Digital Banking: Humanizing the Customer Experience

While pursuing digital banking, banks have the opportunity – nay, the imperative – to focus on humanizing the customer experience, and be personable in impersonal channels

Following the highly successful The 11 Commandments of Digital Banking eBook, we are kicking off a series of 5 deeper dive blog posts that group the 11 commandments below into common themes.

- Digital lift-and-shift is not a strategy!

- Friction – not inherently good or evil

- Be personable in this impersonal channel

- Respect the data

- Engage me, teach me – feed my TikTok obsession

- Use your branch wisely!

- Respect my time and match my effort

- Pester me … but only when I want it

- Be fascinated by your customers, not your technology

- Make customers feel safe

- Come together like a symphony orchestra

I covered commandments 1, 2, and 9 in my post on The Customer Journey. Now let’s talk about commandments 3, 5 and 6.

The COVID pandemic has undoubtedly accelerated plans for digital transformation. Many enterprises have succumbed to the inclination to digitize everything, which by default leads to cold, clinical experiences. It’s difficult, but embracing new technology means that we have the opportunity – nay, the imperative – to focus on humanizing the customer experience. Banks must find ways to be personable in these impersonal channels. It’s about utilizing the data you have to create differentiated experiences based on your knowledge of the customer.

Be Personable in This Impersonal Channel

The digital banking journey needs to be intuitive, friendly, and transparent. Banking doesn’t have to be boring! Be enthusiastic and make customers feel like they made a great choice opening your app or website.

As a financial institution, you already have enough customer data to make subtle adjustments that can create a better experience. Leverage that data so you can make intelligent and meaningful offers, but remember that personalization isn’t about selling products – it’s about making customers feel comfortable and valued during every interaction they have with you.

Analytics-powered digital solutions enable intelligent personalization based on context (i.e., what’s happening in the moment). Use location data to say “Good Morning!” or “Good Afternoon!” depending on the time zone where the customer is located. Find ways to be proactive and show them that you care about their financial wellbeing. Celebrate with your customers (e.g., birthdays, anniversaries, financial accomplishments) – think of it as digital confetti. Simple personalization that’s prominently displayed is the digital equivalent to a teller giving you a big waive and smile as you walk into the bank branch. Even naming your banking app can make it sound more personable, which is why many companies have given their AI programs people names (such as Alexa, Siri, and Erica).

Give customers the option to move seamlessly between channels, but don’t prescribe the journey for them – everyone is different. Leverage technology to handle simple interactions, but make it easy for customers to speak to a human being whenever they want. Remember that every time you engage with a customer, there’s a learning opportunity for both.

Engage Them, Teach Them, Feed Their TikTok Obsession

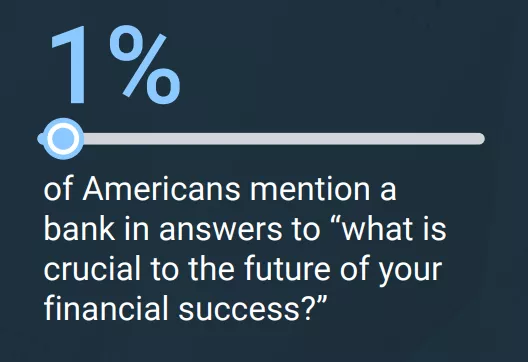

While many consumers are digitally savvy, they’re not necessarily financially savvy. This is something that banks should be involved with – but when Americans consumers were asked, “What is crucial to the future of your financial success?” only 1% of them mentioned banks.

People want to master their financial lives and they want engaging content that teaches them how. That said, customers have increasingly high standards and you only have a short amount of time to impress them (especially Millennials).

What can financial institutions learn from TikTok? It has a tight set of constraints that forces you to create content that’s quick, compelling, and easily understood. Making enjoyable financial services content isn’t easy, but the medium matters a lot.

Videos need to have lots of movement and good visual examples to keep your audience’s attention – and don’t be afraid to add some music! Make sure your content is easy to like, comment, and share. You want customers to engage, and shorter videos give them a reason to come back and watch more. Create content not just to educate existing customers, but also to use as a broader opportunity for organic growth.

Remember these key rules:

- You have 7 seconds to make your first impression.

- Customers want mastery, but they don’t like to learn or hear a lecture. Frame your financial literacy content accordingly.

- ‘How To’ videos are extremely effective, especially for coaching customers through new banking tasks.

Always be respectful of the time customers give you. Engage people and teach them – but don’t lecture or talk down to them. Make sure your content is easy to like, comment, and share. There’s nothing wrong with making it fun!

Use Your Branch Wisely

In 2019, 83% of American households with bank accounts visited a branch at least once. This suggests that the branch’s role as a place to resolve critical problems or get advice remains important, even as its role as a transaction center declines.

You don’t want to get rid of all your branches, especially now with COVID-19 vaccines becoming increasingly available. Branches continue to provide security and comfort, and they’re a way for banks to build trust. The challenge is to make the most of the branches you have.

Remember these key rules:

- Most customers don’t want to go into the branch a lot. Ensure that your fraud and risk management processes aren’t forcing them to visit.

- Omnichannel is customer-led. Give them the option to move seamlessly between channels and let each person establish their own preferences.

- Leverage technology (e.g., voice AI, chat bots, etc.) to handle simple interactions, but make it easy for customers to speak to a human being whenever they want.

What do people want from their financial institution? A recent survey by Future of Money found that they want better communication, more financial advice, better service, and tools to help build wealth. To accomplish these objectives, 39% said they prefer talking to a person, 28% prefer digital tools, and 33% want both of these, equally.

Successful digital transformation means using your bank branches wisely and creatively. You need to understand why customers are coming into the branch and also look for opportunities to incorporate your branch experience with your digital experience. Your branch staff should be advocates for your digital banking tools and help train customers how to use them.

Rationalize your branch footprint and optimize your use of it. Branches can be a differentiator, but only if they are used in the service of your customers’ goals rather than your own.

Join my next LinkedIn Live on February 15, where I will talk with Melaina Vinski, Associate Partner, Head of Behavioural Science and Cognitive & Analytics Practice at IBM, about the importance of humanizing the customer experience in banking.

How FICO Can Help You Advance Your Digital Banking

- Watch my LinkedIn Live video with Alex Johnson of Cornerstone, talking about the customer journey.

- Download the 11 Commandment of Digital Banking

- Explore FICO Platform

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.