Digital-First Originations: Why Friction Counts in Small Amounts

In a world of digital-first originations, consumers will tolerate increased friction when opening accounts for specific high-value financial products, such as mortgages

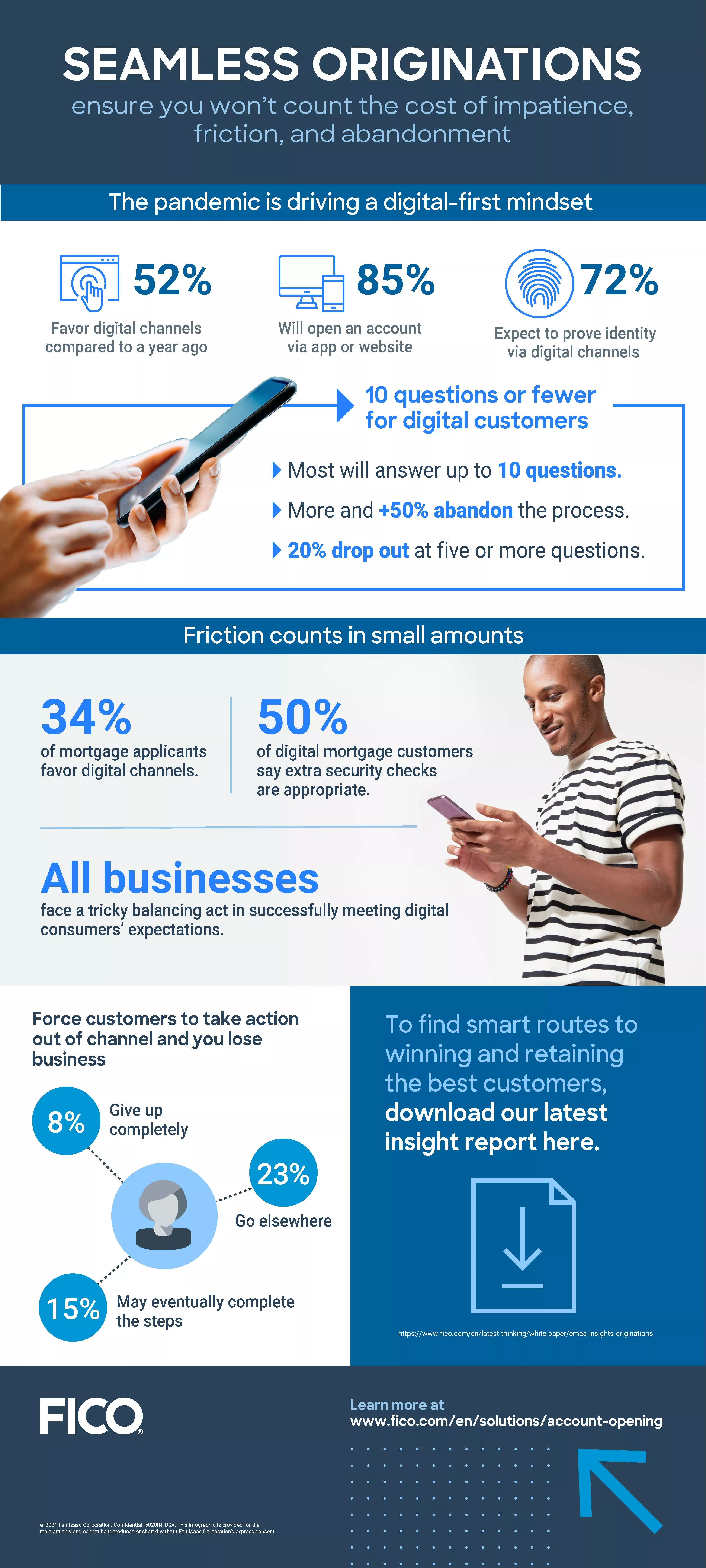

Banks, financial services and commerce all face a tricky balancing act when it comes to successfully meeting digital consumers’ expectations. It’s a benchmark that continues to shorten driven in part by evolving behaviour amid the ongoing pandemic, which has increased the demand for digital-first originations.

Both the onboarding of returning customers and signing in of new visitors requires some form of verification to safeguard them from ID theft, prevent fraud and uphold regulatory requirements.

But the clock’s ticking. Checks can’t be difficult, choppy, or so time-consuming that customers simply get impatient, become dissatisfied or abandon the process – because once they’ve gone, they’ve often gone for good.

Consistently managing onboarding across all channels as smoothly and easily as possible is vital. To assess appetites towards digital account opening, we polled opinion among 14,000 customers across the globe. The results published in our new study Riding The Digital Wave were surprising.

The Theatre of Security

It’s worth noting that increased friction and the ‘theatre of security’ are deemed appropriate by consumers when it comes to applying and onboarding for specific high-value financial products.

Despite relatively high levels of ease and confidence in applying for day-to-day online financial products such as current accounts, savings, loans and credit cards, among more than half (52%) of customers polled, it’s clear customers expect greater rigor when it comes to mortgage applications.

Research showed an average of around one in three (34%) mortgage applicants now favour using digital channels. But in all countries bar the USA and UK, in-branch openings are preferred to online methods. South Africa was a modest outlier with 43% of customers favouring online mortgage applications.

In fact, around half (~50%) of mortgage customers polled also said they were willing to answer 20 or more questions when it comes to successfully being onboarded by a new home loans provider.

At FICO, we're already helping thousands of strategic clients drive ahead with their digital transformation projects to help ensure they stay relevant, front-of-mind and a consistently competitive option for their customers. To meet rapidly growing customer expectations we've launched a powerful next-generation originations solution for digital-first account opening.

It delivers unprecedented insight into your customer’s immediate and future needs by eliminating data silos and enabling seamless interactions between enterprise applications. To find out more, simply click here.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.