Digitalization and Artificial Intelligence: 5 Keys to Success

Digitalization and artificial intelligence will radically change retail banking. What does this mean for banks?

Machine learning, language processing, robotics - the artificial intelligence toolbox offers a range of smart tools that enable machines to act autonomously. In order not to miss the boat of the rapid technological developments, financial institutions need to know where their digitalization journey should go and how they want to use the innovative technologies in a focused manner.

In May 2018, Google CEO Sundar Pichai presented a new technology called Duplex at the Google IO developer conference. This technology enables Google's digital assistant to call service providers or restaurants to make an appointment with a hairdresser or to book a table, in natural language. The conversations presented in the demo are indeed impressive, and the filler words inserted by the AI make the conversations sound very natural. Regardless of how market-ready one may consider such technologies: the progress in the development of automatic dialogue systems is rapid, and it is foreseeable that such systems are or will be more and more capable of taking over significant parts of the interaction with customers in banks as well. This is especially true for many standardized business transactions that do not require much consultation and do not serve conflict resolution.

Banks are facing similar upheavals in process automation: In a first wave of automation 20 to 30 years ago, we saw how certain processes were removed from the branches and transferred to new centralized units. In these units, processes were serialised and trimmed for productivity. With digitalization and AI, many processes can now be fully automated for the first time, without manual steps. This promises both significant cost advantages and faster processing and thus a better customer experience. Compared to such fully digital processes, the processes from the first wave of centralization and rationalization will appear quite manual.

This development is also supported by the fact that the decisions that are necessarily automated in digital processes are becoming better and better and regularly surpass the performance of manual decisions and decision strategies developed judgmentally. Methods from operations research such as mathematical optimization enable a quantitative understanding of the trade-offs between competing goals such as profitability, market share and risk appetite, and thus allow the targeted development of tailored decision strategies.

In order for banks to be successful with digitalization and the use of AI, a number of prerequisites must be met, which I would like to outline in this article.

Thesis 1: Digitalization Requires New Skills

New technologies always come with new requirements on skills. In addition to technical know-how, an engineering mindset is essential to be successful with automated processes.

The management of digital processes and automated decisions requires employees to look at a process the way you would look at a production line – to think about error tolerances, measurement techniques and when to manually intervene with a case. While you get feedback from human employees about the success or failure of actions, you can't expect this kind of proactivity from a machine. Chatbots that do not have the right answers to customer questions lead to frustrating customer experiences – automatically and over and over again. Employees in process control must therefore keep an eye on all process steps, recognise blind spots and improve them where required.

Digitalization will also have an impact on the skillsets required in operations. When the bulk of the tasks are taken over by machines, the cases ending up in operations for manual review are more complex and consultation-intensive, and frequently include exceptions and conflicts; these are the cases that might have been escalated to the team leader in the past. Handling such cases requires more experience and higher qualification. We are already seeing some market participants using natural attrition to reduce headcount in operational units that are being relieved by digital processes. However, where staff are hired, they have significantly higher qualifications and earn significantly higher salaries than the average employee before the change.

Thesis 2: Digitalization Requires Agile Methods

If communication with customers takes place via digital channels, there is no immediate insight into where things are going wrong. While employees intuitively adapt their communication to make it effective, machines stubbornly follow their rulesets without providing feedback on what is not working.

Banks that are successful with digital processes monitor these processes closely and adjust them continuously. The results of the individual dialogue and process steps are systematically evaluated quantitatively, and alternative approaches are tested in a champion/challenger approach.

