Digital-First Collections Means Thinking Like a Marketer

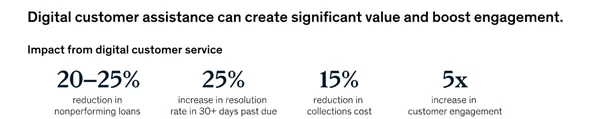

The numbers speak for themselves because digital-first collections counts when it comes to tackling late-paying accounts

As households continuing to grapple with finances, lenders that offer the right combinations of digital-first customer support will experience the benefits, including improved repayments, debt resolution, longer-term customer loyalty and greater market share.

By concentrating on effective customer engagement, lenders will also ensure that they are better aligned with regulatory requirements. As the impacts of the pandemic continue to play out, regulators are heaping ever-more emphasis on fair outcomes and doubling-down on lenders deemed to be harassing late-payers.

Marketing Mindset

Those emerging from the pandemic in a stronger position will continue to require assistance with future borrowing and investing. But with pressured margins, it makes sense to pursue value-creation with a marketing mindset that typically follows digital-first solutions.

The most effective marketeers profile their customers, fit product to profile, time the offering and seek a channel that enables smooth take-up alongside appropriate real-time online validation. They look to get an early understanding of the potential lifetime value of the customer, with a clear relevance of the offering, at minimal cost or customer irritation.

The best collectors profile their customers, fit collections solutions to profiles, time the engagement and seek a channel that enables straightforward automated resolution, again with appropriate real-time validation. They seek to retain the potential lifetime value of the customer, clearly evidenced by the right outcomes at a minimal cost, while also securing a high-level of satisfaction.

It's an area covered in detail during a recent Digital-First Collections Strategy webinar co-presented with McKinsey partner Matt Higginson.

Meeting Minimum Expectations

Sentiment hinges on collaboration and transparency, by offering customers every opportunity to find a mutually acceptable solution. Debt moratoria, light-touch communications and tailored messaging are now a minimum expectation. But irrespective of compliance, there are a mass of strategic and operational reasons to modernise customer assistance by adopting a long-term collaborative and nurturing mindset. Because in all likelihood it's a route to significant revenue value.

Customers are clearly more comfortable than ever using digital channels. As a result, lenders that provide smarter, interactive and more personalised services are in a win-win situation and are likely to out-perform legacy-blighted peers. Some will see reductions in nonperforming loans (NPLs) of up 25% alongside lower risk and significant improvements in customer engagement. In fact, some lenders noted a five-fold cut in average repayment times.

Opposites Attract

Despite marketing and collections being at polar opposites of the credit life cycle, they certainly have a lot in common. The main area of difference is the impact of getting it wrong. For marketing, it’s a lost sale. For collections, it’s a failure to collect credited funds. One holds a cost equivalent to 10% of sale value - the missed potential margin. The other holds a potential loss of between 25% and 100% - if there’s a failure to drive the right result within the first 30 days following a missed payment.

Arguably, collections should never be less equipped than marketing, but crucially, should think like a marketeer! For a deep-dive into the subject, watch the free Digital-First Collections Strategy webinar co-presented with global consulting giant McKinsey.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.