Debt Collection in the Pandemic: Why UK Customers are Dissatisfied

New data points to problems lenders have executing customer-centric collections

Knowing Your Customer, or KYC, is just as critical in debt collection as it is in other parts of the business. However, a recent survey by FICO and Censuswide shows just how far lenders are in the UK from doing effective customer communication based on KYC.

KYC is a general legal obligation on the part of financial institutions to formally identify their customers. While the focus of KYC is to prevent money laundering, many organisations apply the principles of KYC across four business elements:

- Customer acceptance policy – the diligent onboarding of customers.

- Customer identification procedures – fraud and money laundering prevention.

- Monitoring of transactions – fraud and money laundering prevention.

- Risk management – across all elements of the customer lifecycle.

While collections and recoveries is not specifically called out in relation to KYC, my experience is that the insights and knowledge that risk and collections operations have on their customers has significantly improved over the years. However, the development of scorecards, including the introduction of probability of default and propensity to pay modelling, which are the foundation of effective segmentation, are typically used at an account level. The associated collections strategy and contact treatments applied are also at an account level, rather than at a customer level.

The topic of account-level versus customer-level collections has been debated for many years. Most lenders still operate their collections scorecards, segmentation, and customer contact approach at an account, not customer, level. While the reasons for continuing with an account-led approach tend to be driven by legacy and system constraints, across most enterprises the impacts can be considerable and we start to see the consequences in the findings of our consumer research.

Risk of Customer Attrition

One interesting finding is a “cautionary tale” — what happens when the customer is not handled in the right way?

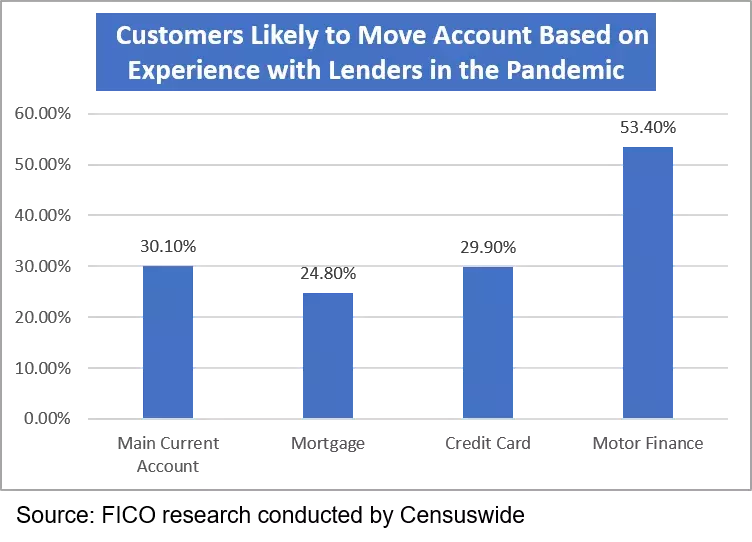

The table below shows the percentage of UK customers surveyed who indicated that they were likely to move their account in the next six months as a result of their experiences with their financial institution during the pandemic.

