Debt Collection and COVID-19: Assessing Affordability

Helping customers get through the current crisis demands a new approach to assessing income, expenditure and affordability

Affordability and driving the right outcomes for customers has never been so front of mind for credit lenders. Over the past couple of months, every market has been challenged to deal with credit-stressed consumers, in situations where they didn’t necessarily expect to be.

In the UK alone, it is estimated that more than 80 million affordability assessments are completed each year, most of which are done manually over the telephone. To the customer, it can feel like an interrogation of their finances and a cumbersome chore to get done with, resulting in rushed, inaccurate answers.

It has taken a long time, but the capabilities are now available to make affordability assessment quick, safe, forward-looking, and intelligent. A solution that combines Open Banking data with a self-service assessment online can reduce the time of assessment for customers from 30 minutes to 3, while cutting costs by 90% for the creditor, and increasing accuracy.

I have recently presented on this topic with Olly Betts, CPO of OpenWrks, and Russell Robinson, VP for Customer Communications Services at FICO. Here’s what we discussed.

How Affordability Risk Is Being Impacted

A good part of your book of customers were doing well and now you don’t know how things will turn out due to the pandemic and economic downturn. You will need additional data to understand where the customer stands. When government-provided relief and payment holidays are over, how will each customer deal with default?

Forward-looking analytics will help you understand if they’re likely to bounce back or not. In order to do that, you will need to collect more data to gain deeper understanding of the household balance sheet. Here are a few tips:

- Investigate past financial behaviour data for signs of affordability challenges

- Understand the causes of consumer default

- Actively collect data from call centre conversations, surveys, expense patterns

