Can Digital Channels Work with High-Risk Collections Accounts?

Digital channels can deliver great results across all risk groups and the entire debt collection lifecycle, improving the customer experience as well as portfolio performance

Note: A version of this post was published in Collections & Credit Risk magazine.

As automated digital communication is becoming the new normal in debt collection, we frequently get confronted with the question whether high-risk accounts are suitable for such automated processes. What can be automated is a matter of dialogue content and complexity, not of risk segmentation.

We often see organisations limiting the use of digital channels to low-risk and medium-risk customers segments in the first month (or even first days) of the collections process. This is a good start but underleverages the potential of self-service and digital customer engagement.

Here are six questions to ask when considering digital channels for high-risk collections accounts.

When Does Digital Contact Work?

Digital contacts automate customer communication, and the design considerations that apply to process automation also apply here: start with processes of limited complexity which are either high-volume or high-effort. Digital contacts work when the conversation is expected to follow a structured path and is expected to have one of a few foreseeable outcomes. Good examples for such conversations include due date reminders in pre-collections and late reminders in early collections.

Digital contacts are not just for the perceived simple interaction, though. For example, digital channels can also help to dramatically reduce the operational effort capturing income and expenditure information in the forbearance processes. Even onboarding processes in 3rd party recoveries have been automated very successfully using digital communication. And we see digital-specific debt collection growing in many markets.

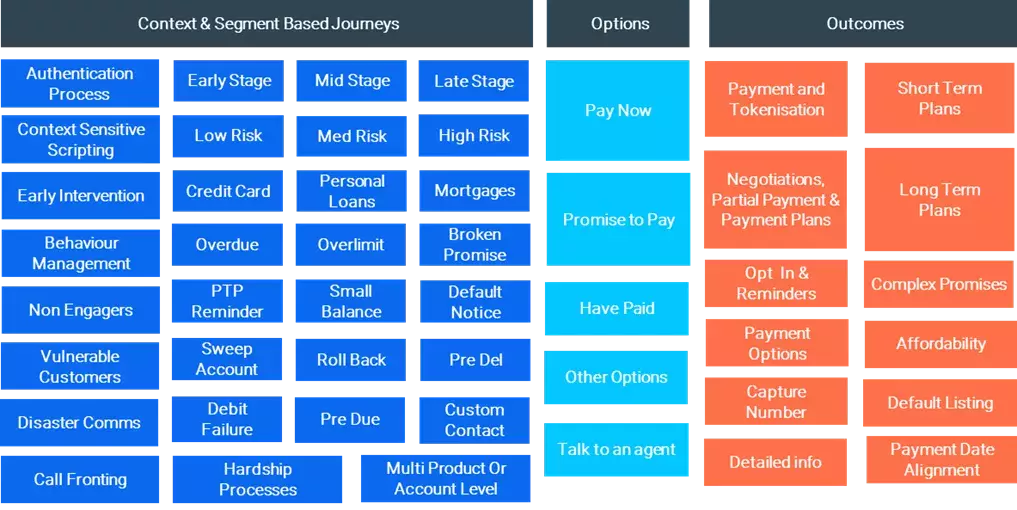

Figure 1: A digital-by-default approach to debt collection and recovery can deliver tremendous benefits across the C&R lifecylce

Is the Message Right for Digital Debt Collection? Is It Relevant Enough?

Digital channels allow automating customer dialogues. Their power comes from their cost-effectiveness, from the scalability they enable, from their availability outside office hours and from the non-judging nature of the dialogue, which many customers in arrears prefer over talking to a live collector. However, human contacts are superior when it comes to situations that require empathy, negotiations, or conflict resolution, as well as the handling of unexpected requests and non-standard situations.

From a customer perspective, automated dialogues allow for an enhanced customer experience as they can be efficient, are not burdened with social conventions about justification for late payment, avoid waiting times and allow communication at the time of customer’s choice. Automated dialogues can though be frustrating if they are difficult to navigate, fail to offer relevant options or lengthen the conversation with content that is perceived as irrelevant.

To make a digital contact worthwhile for both parties, the messaging needs to be relevant to the customer, options need to fit customer’s needs and abilities, and the conversation needs to be suited to address the reason for the contact. This works best when the anticipated dialogue tree is not too complex, and the majority of expected outcomes can be covered in a simple conversation.

This is the case for many conversations across the debt collection and recovery life cycle:

- Reminding the customer of the late payment situation

- Establishing a payment plan

- Explaining consequences of non-adherence

These are all typically well-structured conversations; even in a call centre, they rarely branch off into discussions about politics or sports. However, it is important that customers who are unable to pay, under financial stress or dispute the delinquency, can exit from the standard dialogue and can get help either by a human collector or a dedicated process – nothing is more frustrating than a digital dialogue which does not offer relevant options and referral to competent staff who can help.

Figure 2: Best Practice customer journeys as typically configured for Digital Collections in omni-channel solutions such as FICO Customer Communication Services

What Is High Risk?

Some organisations feel more comfortable having collection call centre staff working the high-risk accounts. A decent segmentation based on a mix of propensity-to-roll and balance, typically, should not flag more than 15-20% of accounts as high-risk.

There is no issue if small segments remain on manual processes until more faith in the digital approach is established. However, these segments can be successfully worked with digital channels, given that in early collections the conversation is expected to be of a ‘reminding’ nature. Customers, though, need to have an option to indicate financial stress or inability to pay, and such customers need to be forwarded to a call centre agent unless automated hardship dialogues are in place.

If your early collections high-risk segment contains well above 20% of the total volume of accounts to be worked, it is worth challenging whether the segmentation can be refined given the impact such a high proportion would have on operational efficiency, if not put through digital collection channels.

How Do We Mix Human and Digital Contact?

A decision whether to treat certain segments of the portfolio digitally or via call centre does not need to be black and white. Human contacts can be preceded by automated contacts, so that the automation benefits can be secured from those customers who are receptive to digital self-service. For the remaining population, the subsequent human contact can enforce the message and ensure and that exceptions are appropriately addressed.

How Can We Test for Effectiveness?

Never should the decision about how to treat a specific segment be based on a positional argument. A much better way to establish trust in digital processes is to test them against traditional processes in champion-challenger mode. This allows you to measure the impact on portfolio performance and operational efforts, and ensures your decisions to change strategies or treatments are based on facts. A quantitative approach is important to understand which digital processes work for which type of accounts, and to identify areas which require improvement.

How Will We Improve Results Over Time?

Contact automation is unlikely to meet all expectations at the first shot. In a call centre, your agents will adapt to customer behaviour and iron out glitches you might have in your call scripts. Such inherent adaptation process is not available in digital communication.

Hence, successful digitalisation requires an agile approach to dialogue configuration design and management. It is essential that physical and logical contact outcomes are constantly monitored, and that dialogue dynamics are understood. As with call quality monitoring in a call centre, undesirable call performance needs to be understood and addressed. This works best with a cross-functional team that continuously challenges the existing dialogues, configures alternative dialogues, and monitors their performance.

With this in mind, digital channels can deliver great results across all risk groups and the entire debt collection lifecycle. It can provide a customer experience as well as portfolio performance that would never be possible in a pure call-centre focussed operation, across a wide range of use cases.

Learn More About How FICO Can Help with Digital Debt Collection and Recovery

- Explore the all-in-one digital decisioning of the FICO Platform

- Explore our omnichannel FICO Customer Communication Services

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.