Debt Collection and COVID-19: A Phased Approach

Omnichannel communications is critically important to debt collection in the era of COVID-19

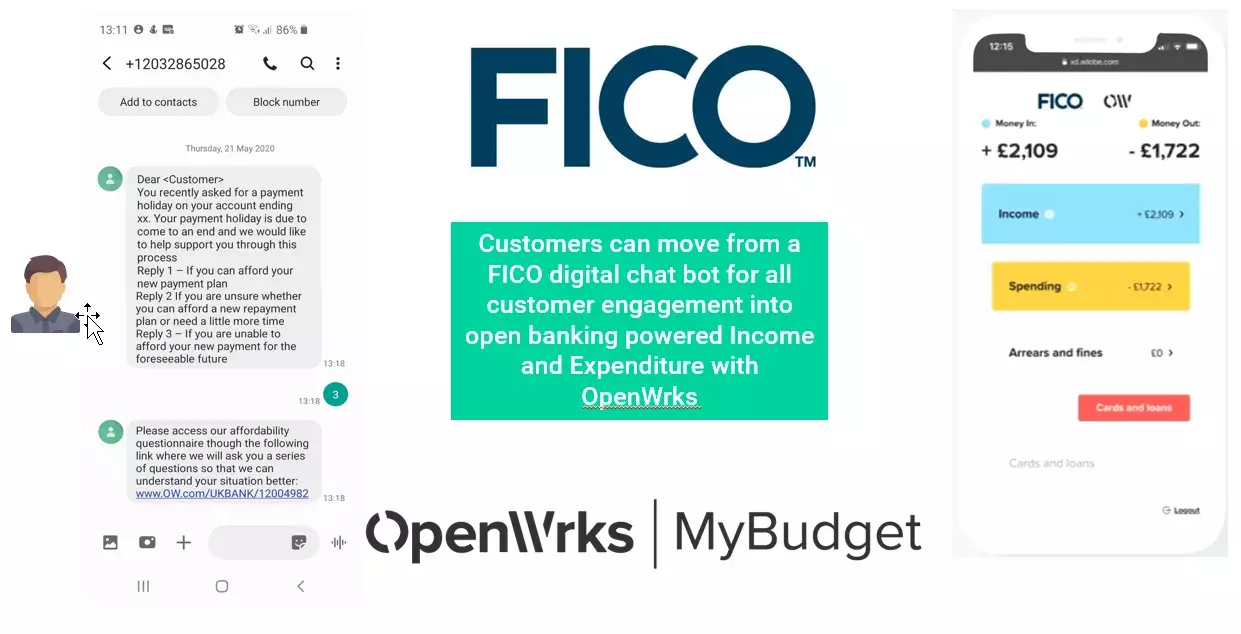

In my last post, I discussed a new approach to affordability assessments using Open Banking data. In this post, I’d like to take a step back and discuss a phased approach to collections in the current crisis, as well as the role of omnichannel communications. I have recently presented on this topic with Olly Betts, CPO of OpenWrks, and Russell Robinson, VP for Customer Communications Services at FICO.

The world has quickly and dramatically changed, so we need to be able to respond accordingly. We see three phases for collection operations in 2020 post-COVID:

- Tactical phase, with a fast-moving, reactive response, intra-day changes, where critical data capture is essential and reputational risk and customer outcomes are driving the decisions. Call centres are being bombarded, while dealing with shortage of staff, there are more people on arrears that were not expected to be there, and the data you had four weeks ago is now “old data”. It’s critical to understand which customers are impacted by COVID and likely to quickly bounce back, and which would be in financial trouble regardless of the crisis. It is important that COVID-19 is captured and registered as a reason for payment holidays. Data and analytics will be key and will need to be revised.

- Mid-term, with payment holidays rolling-off at 90 days and follow-up action required in advance of expiry to ensure the right options are put in place for the best outcome in the longer term. Customer communications and interaction are essential at this point, and the customer journey may take a detour and change to an affordability discussion or forbearance options.

- Long-term, strategic phase, where understanding the reasons for payment holidays or forbearance is critical for regulatory reporting (was it COVID-19 or unrelated?). Collections volumes will still be high, and journeys will get more complex as the initial volumes flat-line. touch points will be required to validate the customer’s financial wellbeing. We expect an increased need for digital-led payment plans.

The Role of Omnichannel in the Path to Financial Wellbeing

An omnichannel communications platform can help creditors engage with customers effectively to optimise their journey through recovery and rehabilitation, from the tactical phase to the long-term, strategic phase.

The first step is to integrate and orchestrate the channels available to the organisation – email, SMS, WhatsApp, mobile apps, voice – to help with responses to payment holiday requests and a change in payment plans. By orchestrate we mean that a creditor can reach out to a customer throughout a day on differential channels, yet all messages are related and when the customer choses to respond they can take a customer journey utilising the most appropriate channels for different steps of that journey, again seamlessly and confidently. Omni-channel is the total opposite of multi-channel.

Having an automated, centralised view and coordination of the customer interactions will help you offer the right payment plan through the right channel for each customer, as well as keep in touch with them during the crisis to gather information or offer advice. Self-service payment terms will reduce operational costs and help your contact centre team focus on customers who need human interaction to deal with their financial difficulties.

Financial stress? Seamless digital transition into debt solutions

Components of Success

Managing customer journeys with omnichannel communications enables the creditor to start looking at collections in a very different way. Omnichannel creates immediate, insightful data at a rapid pace. With omni-channel, we have seen businesses move to as many as 27 cohorts, each worthy in size and profile of very discrete treatment.

Whether used ahead of, concurrent to or following other collection activity, the ability to take customers down an omnichannel journey changes the way we design our segmentation, strategies, operating model, decisioning and performance management. Those with strong omnichannel engagement strategies are making treatment decision on the vast majority of customers within 5 days of strategy commencement in collections, and for those customers that have not responded there is a clearer indication of next steps at 7 to 10 dpd rather than the old 30 and 60 dpd.

In a nutshell, there are the five parts you will need to combine to make sure you’re driving the right outcomes for your customer, while taking care of your business:

- Discover the optimal path forward: assess what data you need and how to turn it into forward-looking data by blending what’s happening, what’s trending, and mixing that with bureau and behaviour data to give you prescriptive analytics (as well as predictive). For organisations of scale, mathematical optimisation is a must if the organisation truly seeks to secure market-leading performance.

- Remove the potential for friction: implement true omnichannel communications to help engage your customers through their journey to financial wellbeing.

- Maintain the agility to leverage available data efficiently: monitor closely, constantly, learn rapidly and be ready to change accordingly with flexible, data-driven collection solutions.

- Invest in the areas where losses are truly mitigated: build a robust collections ecosystem that includes data, insights, analytics, workflow, effective income expenditure and true omnichannel customer engagement.

- Challenge your operating model and ensure a comprehensive understanding of what works well and what can be defended as the optimal point of collections return. There will always be constraints, and too many organisations do not know the cost of those constraints. If they did they would make far more effort to remove them. I recall one client estimating that the amount of recoveries that should have been achievable were the equivalent to one-third of the value of their new business plan. The marketing director became the biggest supporter of the collections budget allocation.

For more information on managing debt collection in the current crisis, see these posts:

- Debt Collection and COVID-19: What Past Crises Can Teach Us

- How to Make Branch Collections Work in the Crisis – Don’t Dial Manually!

- Preparing Your Collections Operation for the Current Crisis

- Payment Holidays: New Tool for Managing the Surge

- COVID-19 and Debt Collection: What’s Happening in Europe

- Is Your Collection Operation Stepping Up to the Pandemic Challenge?

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.