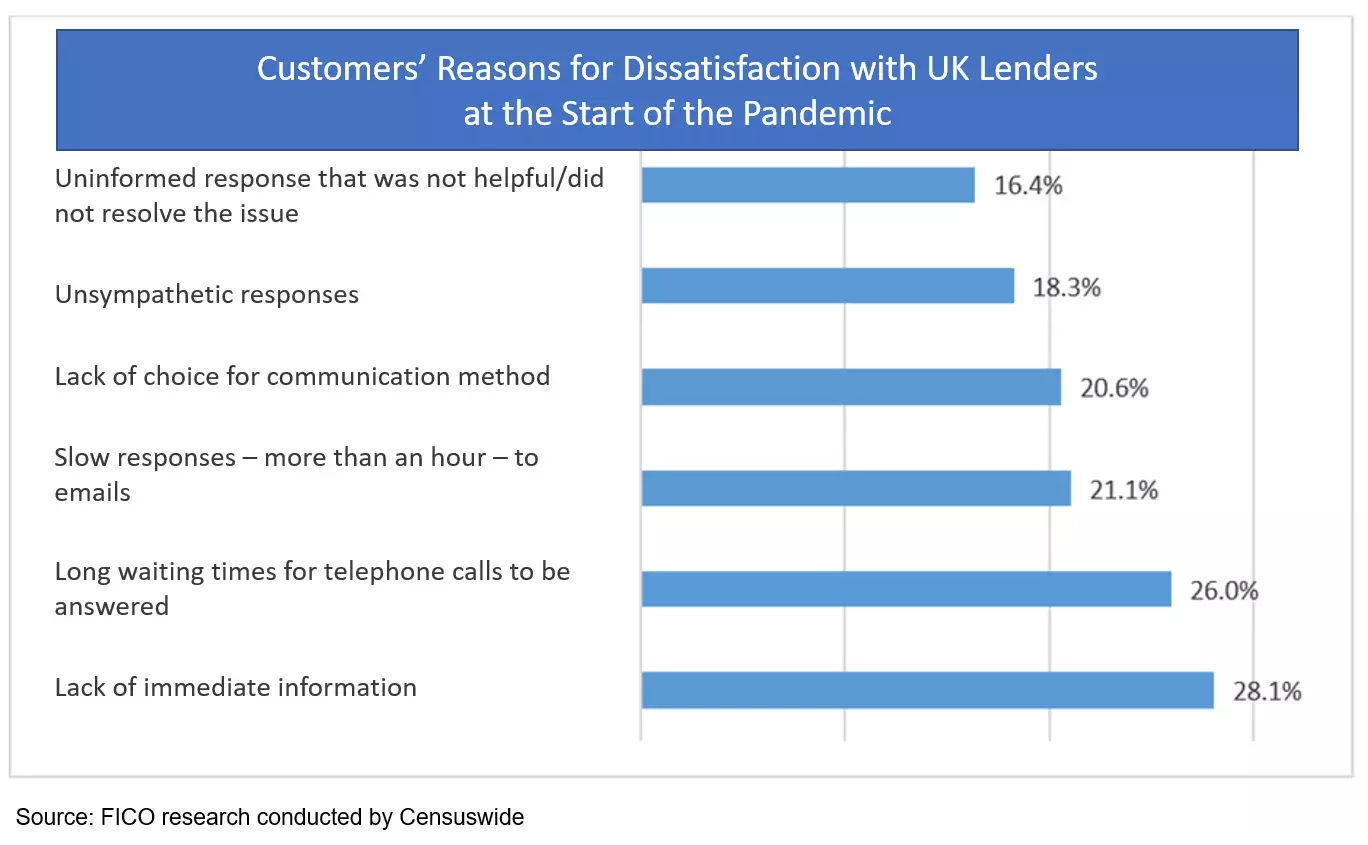

To get a better understanding of this, we then asked those surveyed why they were dissatisfied.

While a number of answers relate to the waits caused by the operational challenges faced by collections and recoveries operations during the initial stages of lockdown, the remaining responses indicate a lack of customer, not account, understanding. For example, more than 20% of customers felt there was a lack of choice of communication methods available to them. This indicates that even in this digital age financial institutions do not truly understand how customers want to interact with them.

When customers did actually manage to get through to someone, their poor experience was compounded by receiving responses that were either uninformed/unhelpful (16.4%) unsympathetic (18.3%) or lacked immediate information (28.1%). These reasons for dissatisfaction could be mitigated with richer customer insight and knowledge of the customer.

All of this is particularly important when we consider that many of the customers we are now dealing with in collections have never been in arrears before. This will be new territory, not only for these customers buts also for risk teams. Without any historic, collections-specific data available, other than credit reference agency data, questions will abound around which customers should we be trying to reach, what treatments should they be offered and what is the best way for us to get in contact with them.

Moving forward, there are a number of steps that can be taken to ensure that we improve our collections KYC approach. Driving a more insightful understanding of our customers should help us deliver more effective and efficient customer interactions and higher levels of satisfaction. This can be achieved through:

- Improving the quality of basic data

- Being creative with analytics, whether simple or complex

- Striving for a single customer view

Get the Right Data

It is surprising that even simple collections data is still not known by many risk and/or collections functions. I have recently come across cases where the risk and/or collections team didn’t know:

- The number of collections customers who have downloaded the business/company app

- How many of these customers were actively using the app

- How many collections notifications were pushed to the app

- How many app customers responded to the notification

- How many collections customers responded to either a 1 way or interactive SMS

- How many collections customers responded to an email

- How many customers have responded to a voicemail being left

These are reasonably basic items of data that should be known, and that contribute to the concept of good collections KYC.

In addition, the introduction of Open Banking has opened up a raft of opportunities for collections teams to supplement their internal data with another rich source of data to provide detailed customer insight. It is encouraging to witness that some businesses involved in collections are starting to embrace Open Banking, although the pace of adoption has been slow. I am sure that, as awareness grows in relation to the insights that Open Banking can deliver, collections KYC will be a key beneficiary.

