Do You Realize What Business You’re Really In?

As Digital Disruption complicates financial services firms’ best-laid customer centricity and decisioning plans, it is easy to lose sight of long-term business strategies.

The 2016 film, “The Founder,” about the earliest days of McDonald’s, is brimming with some valuable business lessons. Not many people realize that before it became the world’s largest restaurant, McDonald's very nearly went out of business in its infancy… were it not for a chance meeting between McDonald's entrepreneurial leader Ray Kroc and a shrewd businessman named Harry Sonneborn.

According to the film, Kroc – teetering on bankruptcy and desperate to save his fledgling business – bares his soul and opens his books to Sonneborn. Sonneborn pores over the ledger, asks Kroc some very pointed questions, and shakes his head in utter dismay… leading to the illuminating discussion that would turn McDonald’s into $25 billion giant with 36,000 locations in 119 countries:

Kroc: (Looking confused) Is there a problem?

Sonneborn: A big one. You don’t seem to realize what business you’re in.

Kroc: (Looking even more confused) How’s that?

Sonneborn: You’re not in the burger business, you’re in the real estate business. You don’t build an empire off a 1.4 percent cut of a 15-cent hamburger. You build it by owning the land upon which that burger is cooked. What you ought to be doing is buying up plots of land, then turning around and leasing those plots to franchisees, who as a condition of their deal should be permitted to lease from you and you alone. This will provide you with two things: One, a steady, upfront revenue stream. Money flows in before the first stake is in the ground. Two, greater capital for expansion. Which in turn fuels further land acquisition, which in turn fuels further expansion. And so on, and so on. Land... That’s where the money is.

Now, anyone who’s ever eaten a Big Mac, QuarterPounder, or cheeseburger knows that McDonald's is clearly in the burger business. Just as every person working in the financial services industry believes that they are in the business of mortgages, car loans, credit cards, and other interest-bearing instruments, right? Yes and no. There is a very strong argument to be made that while financial institutions certainly sell all of those things, they are actually in the business of customer acquisition and retention.

To Keep Customers, Keep Them Happy

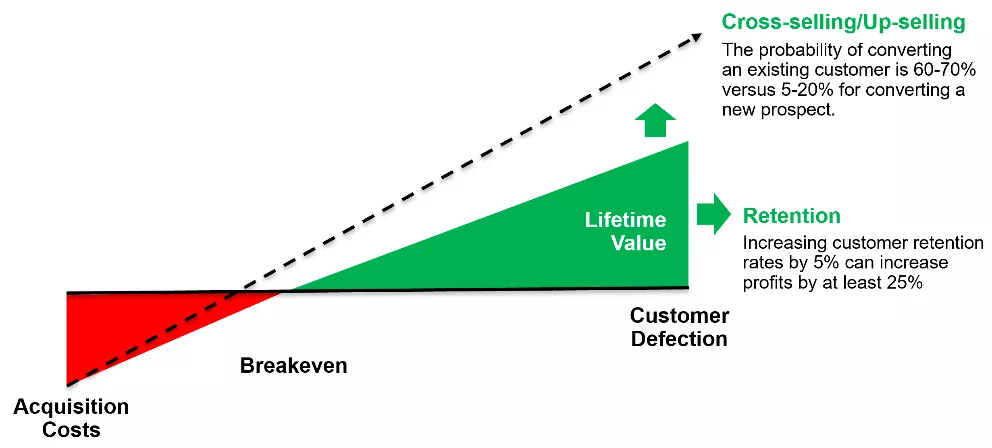

Customer satisfaction and retention is the key to success in financial services. Studies by Harvard Business Review, Bain & Company, and Strategic Insight found that increasing customer retention rates by just 5% can increase profits by at least 25%.

Customer retention makes perfect business sense: the probability of converting an existing customer – that is, upselling them to premium products, or cross-selling them to new ones – is 60-70%; conversely, companies are only likely to convert a new prospect 5-20% of the time.

