Cognitive Analytics for AML - Making SARs Count

Regulatory efforts may prove valuable, but banks and law enforcement still need to use SARs more effectively, and that’s where cognitive analytics for AML can be a tremendous boon.

When it comes to regulatory reform, one of the most talked about changes in the U.S. is to the existing Bank Secrecy Act (BSA)/anti-money laundering (AML) regime. Both banking regulators and policy leaders on Capitol Hill have this topic high on their priority list.

One proposal that is attracting attention is The Counter Terrorism and Illicit Finance Act (CTIFA), recently introduced by Representatives Blaine Leutkeymeyer (R-MO) and Steve Pearce (R-NM). Among the key provisions is addressing the increasing burden on financial institutions required to file Suspicious Activity Reports (SARs) and the enormous amount of data flowing to Treasury’s Financial Crime Enforcement Network (FinCEN). The approach detailed in CTIFA is, in part, to increase the minimum monetary threshold for filing and to study whether these thresholds should be adjusted for inflation.

This sounds like a good start, but it does not address the data challenges facing FinCEN. In the U.S., FinCEN received 2,034,406 SARs in 2017 and volume is growing at a double-digit rate annually.

Ideally, this wealth of data should be providing more actionable insights to law enforcement. While the amount of data is growing, a recent study conducted by the RUSI.ORG Centre for Financial Crime and Security Studies found that law enforcement is struggling to derive value from the wave of information flowing from SARs.

A solution to this problem lies in the adoption of advanced analytics.

Cognitive Analytics

FICO Cognitive Analytics integrates the latest text analytics, Natural Language Processing, graph analytics, machine learning, and artificial intelligence techniques into a holistic approach that helps computers think more like humans — but much, much faster. Cognitive analytics for AML offers a paradigm shift for investigators in financial intelligence units, governments, law enforcement agencies and financial institutions.FICO Cognitive Analytics can ingest structured data such as transactions and lists of politically exposed persons, as well as unstructured data from millions of SARs. Deep-learning neural networks are applied to the SAR data to extract information such as subjects, financial institutions involved, and amounts, with unprecedented precision and recall.

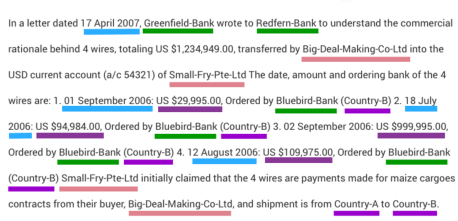

A hypothetical SAR with dates, banks, organizations, amounts, and locations automatically identified and highlighted by analytics.

A hypothetical SAR with dates, banks, organizations, amounts, and locations automatically identified and highlighted by analytics.Source: FICO Blog

