Is COVID-19 Leading to More Food Delivery Fraud?

Home food deliveries have jumped in the pandemic, but FICO data shows that food delivery fraud hasn't

Last week I shared FICO’s insights into fraud patterns related to spending on medical devices, including personal protective equipment (PPE) and medical devices such as nebulizers. This post examines whether increased food deliveries are causing a similar rise in food delivery fraud.

Home food delivery has skyrocketed during the pandemic; from January to July 2020, the number of credit card transactions for on-demand food delivery platforms increased by a whopping 86%. Have fraudulent transactions increased at a corresponding rate?

The short answer is “no.” Here’s how we came to that conclusion.

“Would You Like a Side of Fraud with That?”

My team analyzed 2020 U.S. data from the FICO® Falcon® Intelligence Network for the four largest delivery services: GrubHub, DoorDash, Postmates and UberEats. We found that the sharp increase in delivery spending was not accompanied by a severe spike in fraud rates; in fact, fraud rates across all four delivery services decreased throughout the year. Instead, the rise in gross fraud losses was purely a consequence of a steeper volume of spending on food delivery services. Fraud dollars spent on delivery increased by 49% from January to July, while non-fraud dollars spent in this category rose by 97%.

Within that general trend there were numerous points of interest:

- In January, delivery transactions accounted for 0.64% of all transactions and 0.29% of all dollars spent. By July, these figures had doubled to 1.25% and 0.62% respectively.

- Most of this increase is explained by new clientele; in January, only 2.9% of cardholders purchased delivery, but by July this number had grown to 4.3%, an increase of nearly 50%.

- The monthly frequency of delivery increased to an average of 4.85 in July compared to 3.79 times a month before COVID.

Food Delivery Buyers Are Bigger Spenders

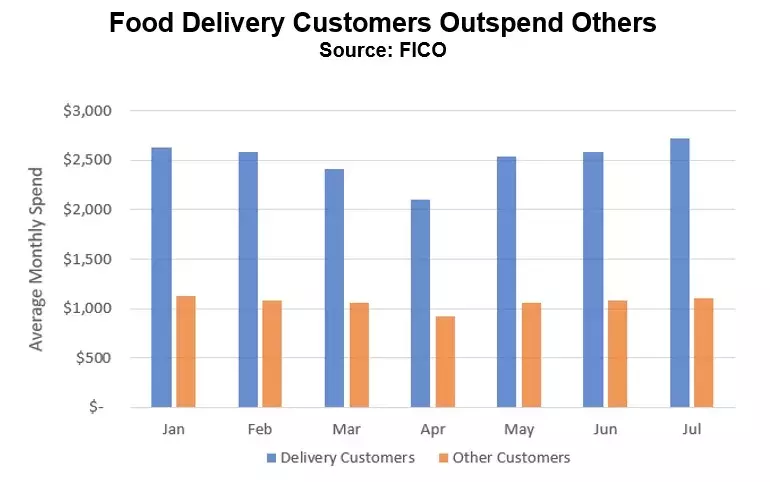

For each month, we also analyzed the overall spending behavior of delivery customers, defined as cardholders who had purchased delivery service at least once during that month. How do these 4% (the customers getting food delivery) differ from the other 96% of Americans? They are much bigger spenders. Each month, delivery customers spend an average of $2,510, while others spend only $1,065 on average.

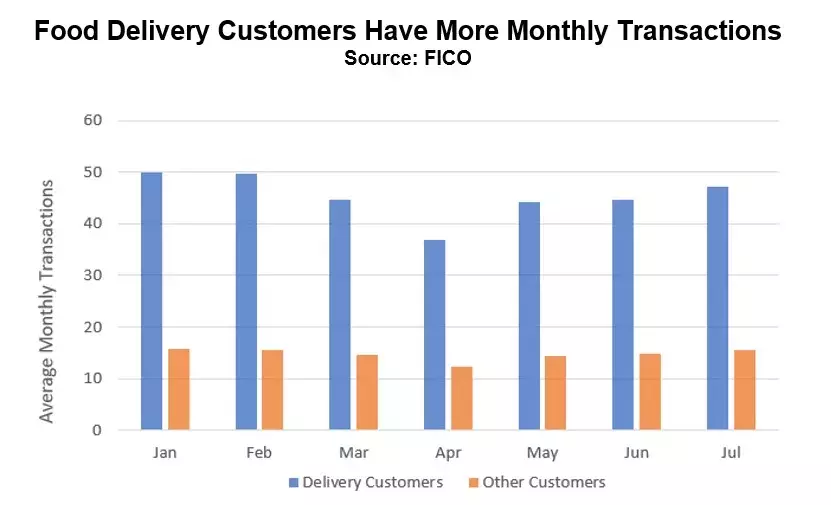

These customers also make smaller but much more frequent purchases. Delivery customers make 45 credit card purchases a month, which is triple the average of 15 for non-delivery customers. This reflects disparity in the usage of these services based on one’s ability to spend.

Key Takeaways on Food Delivery Fraud

Our investigation into food delivery fraud yielded two key learnings:

- Within food delivery services, “friendly fraud” (fraudulent refunds issued to first parties seeking to flat-out bilk the delivery service) is difficult to perpetrate, as these companies cap the amount of refunds they will issue. It also is possible that the goods provided in this vertical (quick, local food items that cannot be returned or resold) are less appealing for fraudsters than targeting other, more lucrative industries. These conditions may contribute to the disproportionately lower increase in fraud as use of food delivery services rose rapidly.

- The distinct spending behaviors exhibited by the 4% of American consumers who are heavy users of food delivery services present a COVID-specific segmentation in customer behavior This shows how technologies such as collaborative profiling, a patented FICO technology that distills behaviors from a large group down to a few basic “archetypes” of behavior, can capture unique customer spending behaviors. These archetypes can be grouped into “soft clusters” that can be useful in further determining which kinds of spending behaviors these same groups share in response to the pandemic.

Throughout the tumult of the global pandemic, FICO® Falcon Fraud Platform models remain a step ahead of fraudsters, employing AI and machine learning technology to detect emerging fraud patterns. Keep up with my latest thoughts on fraud, AI innovation and much more on Twitter @scottzoldi and on LinkedIn.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.