COVID-19 and Debt Collection: What’s Happening in Europe

The collections & recoveries community across Europe has jumped into action - what's happening and what are the longer-term ramifications?

Following the global COVID-19 outbreak, the collections & recoveries (C&R) community across Europe has jumped into action to safeguard customers, employees and wider stakeholders. Which actions have been taken and what are the longer-term ramifications for the sector?

Customer Forbearance

Unsurprisingly, the Italian financial services sector was the first in Europe to react when it came to introducing large-scale moratoria on debt repayments for mortgages, small loans and companies revolving credit lines. As expected, other countries followed suit, with UK banks offering 3-month payment holidays on mortgages and other firms (such as utilities) offering delayed repayments on a case-by-case basis.

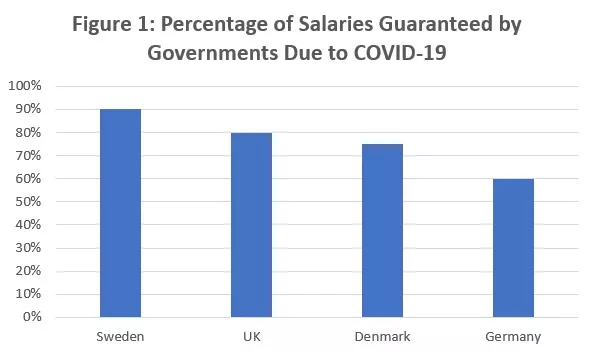

Alongside the management of outgoing expenses, we’ve also seen countries take steps to help with customer income. Largely, countries are following Germany’s “Kurzarbeitergeld compensation scheme”. This approach sees a percentage of people’s salaries guaranteed by the government (up to certain thresholds). This approach was particularly successful for Germany during the 2008-09 crisis, resulting in Germany only seeing a 0.9% increase in unemployment and a faster return to prosperity, compared to a 3% increase in unemployment for other Organisation for Economic Co-operation and Development (OECD) countries.

Ultimately, the purpose of forbearance is to return customers to being up to date, whilst preventing unfair customer outcomes. There have been significant numbers of forbearance requests from customers, and C&R teams will need to exercise discipline regarding when and how forbearance is provided. For example, with government income guarantees, C&R teams should work with customers to consider what levels of forbearance are necessary now, alongside the potential to cause detriment through indebtedness further down the line.

Financial Stability of Businesses

When offering forbearance to customers, we must consider how creditors will remain financially stable. How COVID-19 will impact lenders’ balance sheets in the short-term and long-term remains to be seen. One of the key questions we have is: to what extent will the European banking sector allow lenders to delay recognising bad loans, as has been seen in China?

Whilst there isn’t yet enough reliable and detailed data on the impact of COVID-19 to incorporate into expected credit loss (ECL) models, at the current time there is already some flexibility being given by regulators in other areas. For example, BaFIN (the Federal Financial Supervisory Authority in Germany) is offering some freedom in their assessment of capital requirements.

At present there’s certainly more caution from debt purchasers when reviewing portfolios being sold, which will be reflected in the interest of bidding on portfolios, the duration of contracts and the prices paid. No one knows how this will impact the longer term debt sale market, but if the events of 2008-09 are anything to go by, we may see 3-4 years of market contraction as funders stick to a more cautious approach, particularly during a period where the market has been focussed on deleveraging.

Customer Communications

C&R teams are at the front line of dealing with the implications of this crisis. Many contact centres are already receiving a months’ worth of inbound calls in a day related to forbearance. Outbound dialling activity is being limited or stopped completely, both as a result of the influx of inbound contacts and due to C&R operations respecting the sensitivity of the current situation.

When combined with potential staff shortages (absence rates of 50% are commonplace) that may occur in future due to quarantine restrictions, self-resolution channels for customers (2-way digital) are going to become increasingly important. Without those 2-way capabilities, C&R operations will simply see increased inbound calls, increased customer wait times and see their contact centres become the cause of customer frustration.

Business Continuity Planning

Most C&R operations have high volumes of staff across tightly knit teams. With government guidance across the world focussed on home working and ‘social distancing,’ working practices are already changing.

Home working has often been a restricted practice for C&R teams due to data security concerns around working with customer data. We’re already seeing risk directors lift these restrictions (particularly for inbound contact and where the right controls are in place), as the risk of not being able to run contact centres due to health concerns outweighs the data security risks. Some businesses also report issues with their internal VPN networks not being able to handle the increased capacity, with as many as 10000+ FTE working from home.

Additionally, C&R teams will be taking measured responses to managing third-party agencies. These may include setting refreshed contact frameworks for debt collection agencies (DCAs) and working on debt placement/staffing forecasts that account for current conditions.

Commercial Structures

As it stands, many DCAs and debt advice agency relationships are paid a percentage commission, or ‘fair share’ based on amounts collected. In the coming months, it’s likely that DCAs and the debt advice sector are going to see increasing requests for help from customers, with significant reductions in the amounts paid by creditors to help service these customers.

This brings to light a longer-term question about the funding of the debt resolution sector:

- Are the commercial structures used to fund the debt advisors and the DCA sectors appropriate?

- Which commercial structures should a creditor/DCA and debt advice relationships use to generate the right outcomes?

We need to see change in the way these businesses are funded. Whilst these sectors were originally about ‘debt collected,’ they’re now more focussed on ‘debt resolution’ and generating the right customer outcomes. As such, fees in relation to outcome, rather than amounts collected, are more appropriate.

Overall

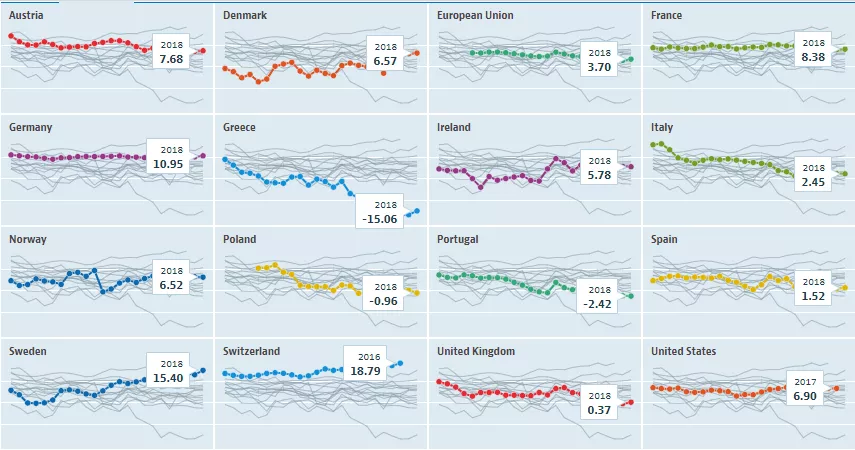

Recent events will sharpen the focus of customers and C&R alike. From a C&R perspective, COVID-19 is likely to further develop business models that were developed since the last financial crisis, whereby the importance of sustainability, security and customer outcomes are prioritised. From a customer perspective, current events may act as an education about the need to build more personal financial resilience into our lifestyles (much as people would have had in years gone by).

Figure 2: The Decline of Household Savings as a % of Disposable Income for Selected Countries (1995-2018)

If you’re running a collections shop and have questions about how you can maintain performance in the current environment, reach out to us at info@fico.com. We have people steeped in industry best practices who are seeing what’s happening around the world. We can help.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.