Competitive Loan Pricing: How To Outprice (not Underprice) Rivals

5 key steps to winning using customer-centric loan pricing optimization

Competitive loan pricing is a term that’s often overused to imply lower pricing than close competitors. But it's not always strictly true. Financial institutions that can make offers at higher prices, while continuing to win business, are even more competitive.

The leading lenders achieve this by mastering customer-centric loan pricing optimization, which encompasses much more than just price. It’s an approach where financial services firms make astute decisions about the entire loan offer – based on detailed predictions of customer value, sensitivities, and behavior analysis, as well as customer attitudes and choices, revealed at the point of sale.

Competitive Loan Pricing Is a Race – But Not to the Bottom

In many financial services markets, the downward pressure on prices is being caused by thin margins, new sources of competition, and the ease with which consumers can assess a mass of competing products and offers. The perceived need to continually underprice competitors can exert a vortex-like pull, drawing financial services firms into a race to the bottom. But competitive loan pricing doesn't need to be a downward spiral.

Instead, it should be a race to the so-called “sweet spot” – an offer that fully meets the needs and objectives of both the customer and the business. Companies that quickly identify the sweet spot have an edge over competitors even when their loan prices are often not the lowest.

Today, we can use AI and machine learning to drive better loan pricing decisions. Customer-centric pricing optimization combines analytic, collaborative, and interactive processes into smart, flexible, and efficient workflows.

5 Key Steps to Outpricing Competitors

Increasingly, companies are winning with a focus on customer-centric loan pricing optimization. Unlike traditional methods rooted in price sheets, loan prices now emerge from very granular Big Data-driven analytic segmentation of customer populations. With this approach, loan pricing is not an isolated exercise. Instead, loan prices are optimized within the context of the entire customer offer.

The five key steps to outpricing your competitors when it comes to loan pricing are as follows:

- Simplify complex loan pricing challenges.

- Make analytics transparent, understandable, and easy to use.

- Enable stakeholders to collaboratively drive your optimization processes.

- Integrate backroom policymaking with real-time customer interactions.

- Ensure agility for your business so you can adapt to the speed of the market – or faster.

1. Simplify Complex Loan Pricing Problems

Outpricing the competition means directly tackling the complexity of the loan pricing problems financial services face in today’s crowded, dynamic, and highly regulated markets.

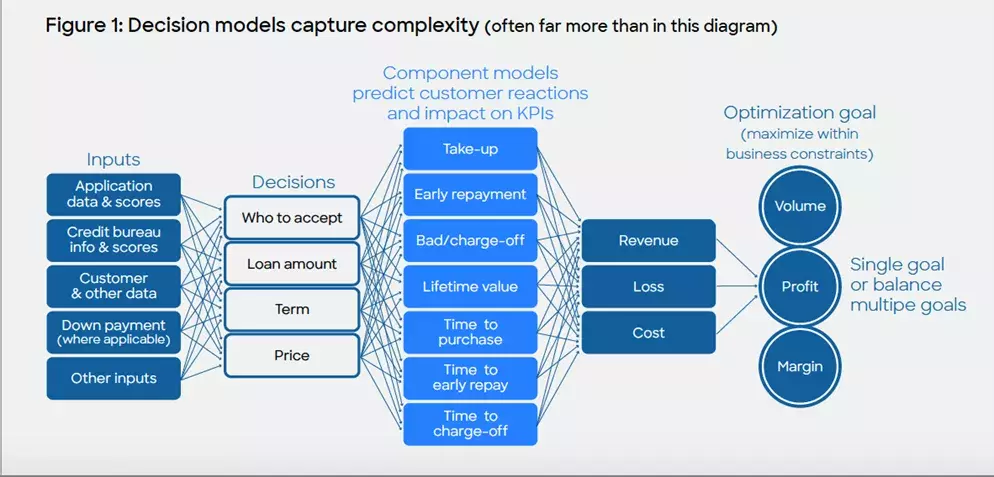

To deliver the fine-grained analysis and accurately target offers to key customer segments, financial services firms need to consider a wide range of data and customer behavioral predictions. Analytic techniques are used to capture such complex loan pricing problems and model each decision. Modelers work backward from the business goal to identify the important decision factors and codify relationships between them in mathematical equations (represented by the blue arrows in Figure 1).

At the heart of the decision model is a network of action-effect models, predicting likely customer reactions to the company’s possible actions – including loan pricing and other offer aspects – and the resulting impact on KPIs.