Use More Analytics

Collections scorecards and robust segmentation are a great foundation for your collections KYC. This can be enhanced simply by taking a broader of view of analytics and viewing your collections portfolio through a different lens.

A great example of this in action was a FICO client who wanted to improve the performance of their FICO omnichannel solution, specifically reducing the roll forward on low balances via improved optimisation and automation. They set three key objectives:

- Increase immediate payment rates (probability of payment)

- Identify customers who best interact with an automated system (probability of connect & authentication)

- Redefine the contact strategies for these customers

FICO analysed a combination of data from their FICO omnichannel solution and internal collections data, which resulted in multiple “new” segments being generated. These were then prioritised and, in line with the overarching objectives, a set of strategy recommendations deployed.

The results were impressive:

- Authentication rates increased by 14%

- RPC rate increased by 3%

- Immediate pay now rates improved from 5% to 9%

- Overall increase in cash collected of 6%

- Reduction of 1,500 calls being presented to call centre

Another example of the importance of improving your collections KYC relates to a FICO client who has been using our omnichannel solution for a number of years. They have developed an acute understanding of what types of account, again driven by customer behaviour, will react and resolve through digital channels. All the analytics are conducted in house, without any third-party support, and the matrix of segments that they generate cuts across characteristics, including product type, risk category, balance, what time in the month to contact, what time of day to contact and what self-serve options are most likely to generate collaboration.

This understanding and approach has resulted in the client only ever having to send a unique account to the omnichannel solution twice to obtain resolution. Friction, for both the client and their customers, has almost been eradicated, and the customer experience enhanced. This method has also produced impressive cost control, with the cost of resolution being less than 1 Euro per account.

This demonstrates that getting to Know Your Customers’ behaviours in small ways can reap significant rewards.

Customer-Level Collections

The single view of the customer, particularly in collections, is a panacea for many organisations, although there are very few who manage to achieve this. So, just how difficult can it be to get to this single view of the customer as a valued individual, in collections? In my opinion you can look at things at 3 levels: Basic, Better and Best.

Basic

Even with the challenge of multiple legacy systems and account-level collections, it is still possible to use your data, in conjunction with an omnichannel solution, to reach out and communicate with a single customer who has multiple accounts.

I have worked with a lender that wanted to contact customers once, regardless of whether those customers had one or more delinquent accounts. They were able to align their data so that the single customer and the multiple account elements aligned perfectly in the data payload ingested by the omnichannel solution. In addition, they were clear about their strategy in relation to which overdue account would drive the contact strategy. This made it straightforward for the omnichannel solution to execute the “multiple account customer” contact strategy and deliver the contact attempts, once only, to these customers.

The only compromise that the client had to make, with this approach, was the processing of the output file from the omnichannel solution into the collections system. This required the client to adopt a manual update process, specifically where a “multiple account customer” had resolved their arrears with an “already paid” or a “promise To pay” option in the self-service channels. The benefits, however, of being able to work customers in an automated way, regardless of the number of accounts they held, far outweighed the manual updating of accounts in the back-end process.

Better

If you are on a journey of delivering digital transformation in collections, the Basic approach is not going to be acceptable. So, what can you do about it?

Serious consideration needs to be given to investing in a collections solution where the management of customers with more than one account, delinquent or otherwise, is a fundamental capability. Not only should this solution have the ability to automatically identify customers with multiple accounts from the host system, it should also have the ability to automatically know which contact strategy to deploy and then automatically update either the outcomes of the contact attempts or the individual associated accounts. The key element here is the automation element – automatic recognition of “multiple account customers”, automatic execution of the correct contact strategy and the automatic update of the customer and/or their accounts.

Best

In an ideal world, collections from an analytical, decisioning and strategy execution perspective would be housed on a single platform. This platform should be able to provide the ideal decisioning foundation companies need to successfully achieve digital transformation, not only in collections but across the whole enterprise. Having the ability to gain unprecedented insight into your customer’s immediate and future needs by eliminating data silos and enabling interoperability between your enterprise applications should be the goal for all risk and collections teams.

In my next posts, I’ll discuss managing customer demand and proactive customer contact. In the meantime, if you have any questions regarding this post or would like to discuss ways that FICO might be able to support you in collections, please email me at huwvaughan@fico.com. For more information on the survey, see our news release: FICO Data: UK Consumers Struggled to Reach Lenders About Payment Problems in Pandemic.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.