Developing A Platform Approach To Decision Automation To Combat A Crisis

Learn how to establish a resilient, digital customer development infrastructure to meet the challenges of today and tomorrow

FICO and many other companies have sent out messages to support the dramatic personal and market changes underway due to the COVID-19 pandemic. Clearly this health crisis and the resulting economic disruption has fundamentally changed the way that organizations establish, build, and retain relationships with their customers.

In much the same way as we’ve been beating the digital transformation drum over the last few years (and we’re not alone in this), it’s never been clearer that simply going digital is no longer enough. While it is increasingly essential; for everything from account opening to communicating vital updates to customers’ facing urgent financial problems. Equally essential is a flexible, analytic-powered decisioning infrastructure to drive those digital interactions. Connecting, collaborating, learning and adapting – based on data insights – customer communications and subsequent decision making processes is a reality today more than ever. This crisis proves that.

Organizations which recognize that delivering analytically powered decision making consistently across a customer’s entire buying journey will be best-positioned to weather the current crisis and significantly strengthen the customer engagement, create an optimized experience across even the most diverse set of offerings, and build loyalty and trust. Those without are falling behind (even if they don’t realize it yet).

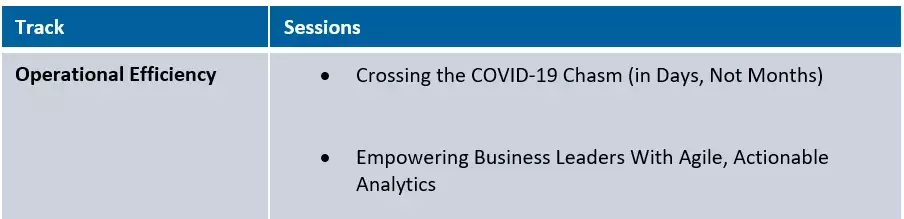

To help your organization in establishing a resilient, digital customer development infrastructure, FICO is launching a month-long virtual event entitled “Building Resiliency: Adapting to the Challenges of Today”. With a series of webinars held across the globe, FICO subject matter experts will share learnings, best practices and strategies on topics that fall within six tracks including Adaptability, Digital Customer Engagement, Risk Management, Operational Efficiency, Building Trust and Protecting Customers. I particularly wanted to remind you of two key sessions:

While we hope that you will explore the many sessions touching upon these best practices and invest the time to learn more about how FICO solutions are built to help companies react and respond better to crises, we also hope that you will consider how your short term investments can be built in such a way to make your business more strategic and adaptable to change long term.

Registration is complementary and open now. We hope to see you there!

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.