Detecting Prepaid Card Fraud: A Multi-Layered Approach

In this deep dive, Scott Zoldi explains how innovations in machine learning and self-calibrating models are finding more fraud and reducing false positives

As I recently blogged, the use of prepaid cards is growing, in forms ranging from one-time gift cards to reloadable payment mechanisms for benefit distribution. In that blog I introduced FICO’s patented Multi-Layered Self-Calibrating (MLSC) fraud model, which we have successfully deployed to overcome regional- and usage-specific variations in normal prepaid card spending behaviors, and find more prepaid card fraud. US Prepaid and GIM Prepaid 1.0 models are available to clients using the FICO Falcon Platform.

This technical post drills down into the details of MLSC and why it’s important in heterogenous transaction environments. Put on your data scientist propeller beanie and let’s go!

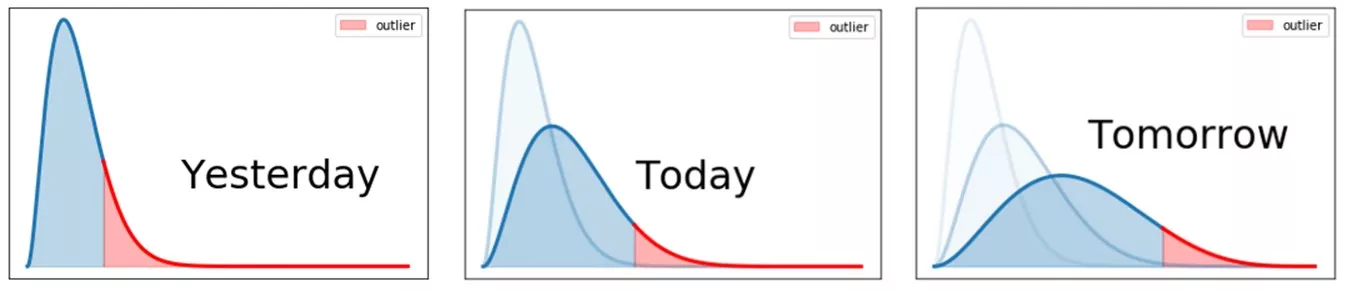

Outliers Are Always in Flux

The decision boundaries that distinguish normal transaction behaviors from outlier ones are constantly changing, especially in emerging fraud markets and dynamic payment environments. A good outlier detection algorithm must be able to tune the decision boundaries over the time. FICO’s MLSC model achieves this (e.g., it finds fraudulent prepaid transaction cards) by learning, in real-time, the distributions of the features that describe transaction behaviors, and adjusting decision boundaries accordingly.

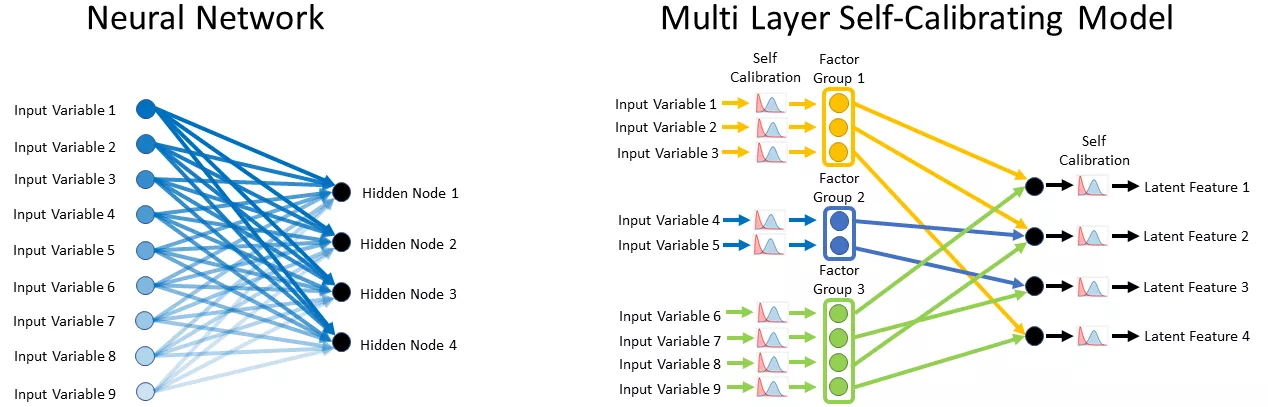

The structure of an MLSC model resembles a Multi-Layered Neural Network model (Figure 1). Compared to a traditional neural network, in which all input variables can interact in each node of the hidden layer, an MLSC model allows only limited-input variables’ contribution from distinct factor groups to interact in the nodes of the hidden layer. This aspect of the MSLC model allows it to explore a varied latent feature space of prepaid card transactions, to find the underlying non-linear variable relationships that will form good outliers for fraud detection.

In addition, the output of the hidden node in a MLSC model dynamically scales based on its recent history. Together, these factors can allow MLSC models to deliver robust fraud detection in heterogeneous transaction environments.

Figure 1: MSLC models share some similar characteristics of neural networks.

Dealing with Multimodality

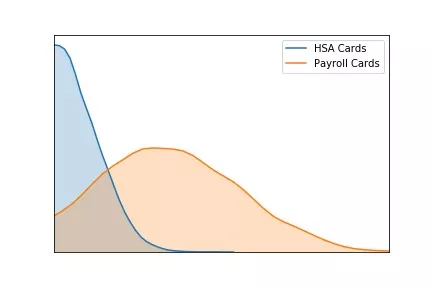

Studies have shown that prepaid card types are closely associated with certain transaction behavior. For example, the distribution of weekly spending on ATMs for prepaid HSA cards typically has its mode centered around $0, while prepaid payroll cards exhibit a much higher mode (Figure 2). This dramatic difference in distributions between groups can lead to convoluted multi-modal distributions, which in turn makes it harder for traditional models, particularly outlier models, to identify true outliers.

To combat the inherent multimodality in prepaid cards, the MLSC model uses peer-grouping to inform model segmentation. As a result, the model can deliver higher-resolution outlier detection, decreased false positives and increased fraud detection, compared to fraud detection models without MSLC.

Fraudulent transactions often surface in determining abnormal variable values (outliers) in the variable distribution from a payment card fraud detection model. MLSC uses the quantiles of the input variables to establish the corresponding thresholds of each variable distribution to distinguish outliers. These quantiles are used to scale the input variables, such that variables with a scaled value that falls above a certain threshold are considered outliers.

The greater the magnitude of the scaled input variable, the higher the likelihood a particular transaction is fraudulent. The scaling and outlier thresholds are not static, but rather are updated in real-time as transactions stream into the model. Therefore, they vary among different peer groups for the same period (Figure 2) and vary with different periods in time for similar cards (Figure 3).

More than a 20% Reduction in False Positives

FICO recently released our first consortium prepaid fraud models for US and international markets. Incorporating innovative technologies such as MLSC and Collaborative Profiling, the resulting prepaid consortium model had more than a 20% reduction in false positives, while boosting both real-time value detection rate and account detection rate at a typical non-fraud transaction review rate.

The bottom line: The successful implementation of MLSC with peer grouping in prepaid models accommodates regional and usage specific variations in normal prepaid card spending behaviors. MLSC iteratively adapts to migratory trends in consumer spending patterns in rea -time, to accurately assess if a prepaid transaction is fraudulent.

You made it! You may now take off your propeller beanie. Keep up with my latest thoughts on data science and AI innovation––follow me on Twitter @ScottZoldi.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.