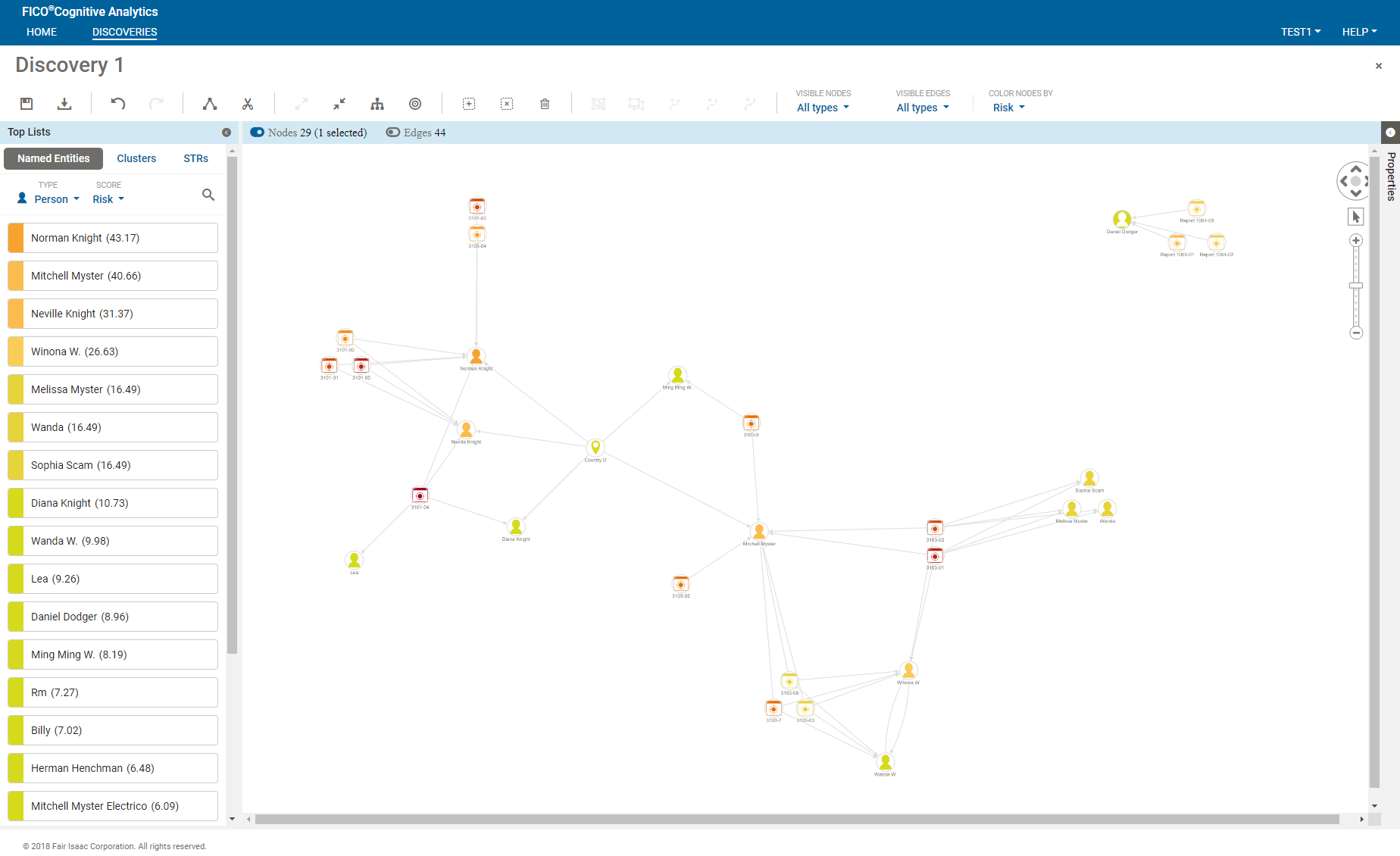

Next, structured information and entities extracted from all SARs are stored in a massive SAR-centric graph database that shows how everything is related. Finally, state-of-the art graph analytic algorithms identify risk, find communities, and discover hidden relationships.

Source: FICO Blog

Source: FICO BlogFICO Cognitive Analytics for AML provides an easy-to-use visual investigative framework that offers a consistent approach to triaging entities and communities for investigation. Investigators can sort entities such as persons by risk and quickly visualize key relationships. Investigators can focus their energies where it matters most. No tips are required to quickly find the needles in the haystack! Hours of manual reading and drawing inferences about SARs are automated and completed in minutes. In short, cognitive analytics can help bring critical new insights to information that may be going untapped by investigators today.

High volume of disparate data and hidden connections should not be the enemy of better AML efforts — rather, they should be the fuel that enables machine learning to guide human investigators toward the real perpetrators. Regulatory efforts may prove valuable, but banks and law enforcement still need to use the data they have more effectively, and that’s where cognitive analytics for AML can be a tremendous boon.

For more information on using AI to fight AML, see:

Machine Learning for AML Gives Pros “Superhuman” Powers

Using AI and Machine Learning to Improve AML

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.