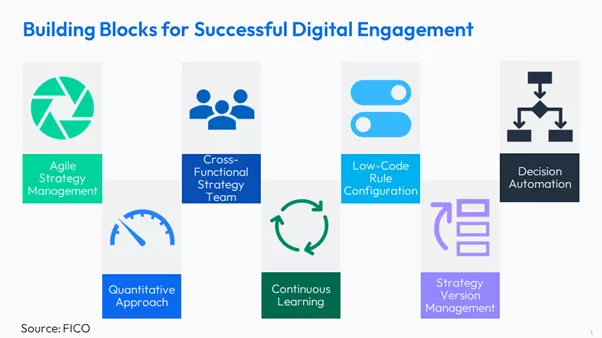

To facilitate this continuous learning loop, banks implement a cross-functional strategy team that reviews the results of the individual process steps jointly with the respective business owners, develop ideas for improvements and test them. The prerequisite for this agile and quantitative approach is the ability to implement adjustments quickly and largely without the involvement of IT resources. Therefore, the decisioning technology used must enable employees without programming skills to configure rules and communication content independently. IT resources are mainly involved in version management, if at all; the actual process and rule configuration is the responsibility of the respective business unit.

Successful organisations constantly refine digital processes with agile methods

Thesis 3: AI and Operations Research Unleash Additional Effectiveness

Which credit offers or limits a customer receives, which marketing initiatives are promising for a target group or how intensively receivables management approaches customers – the decision strategies that guide these actions are generally developed based on business experience. Analytics are frequently used to segment the portfolio — but analytical methods are often underleveraged when assigning decisions, measures or prices to these segments. This leads to considerable opportunity costs.

I expect that methods from operations research will be increasingly used in the development of price strategies, but also when developing targeted operational processes – which in some industries, such as manufacturing, has been common practice for decades. With mathematical decision optimization, the dependencies between turnover, profitability and risk goals, for example, can be understood quantitatively, so that decision strategies can strike the optimal balance between competing goals. Not using these methods is expensive: I estimate that insufficient use of mathematical methods in the development of pricing strategies causes European banks to miss out on annual profits between 500 million and 1 billion Euro from instalment loans alone.

Thesis 4: AI Requires Effort

Machine learning and artificial intelligence are surrounded by an aura of effortlessness: Problems solve themselves. This assessment is inaccurate.

Many underestimate that the introduction of AI requires good preparation and regular monitoring and readjustment. This starts with the selection of the appropriate method: not every algorithm is suitable for every problem. And a model is only as good as the underlying data. Accordingly, careful data preparation and cleaning is essential.

In order to achieve real added value, it is also imperative to have a solid understanding of dependencies between business goals, methods and decision space. Where is the value in a business process, and which decision has the greatest impact? What knowledge and predictions can help improve that decision? These questions will continue to require answers from expert staff.

Thesis 5: AI Must Be Explainable

Automated decisions using AI are highly scalable. This carries the risk that errors and undesirable bias replicate in an automated fashion. Decision logic that represents a black box therefore harbors incalculable risks. It is essential to understand how models work, and you must be able to see and explain which data characteristics dominate a decision — both on a global level and for an individual decision.

According to a recent study "State of Responsible AI" by market research firm Corinium and commissioned by FICO, 65% of companies surveyed cannot explain how AI decisions or predictions are made. Only a fifth actively monitor models for fairness and ethics. These are worrying numbers.

However, the need for explainable AI does not just result from principles of good corporate governance. In various discussion papers issued by the European Banking Association and national regulatory bodies, regulations are emerging that demand explainability at least for risk-related decisions. This makes explainable analytics an imperative for reasons of investment security alone.

Conclusion

Artificial intelligence and digitalization promise to significantly improve the cost structure in retail banking. As with all automation projects, however, it is important to use these tools carefully. But even intelligent technologies cannot magically fix mediocre processes. Therefore, it is worth focusing on the decisions and processes that deliver the greatest value to your organisation. When you do this, AI moves beyond being just another buzzword, and opens up new potential in retail banking.

How FICO Can Help You Advance Your Use of AI

- Discover our AI and machine learning solutions

- Read posts by our chief analytics officer, Dr. Scott Zoldi

- Download our paper on The State of Responsible AI

- Download our AI Playbook: A Step-by-Step Guide for Achieving Responsible AI

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.