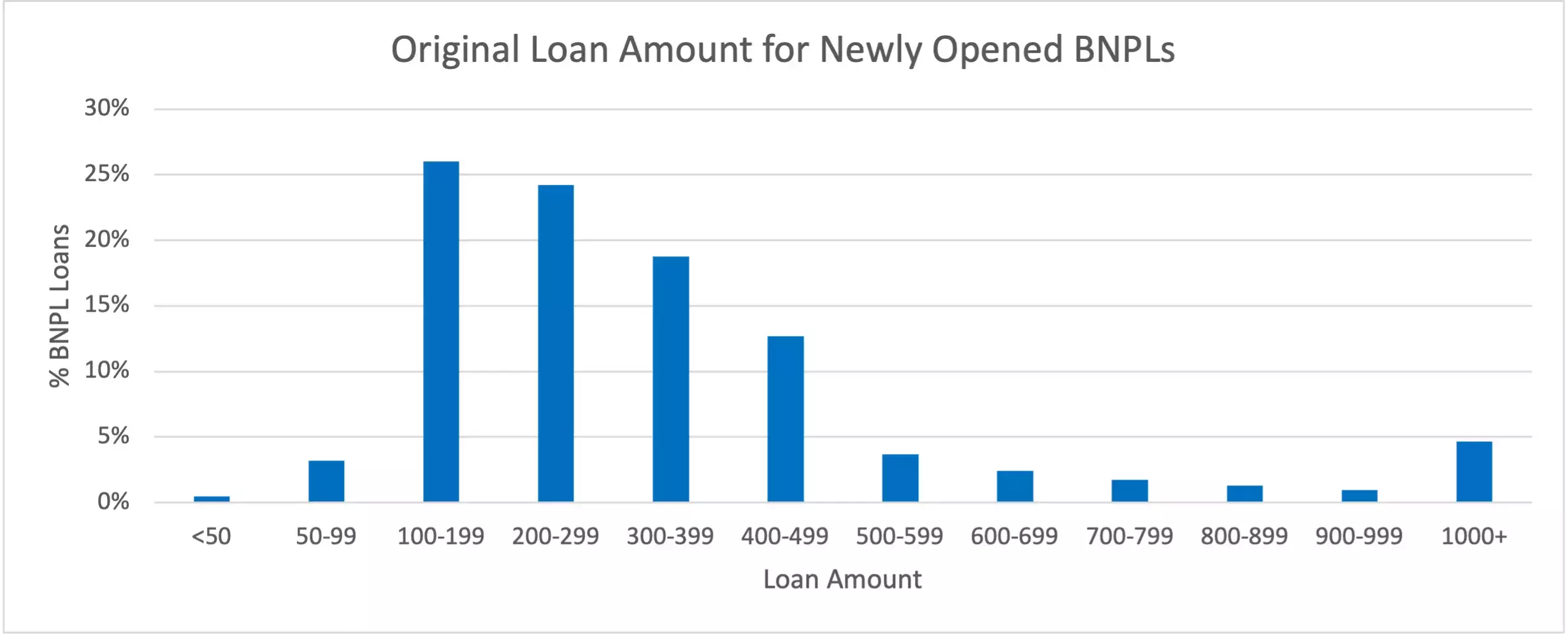

To examine the unique nature of these short-term, small-dollar BNPL loans, our study focused only on those loans with a credit amount less than $500 and a loan term shorter than a year. As shown in the distribution in Figure 1 below, less than 15% of the BNPL accounts in our analysis sample had loan amounts greater than $500. On the other hand, loan amounts less than $100 were rare in this BNPL portfolio.

Figure 1: Majority of the BNPL Loans Have Credit Amounts < $500

Before we delve into the results of our findings on score impact, let’s first review some important summary statistics that highlight the credit profile of this particular BNPL provider’s portfolio:

- The starting average FICO® Score 8 as of September 2020 for this BNPL provider’s customers is 662, not including the newly opened BNPL accounts in their credit profiles. This statistic is some 40 points lower than the average score of U.S. consumers who opened at least one new account of any type (e.g., credit card, mortgage, student loan, etc.) during the same three-month window.

- 60% of this BNPL provider’s customers were credit rebuilders with at least one serious delinquency, a public record, or a collection in their credit profiles. Another 15% of this BNPL provider’s portfolio consisted of credit builders with thin (fewer than four accounts) or new-to-credit (shorter than three years of credit history) profiles.

- 86% of the BNPL customers have a credit history longer than five years; thus, most are not new to credit.

- Almost all BNPL customers already have FICO® Score 8 before the inclusion of the payment data for the newly opened BNPL loan.

