Covid to Cost-of-Living: Assessing Affordability in Uncertain Times

The removal of the mortgage market affordability test in the UK could pose challenges at a time when affordability is an important lending issue

As the pandemic finally starts to abate and related restrictions, as well as support, eases around the globe, we’ve moved swiftly into a global cost-of-living crisis. It is one of the biggest challenges lenders face over the next few years. It comes amid widespread predictions of a forthcoming tsunami of debt as more people find themselves unable to pay their bills.

Affordability is top of mind. The ability to achieve it was already up against some acute challenges brought on by the pandemic. Millions of people, a significant proportion of whom were financially stable, were suddenly furloughed or unable to work due to self-isolation and applications for state support almost doubled.

The conditions of the current environment, however, have not been experienced since the global financial crisis. In the UK, inflation is at a 40-year high and interest rates at a 13-year high. Average gas and electricity prices have jumped by over 50 per cent. Food and fuel prices are soaring day by day and more than a third of adults in the UK are now struggling financially, with many more experiencing a significant squeeze on their finances for the first time in their lives.

Despite this, demand for housing continues. Last year saw the highest level of mortgage lending the UK has seen since before the global financial crisis. Across Europe, many countries are building hundreds of thousands of homes to meet demands. Average house prices have varied from country to country, but the UK is more than three times higher than some other European countries.

The timing of the removal of the mortgage market affordability test in the UK, then, comes as a surprise. At a time when affordability is front of mind, the removal of such a significant rule has raised questions.

Affordability Assessments and Unrestrained Lending

The mortgage market affordability test was introduced in the aftermath of the 2008 global financial crisis. Triggered in part by the US housing market collapse and an unprecedented number of loan defaults, the crisis uncovered a shocking level of unrestrained lending and excessive risk taking. The fallout was felt around the world, with banks failing and stock markets crashing.

Affordability became a top priority for regulators across the board. In the UK, new regulations relating to mortgage lending practices were introduced - including the mortgage affordability stress test. Lenders could no longer base decisions simply on a customer’s history of repaying. Reasonable steps to assess and understand a customer’s ability to be able to pay in the future had to be taken, to ensure financial difficulties or adverse consequences were not incurred.

Many in the industry complained the affordability test was too onerous, seeing it as an obstacle to mortgage access for those who could afford it. By withdrawing the stress test, the Bank of England hopes to increase borrowing capacity for those who have, until now, been limited by it and struggled to get onto the property ladder. While serious concerns have been raised about the market turning into a ‘free for all’ on the lending front, others have argued that borrowers will still be assessed under the FCA’s wider lending rules on affordability and the loan-to-income framework.

Increasingly Complex Lending Challenges

Lenders have refined and improved their affordability models over the years in adherence to regulatory requirements. This has meant multiple affordability models sitting across different product lines and use cases, and a lack of consistency in terms of the data used and calculations applied. As such, achieving a genuine customer-centric view when it comes to affordability has been a challenge.

With the rapidly changing market conditions, the task of updating them efficiently and effectively has proven a considerable drain on resources. It's a significant back-office headache that we’ve found all too common among lenders.

Affordability models are primarily underpinned by credit data. But a crucial challenge to existing affordability assessments has been the huge spike in ‘buy now, pay later’ loans (BNPL). Easier to qualify for, BNPL has given shoppers, particularly those with little or no credit history, the ability to access – or stack - multiple BNPL arrangements at once without them appearing in bureau data used to assess consumer credit risk.

At the same time, regulators across the globe have increased pressure and scrutiny on lenders. There is greater focus on the impact of their actions on future customer wellbeing. In the UK, the forthcoming Consumer Duty will be a game changer and lenders will have to ‘prove’ they’ve taken appropriate steps to protects customers from harm.

The question that now needs to be answered is: can lenders be confident their existing affordability models are optimal in the current climate?

The Future of Informed Affordability Assessments

While ‘traditional’ credit data continues to hold significant value, there is an abundance of alternative data now accessible that can reveal a mountain of insights. This is particularly valuable for first-time mortgage applicants for who, in many cases, there may be limited information and insight available.

Among the banking industry’s biggest recent ‘transformational levers’ has been Open Banking and the transactional data that can now be accessed as a result. Lenders can better understand a person’s ability to pay by having a view on what they are spending their money on, be it school tuition fees, gambling, utilities and so on. Real-time access to informed transactional data can transform affordability models, making them significantly more sensitive to sudden changes in circumstances and household disposable incomes, providing crucial insight into how price increases are impacting customers. The burden of highly complex legacy systems and multiple affordability models across different products lines can be overcome. As such, partnerships with third-party fintech providers will prove vital this year.

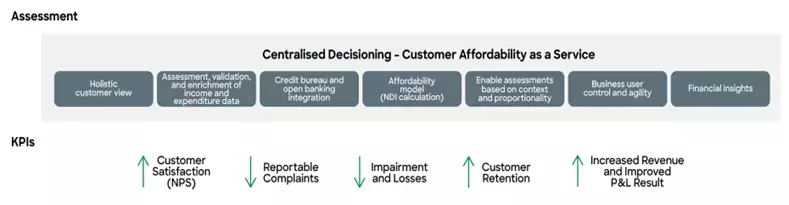

Customer Affordability-as-a-Service was developed in response to this very challenge. It consolidates the complexity of affordability models and calculations across multiple lines of business into one hub, ensuring consistency, the right customer outcomes, agility and an increase in customer satisfaction metrics.

Using AI, machine learning and predictive analytics, it streamlines originations, enabling smarter customer relationships and better customer management. For example, where previously large technical teams would manually adjust different sets of analysis whenever an interest rate change took place, FICO Platform would enable this to be done by one person in a matter of hours and across multiple systems.

How FICO Is Meeting the Customer Affordability Challenge

The ability to offer full control of affordability strategies and models to ensure agility, flexibility and transparency really matters — because accurate insight into household incomes is getting ever-more complex. It was a key driver in our mission to develop Customer Affordability as-a-Service as a key addition to FICO Platform. The service enables lenders to adopt a truly comprehensive perspective by fully leveraging the vast range of internal and external datasets now available when it comes to assessing affordability.

The result enables fast, smart, and scalable management of net disposable income models and calculations tailored by critical business context, with an overview of the volume of sanctioned lending being made at any given time. It delivers clarity with standardised, granular data assessments of customers’ income, exposure, and commitments. Data can be further enriched with real-time credit bureau analyses and open banking insight to validate customers’ financial positions.

How FICO Can Help You Improve Affordability Assessments

- Read Debt Collection and COVID-19: Assessing Affordability.

- How to Meet the Customer Affordability Challenge at Speed and Scale.

- Read more on Digital Customer Communications and COVID-19

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.