Disruption and Transformation: Opposite Sides of the Same Coin

One company’s digital transformation is everyone else’s digital disruption

Digital disruption, customer centricity, and decisioning technologies have combined to create a dilemma for companies seeking to improve client satisfaction and retention: should they do nothing, and take a wait-and-see approach? Or should they take the initiative and go through the pain of reinventing themselves?

Just as Pablo Picasso once observed that "Every act of creation is first an act of destruction,” people have been drawn to the notion of symmetry and balance in our surrounding world throughout human history: the Roman god Janus; Yin and Yang; even The Force in Star Wars. We accept that all things exist as inseparable and contradictory opposites, and that these contradictions are inexorably intertwined: day and night, light and dark, peace and war, and life and death, in a never-ending dance. One remains until the other consumes it, ad infinitum.

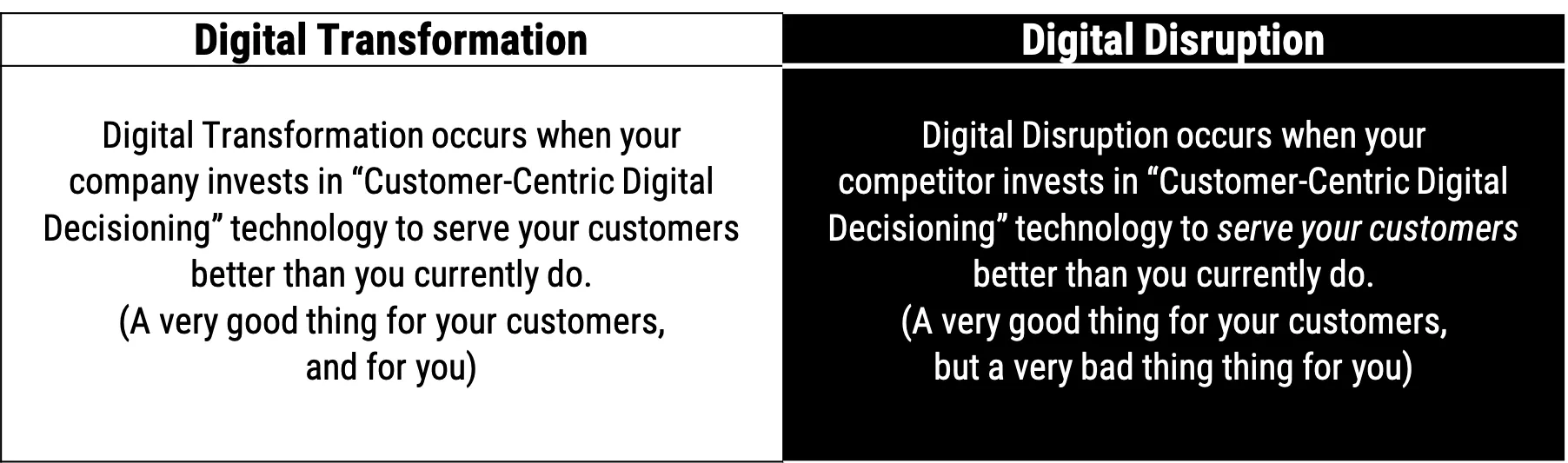

Many business people naively talk about digital transformation and digital disruption as if they were two unrelated things; they aren’t. They are opposite sides of the same coin. Technology and market forces have tossed that coin into the air; and before it lands, you have to choose heads or tails, or a competitor will choose for you.

Here’s why: one company’s digital transformation is everyone else’s digital disruption. You can be the disruptor or the disruptee. It’s your call. Either way, change is coming, and your customers will soon be getting options on the solution of his or her choosing. The only question is, will they stay your customer, or will they be lured away by a competitor?

Your options look something like this:

Disruption Isn’t Just Taxicabs and Retailers Anymore

Today, in hypercompetitive, disrupted industries, every customer touch becomes a zero-sum faceoff of its own: each win comes at a competitor’s expense, and their wins come at yours. Every Uber trip means a taxicab didn’t get a fare; every Kindle download costs bookstores a sale; every purchase on Amazon was one that didn’t happen at a retailer; and every booking at an AirBnB is one that didn’t occur in a hotel. But the results of each satisfactory experience are cumulative; people who try Uber, Kindle, Amazon, and AirBnB are very likely never turning back.

Could this level of disruption happen in banking and financial services? The experts believe that it’s already here: top analysts like Forrester, Gartner, and IDC – as well as top consulting firms like Accenture, Deloitte, E&Y, and McKinsey – are advising their banking clients to rebuild their businessesinto full, customer-centric operations as a way to stave off disruptors.

Venture capitalists are betting big on the disruptors: they plowed almost $12 billion in fintech and financial services investment last year, up 120% from the year before. Even the executive director of the Bank of England is telling bankers, “We can’t afford to be Uber’d; banks have to ensure we adapt, just like everyone else.”

Taking Control of Your Destiny

Probably the worst thing financial services companies can do right now is take a wait-and-see attitude. The reality is the longer you wait, the further behind you will be when disruption hits. And make no mistake: it will hit, if it hasn’t already.

Smart companies are already bracing for disruption by self-disrupting. They aren’t waiting around for change to hit them: they are seizing control of their futures, knowing that fortune favors the bold. Their strategy is to preempt digital disruption and customer defections by transforming themselves, their information assets, and their internal processes to achieve a 360-degree view of their customers called “customer centricity.” This means that every single customer touch – across your entire product and services portfolio – is optimized to create a customer experience that exceeds expectations for the duration of the customer lifecycle.

The road to customer centricity begins with digital decisioning – or in FICO’s case “Centralized Decisioning” – consisting of six essential steps:

- Adopting a unified, scalable decision platform across the enterprise

- Committing to creating personalized customer treatments at every touch

- Empowering business users to create and manage the strategies, rules and analytics

- Re-use connected decision assets across the customer lifecycle to improve decisions, while making them transparent and explainable

- Validate and simulate decisions before they are put into production, with dashboards displaying predicted and compared-to results

- Stop producing costly one-off “shelfware”: bring technologists and business SMEs together, to operationalize analytics and solve vexing enterprise challenges

By embracing these measures, companies can maximize the return-on-decisions across the enterprise and throughout the entire customer lifecycle. They can access more, and more types, of the freshest data available, in order to glean the types of valuable, actionable insights that drive winning customer strategies. Armed with those insights, they can take carefully-designed actions at the most opportune moment across all channels, as well as continually improve ROI by maintaining a deep, analytical understanding of the effectiveness of decisions and actions.

FICO Centralized Decisioning is recognized as a leading platform for enabling customer centricity. It is already helping companies worldwide to make faster, smarter, and more profitable decisions over the lifespan of every customer relationship. “Centralized” doesn’t mean decisions are made by a central committee; it means all customer-facing decisions and strategies across the enterprise are made with a 360-degree, connected focus with the customer at the center, using all knowable information, updated in real-time. This means that over time, customer insights incrementally grow deeper and more accurate with each iteration, resulting in increasingly higher return-on-decisions.

It also means that you are taking the offensive, not just acquiring and serving customers better than ever before… but being the disruptive force in your industry who sets everyone else into reactive mode. And when they are busy reacting to you, they are taking their eye off their customers.

The future of your company is too important to trust to a coin toss. Commit yourself to learning more about disruptive threats facing your industry, and the strategies that will separate the winners from the losers in the year ahead.

To read more about Centralized Decisioning, including case studies and whitepapers (registration may be required) please visit https://www.fico.com/CentralizedDecisioning

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.