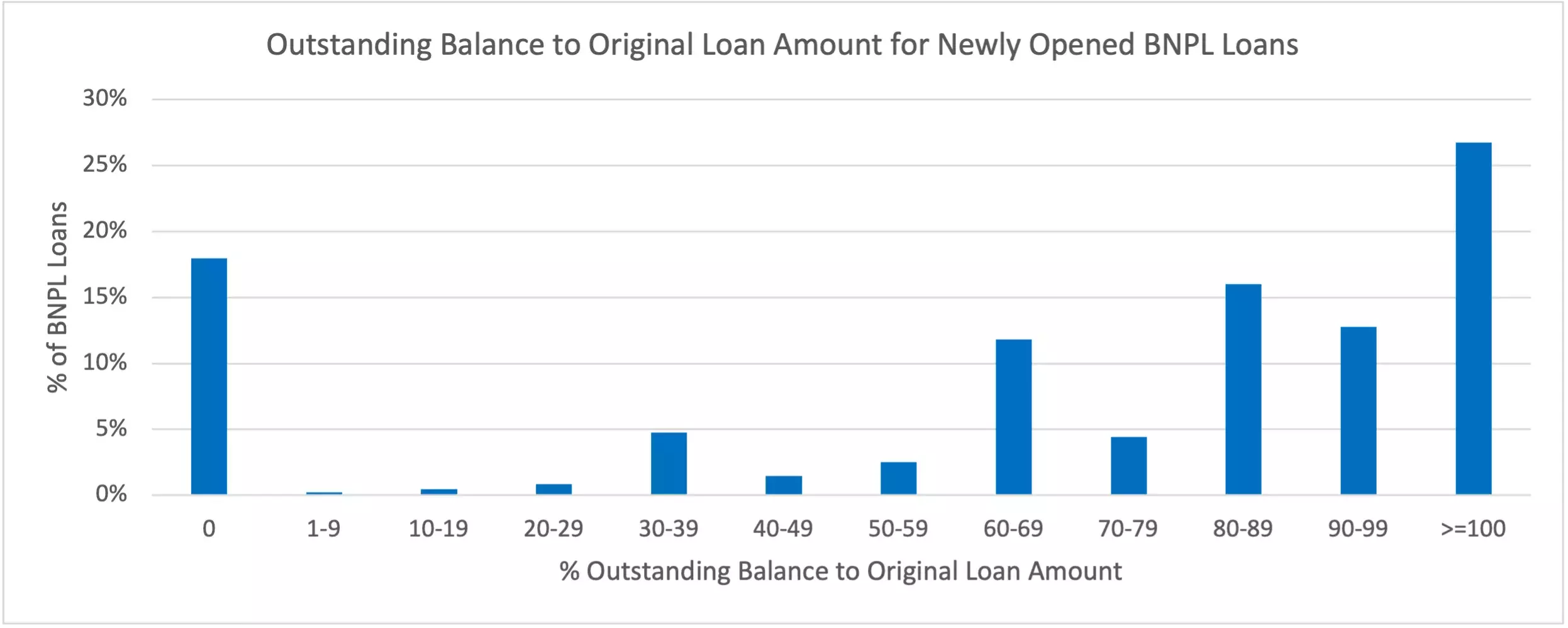

- The ratio of outstanding balance to the original loan amount for these recently opened BNPL loans as of September 2020 skewed towards higher values. As shown in Figure 2, three-quarters of the loans had more than half of the original loan amount yet to be paid. Only 18% of the loans had been fully paid during the three-month window from July to September 2020. Overall, an average outstanding balance to the loan amount of 68% is observed on these newly opened BNPL accounts.

Figure 2: Majority of the BNPL Loans Have a High Ratio of Outstanding Balance to Original Loan Amount

