Collections Analytics: Are We Missing the Credit Risk Revolution?

Taking up innovations used in credit risk management can pay off handsomely in collections & recoveries

Having worked in credit risk for most of my career during the revolution in analytics, it continues to concern me that the collections and recoveries (C&R) divisions of banks seem to be left behind. Innovations in credit risk analytics that have been widely adopted in other risk areas rarely get used at the C&R level.

Is it a case of credit risk analysts being uninspired? Or does the C&R space have so many legacy issues and manual processes that there is no time for innovation?

Primarily, it’s the latter! Manual processes turn C&R credit risk analysts into data mining analysts – finding issues and putting in temporary fixes in order to manage the bleeding impairment problem or ‘effectively’ trying to support the operational team. When impairments are within plan, then no one is seeking further analytics attention. This inevitably leads to the analyst moving on to other ‘exciting’ teams or remaining extremely frustrated in a C&R risk role.

I thought I would draw a comparison to the ‘exciting’ credit risk analyst space and demonstrate that all is not lost being a C&R risk analyst. There is plenty of ‘cool stuff’ going on — you just need the strategic intent to prioritize the order of work and limit manual processes.

Building Scorecards for Collections and Recoveries

The mindset of an origination credit risk analyst is to obtain a decision, that is most aligned to the product/service being sold, based on a data-driven assessment, that is as accurate as possible in predicting the risk of a client defaulting. This is done by developing highly tailored specific origination models, which provide credit risk scores on applicants.

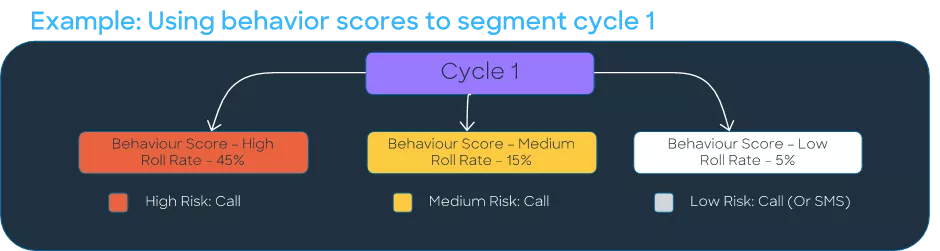

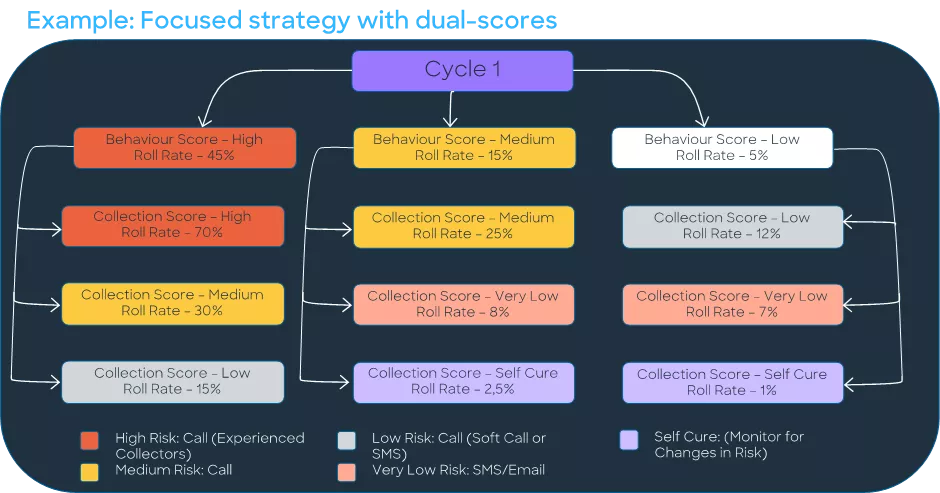

In collections, a similar case can be made – rather than collect on everyone, you can use analytics to collect on customers who have the likelihood to incur impairment or run to a credit loss if action is not taken. Typical collection strategies tend to start without using any scores in collections, then move to applying behavior scores (from account management) to improve accuracy in the identification of the high-risk accounts and early cycle segmentation, and to eventually modelling specific customer reaction-to-collections actions and how the timing of those highly predictable actions will impact net roll-rates between the cycles.

By the time customers are in recoveries, where finding the highest likelihood to pay is critical for recovery success, as they are all high risk, using traditional risk models become less effective. Here, developing payment projection or predicted yield scores are very useful in determining whom to target, with what offer and when.

The scoring piece allows for segmentation in the C&R environment, but that’s just part of the analytic advantage. The treatments related to the segmentation can also be enhanced using analytics.

Extending Use of Scores in Treatment Strategies

From an origination perspective, a credit score initially provided a binary accept or decline decision. However, as scores ranked applicants from high risk to low risk, credit risk analysts used the scores to create limit strategies, run risk-based pricing and even developed cross/up sell strategies – all from the same scorecard!

Why not do the same? In the collections case, using custom-created models can improve strategies by determining the prescribed channel – whether to call customers, sms, email or leave them alone, that will result in the most effective use of the operational teams. The collections scores can also be used to determine the sequence of all actions – you could call at one instance, sms a second, email a third and follow up with a call again. Some actions may be sequential, others concurrent – all in one day!

Here is an example of moving from a behavior score to a dual combination score and treatment strategy.

Both the scorecard development and treatment strategy development follow similar tactics as in other parts of the credit risk lifecycle but with more granular adaptation for C&R. The treatment actions for the customers in collection can be highly dynamic, there is always something that can be done better and the value of doing so is often surprisingly high.

To learn more about the common myths in C&R, watch this short video from my colleague, Dave Lightfoot:

Using Analytics to Optimize the Treatment Strategy

The next complication to overcome is that with all these risk bands and different channels, what is the best way to get the highest recovery/lowest impairment or the lowest cost? This is where operations research and mathematical optimization come in.

My colleague Dr. Ulrich Wiesner goes into detail in this blog post around collections optimization.

The C&R world can be viewed, from a risk analytic perspective, as a far more dynamic than the other life cycle areas – if time is spent prioritizing and understanding the opportunities present. Those professionals who provide the most innovative thinking in the approach towards mitigating credit losses from those customers in collections, whilst minimizing cost and maximizing the retention of future good customers, will position their enterprises as market leaders.

At FICO, we offer extensive C&R analytics capabilities and I will be happy to have a further conversation on the topics above with any risk professional interested in assuring they are maximizing the contribution of analytics to business performance.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.