Further, their studies showed that making customer retention a driving corporate priority can, over an 18-24-month period, increase revenue over by as much as 80%+, reduce customer acquisition costs by 30%+, and increase total customer count by 1.5x.

Targeting the Right Customers

Unfortunately, there are no crystal balls, but an excellent measure of customer acquisition cost vs. lifetime value is LTV/CAC (“Life-Time Value/Cost of Acquiring Customer”). LTV/CAC provides dual benefits: it lets you clearly see if your customer acquisition and retention efforts are paying off, while also helping you know if you are attracting the right kind of customers, e.g. those who are the most profitable over the long-term, relative to the cost of acquiring them.

To calculate LTV/CAC, divide the expected lifetime value (LTV) of new customers – the average revenue forecasted from these customers over the expected duration of their account – by the cost of acquiring them (CAC): LTV ÷ CAC = LTV/CAC. The higher the return, the higher the LTV/CAC score will be; if your LTV/CAC is low, or even negative, you need to seriously rethink your customer acquisition and retention strategy.

Think in Terms of Lifetime Value

Consider the potential lifetime value of a theoretical ideal banking customer, who over the course of the bank-customer lifecycle, is continually being upsold to new banking products:

- A young prospect comes to your bank as a teenager working in their first job, needing a savings account, checking account, and a debit card… soon followed by their first credit card;

- Their senior year of high school, they come to you for a Student Loan for college;

- After college, they get a job and return to you for a car loan for their first car;

- After a couple of years, they get married, purchase their first home, and return to you for a mortgage (and the associated fees that come with it);

- A couple of children later, they need to purchase a larger home and upgrade to larger family vehicles; as the kids get older, they may need additional cars for their new drivers.

- When they are established in their careers, they may try their hand at owning their own business and come to you for the up-front capital they need to get started, or maybe business loans to fuel their expansion;

- As they reach the pinnacle of their financial success, they turn to you for retirement and estate planning services.

When you tally all of those individual touches up, it becomes clear that the lifetime value of retaining customers can be immense, especially when you consider that the average driver owns between six and nine cars in their lifetimes and most Americans change and/or refinance their homes about every 10 years. All because you helped a youngster open up their first savings account.

Automate Decisioning to Drive Customer Loyalty and Retention

If it follows that superior customer treatments result in higher customer satisfaction and lower customer defections – and thus, optimal long-term profitability – you should be focused like a laser on how to exceed customer expectations at every touch, across every channel, for the full duration of the life cycle.

To do this you will need a mastery of all customer information, both past and present real-time data – and use it as the basis to make forward-looking strategies about each customer’s future needs, and how to proactively (or “prescriptively”) meet those needs.

“Mastering the data” involves six steps:

- Harnessing all knowable information across the enterprise via a unified decision platform

- Making every customer touch a personalized, satisfactory (or better) experience

- Enacting business-driven strategies, rules and analytics, not just technology-driven ones, by enabling business users to be as self-sufficient as possible

- Understand the interrelationships of data and decision assets, and re-use them across the customer lifecycle to fully understand, improve, and optimize decisions

- Test and validate strategies before launching the, with dashboards that displaying the predicted and compared-to results

- Get business strategists and technologists on the same page, with business users taking the lead in designing solutions to pressing business challenges

The United States Census Bureau reports that the average salary in America is $35,000/year, and the average household income is $51,000/year; this means that over the course of their career, the average unmarried American would earn $1.4 million, while the average household earns more than $2 million. The amount of money spent on mortgages, cars, education, and credit cards – especially by more affluent households – poses a staggering opportunity for financial services providers. Just as McDonalds had to think bigger than just burgers and fries, financial institutions have to look beyond one-time transactional relationships like savings accounts and credit cards, and focus on how to win customers for life… and the lifecycle.

To read more about Centralized Decisioning, including case studies and whitepapers (registration may be required) please visit https://www.fico.com/en/solutions/fico-centralized-decisioning

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.