The Impact of BNPL Data on FICO® Score 8: A Data Point

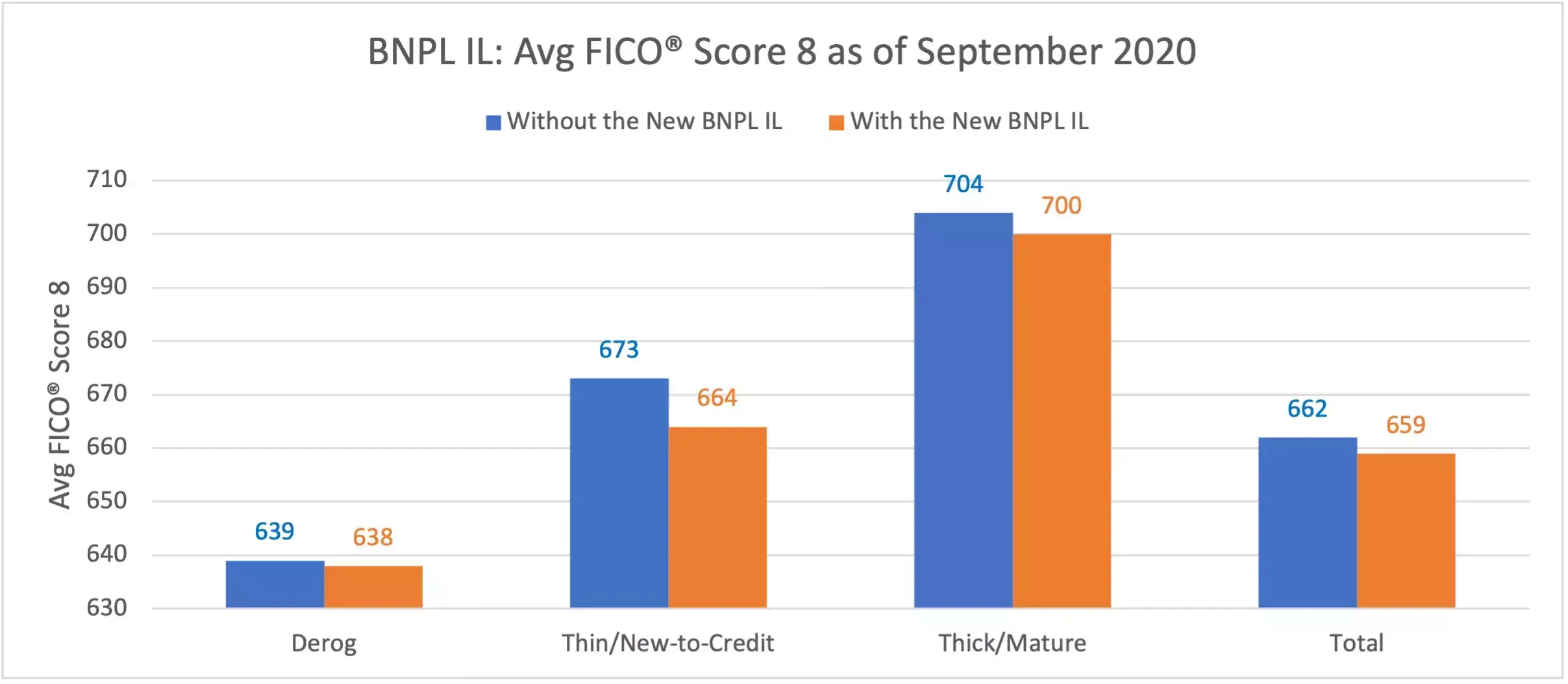

Our study on this BNPL data reported as an installment product shows a modest downward trend of an average of 3 points after the inclusion of the new BNPL account in the FICO® Score calculation, as shown in Figure 3. The blue bars correspond to the FICO Score calculation without the BNPL accounts included, and the orange bars represent the FICO Score calculation with those same BNPL accounts included. This modest downward trend in score resulting from the inclusion of BNPL data is consistent across key consumer segments. While consumers with thin or new-to-credit files observe a 9-point score decrease on average, consumers with derogatory files experience an even more muted average score drop of 1 point.

Figure 3: Average FICO® Score 8 With and Without BNPL Account Included

As a benchmark for comparison, U.S. consumers who opened a new account during the same three-month window experienced an average score decrease of two points after the inclusion of the new accounts. Therefore, the slightly downward skew in score resulting from opening a new account is not unique to BNPL products reported as installment accounts.

The score averages provide a high-level overview of the effect of including these BNPL accounts in the consumer credit report and, by extension, the FICO® Score. In our next blog post, we will share some interesting findings on the distribution of the score difference (between the score with and without BNPL loans included) six and twelve months after opening the BNPL loans. We will also review our analysis results on two key questions that we are frequently hearing:

- What effect does opening multiple BNPL accounts reported as installment loans have on FICO® Score 8?

- How is FICO® Score 8’s performance impacted after including the BNPL payment data?

At FICO, we are determined to continue developing our understanding of the breadth of BNPL loans being furnished to the CRAs, the profile of consumers acquiring these loans, and the potential impact to FICO® Score that can result from these loans being reported on a consumer’s credit file. The analysis results shared here are our first steps towards this goal. As the BNPL market continues to mature and reporting of this credit product becomes more commonplace and standardized in the CRA databases, we will continue to study this topic and generate further insights and analyses results to share with you. Stay tuned!

This blog is co-authored with Senior Director of FICO Scores and Predictive Analytics, Suna Hafizogullari.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.