Leading lenders continue to move from a price-sheet approach to one where optimal pricing emerges from very granular analytics-based segmentation of customer populations and state-of-the-art optimization supports segments as small as one individual.

2. Make Analytics Transparent, Understandable, and Easy to Use for Business Experts

Can financial services firms always trust the answer-outputs delivered by loan pricing optimization? Generally, yes – provided the input data, decision models, and component models are all sufficiently high quality. But trust shouldn’t be blind.

Unlike black box analytics solutions, the FICO approach to customer-centric loan pricing optimization is transparent. Business experts can expose and examine any part of the modeling process. Where their role allows, they may adjust or add in domain expertise and selective business judgment.

By tightening or loosening constraints, users can explore critical trade-offs between multiple (and sometimes conflicting) objectives to better understand performance drivers. This kind of exploration generates an efficient frontier of possible optimized strategies from which the company selects the best operating point for its business. It’s a quick process, so many 'what if' scenarios can be considered in a small amount of time.

3. Enable Stakeholders to Collaboratively Drive Optimization Processes

The various stakeholders in loan pricing typically have differing points of view – but all need an easy way to participate in the optimization process. With FICO’s approach, they can add objectives and constraints from their own management perspective into role-specific, workflow-driven interfaces. They can also review proposed pricing strategies and view optimization process details, results, and reports, as they deem appropriate.

A state-of-the-art optimization solution will enable any workflow involving any number of role-based interfaces to be driven from shared “single source of truth” repositories for data, analytics, and business rules. Such comprehensive, highly customized solutions can be developed and deployed in a fraction of the time usually required for interactive, collaborative data-driven applications.

4. Integrate Backroom Policymaking with Real-Time Customer Interactions

The collaborative process can be extended as far as needed into the frontline so that loan pricing optimization considers both what is known about customers and what is learned at the point of sale.

Interfaces enable users to input data and adjust the relative important and weighted elements of any deal. Within a matter of seconds, they can run real-time optimization and review a range of alternative offers that reflect each customer’s needs and attitudes. This allows agents on the frontline to have more meaningful conversations at the point of sale. They can respond flexibly and directly to what they’re hearing from the customer to restructure, and re-price offers, while staying within the parameters of the creditor’s policies.

Real-time optimization enforces consistency in point-of-sale actions, and it leads to fewer exception pricing requests and higher offer take-up rates. Faster decisions improve cost of sales. Customers experiencing efficiency, as well as responsiveness, to their individual needs are more satisfied with the process.

5. Speed, Agility, and Market Maneuverability

Given the dynamic nature of today’s markets, loan pricing collaboration and optimization need to be unhindered and ongoing. Participants must be able to make changes to their inputs and choices at any time. Submitted changes (subject to business-rules-driven workflows and approvals) would then immediately affect all subsequent optimizations. This means that companies can implement new promotional campaigns and agreements with business partners without delay. They can adeptly respond to new regulatory requirements or to sudden promotional moves or pricing parries by competitors.

Financial services companies can also constantly look ahead at what to do next because customer-centric pricing optimization incorporates an endless feedback loop. All participants in the process can very quickly evaluate the operational outcomes of current strategies.

They can see how well actual and simulated results align, where gaps indicate the need for improvements and point to opportunities for further learning about customer behavior.

Where There’s a Way, There’s a Win

Outpricing the competition hinges on speed and agility in identifying the sweet spot, where price and all key elements of the offer meet the needs and objectives of both the customer and the business.

The only way to do it – given Big Data, the complexity of factors to be weighed, the number of internal stakeholders, and the need to consider a mass of real-time inputs – is with customer-centric loan pricing optimization.

Winners no longer rely solely on price sheet calculations, but on using analytics to finely segment customer populations to fully understand their behavior. For them, loan pricing may start with backroom policymaking, but it extends through all aspects of operations and into real-time interactions with customers.

How FICO Can Help You Optimize Loan Pricing

- For a deeper dive on loan pricing optimization, read the whitepaper, “Five Keys to Outpricing the Competition”

- To see a real-world example of loan pricing optimization in action, read this related blog post, “Loan Pricing Optimization: Secrets of Success”

- For more briefings, analysis, and research like this from FICO, please visit www.fico.com/loan-pricing

- To find out how optimization can help your organization become more competitive, contact us at: info@fico.com

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.