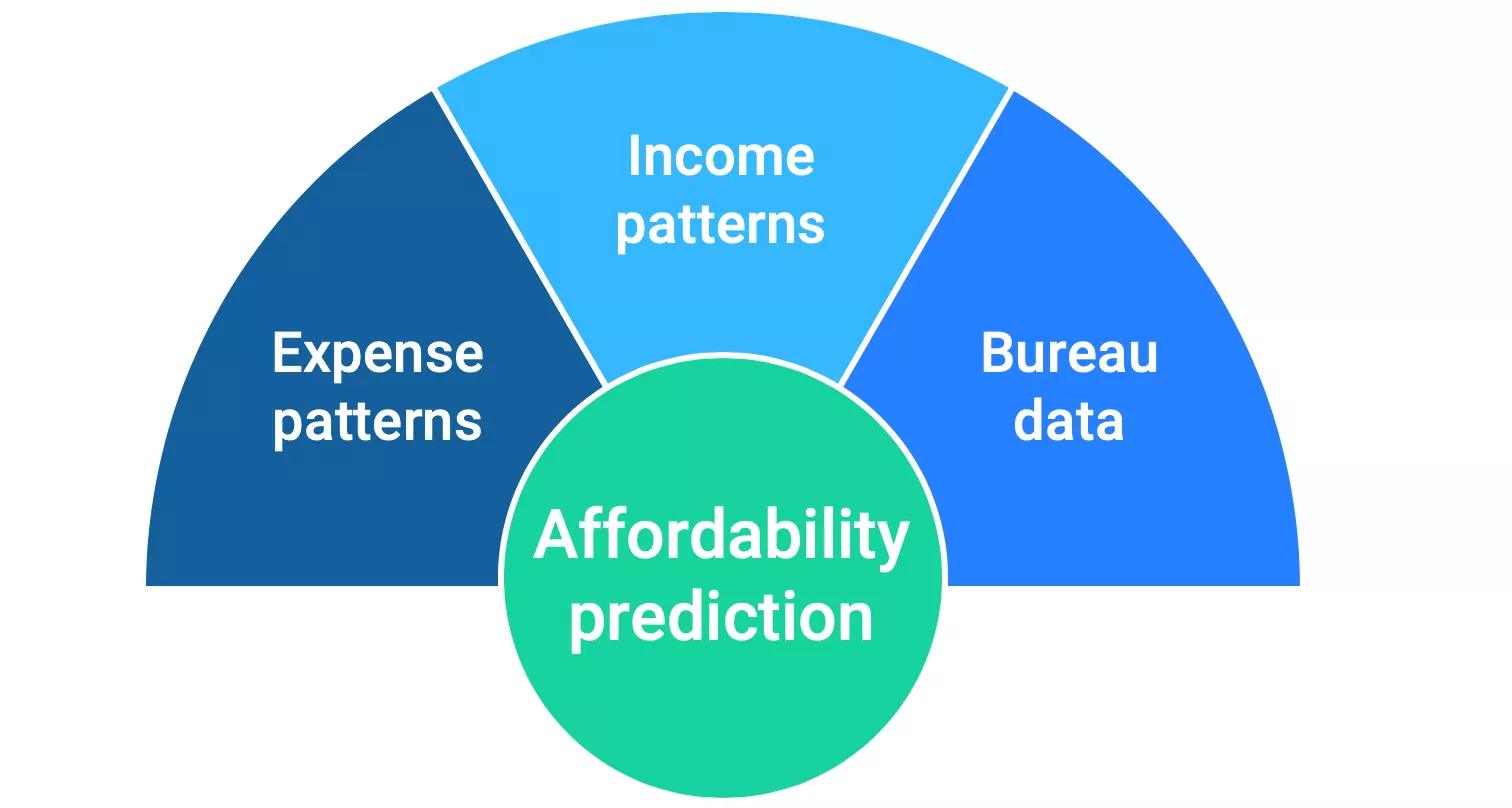

- Blend in-house and bureau data to gain affordability prediction. In the past, creditors have relied simply on bureau data and risk scores. That doesn’t tell you enough on how people spend the money. Today, you need to go deeper, and luckily, the ability to harvest data has improved a lot.

Assessing Income and Expenditure

Industry leaders are responding by leveraging digital solutions that combine Open Banking data and ongoing updates on customer situations. These solutions, such as Tully, provide support at scale in three phases:

- Relieve (tactical phase): referral service enabling the customer to check their eligibility for relief

- Automate assessment to verify need for payment holidays, payment plans or other

- Ensure customers with affordability continue to service debt to mitigate long-term impacts on individuals

- Provide a temporary solution that can be automatically and frequently reviewed

- Enable teams to focus efforts and phone capacity on customers with most need

- Nurture (mid-term): maintaining contact to understand situational changes and act accordingly

- Identify changes in customer circumstances via monthly updates of Open Banking data. This would be in the form of:

- Transaction velocity

- Spend type / classification and association

- Credit and debit through account and credit source

- Gather status codes relating to reason for delinquency, duration of impact and forbearance eligibility to save consumer and creditors from the hurdle of multiple calls

- Understand what is being reported to the credit bureaus and what has been suspended, and determine how to maintain an accurate view of a customer’s true creditworthiness

- Identify changes in customer circumstances via monthly updates of Open Banking data. This would be in the form of:

- Recover (long-term): planning for a controlled way to enable customers to return to “normal”

- Create seamless transition from COVID-19 relief into mainstream creditor repayments with post-crisis updated budget

- Enable a seamless digital transition into debt solutions for customers with longer-term financial stress

FICO has partnered with OpenWrks to combine the Open Banking data (spend patterns, last paycheck) with ongoing updates on customer situation (furlough, reduced hours, redundancy, BAU). Our analytical insights can be used to segment customers and deploy highly tailored treatments that will help each of them repay and go back as quickly as possible to financial wellbeing.

Driving the Right Outcomes

There are four parts you will need to combine to make sure you’re driving the right outcomes for your customer, while taking care of your business:

- Discover the optimal path forward: assess what data you need and how to turn it into forward-looking data by blending what’s happening, what’s trending, and mixing that with bureau and behaviour data to give you prescriptive analytics (not just predictive).

- Remove the potential for friction: implement true omnichannel communications to help engage your customers through their journey to financial wellbeing, whilst capturing important customer data.

- Maintain the agility to leverage available data efficiently: monitor closely, constantly, learn rapidly and be ready to change accordingly with flexible, data-driven collection solutions. Know when to move from policy-driven payment holidays, through collections solutions, to short-term forbearance and longer-term credit term modifications. It is the agility across this range of solutions that will differentiate creditors.

- Invest in the areas where losses are truly mitigated: build a robust collections ecosystem that includes data, insights, analytics, workflow, effective income expenditure and true omnichannel customer engagement. That way creditors will be able to determine what is most appropriate for the customer and the balance sheet, how the solution needs to adjust over time, when and to what degree. Omnichannel ensures the scalable means to cover high numbers of customers at the same time, or the ability to drive a very specific customer journey anytime 24/7. Understanding the relationship of capabilities across the ecosystem is critical to effective collections portfolio management.

In my next post, I’ll go into this further, and discuss a phased strategy as well as the role for omnichannel communications.

For more information on managing debt collection in the current crisis, see these posts:

- Debt Collection and COVID-19: What Past Crises Can Teach Us

- How Is COVID-19 Impacting IFRS 9?

- Debt Collection and COVID-19: Why a Vision Matters

- How to Make Branch Collections Work in the Crisis – Don’t Dial Manually!

- Preparing Your Collections Operation for the Current Crisis

- Payment Holidays: New Tool for Managing the Surge

- COVID-19 and Debt Collection: What’s Happening in Europe

- Is Your Collection Operation Stepping Up to the Pandemic Challenge?

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.