East Bests West in Utility of Mobility

Guess which continent leads the pack when it comes to businesses engaging with consumers through mobile devices. Hint: It starts with an A, ends with an A, and it’s not Africa, Ant…

Guess which continent leads the pack when it comes to businesses engaging with consumers through mobile devices. Hint: It starts with an A, ends with an A, and it’s not Africa, Antarctica or Australia.

We recently commissioned a survey of more than 2,000 smartphone users in 14 countries to learn more about the ways businesses and consumers are interacting. In our survey, three Asian countries – China (51 percent), Korea (50 percent), India (49 percent) – were the countries with the highest percentage of “mobile native” consumers — consumers who interact with businesses via mobile devices every day.

At the other end of the spectrum, France (12 percent) and the US (16 percent) had very low percentages of mobile-native responders. In a bit of a surprise, Japan (15 percent) was also in that group. While many factors may help explain Japan’s presence in this group, the fact that Japan has the most mature technology infrastructure in Asia probably causes it to behave a bit more like western countries in its approach to emerging technologies.

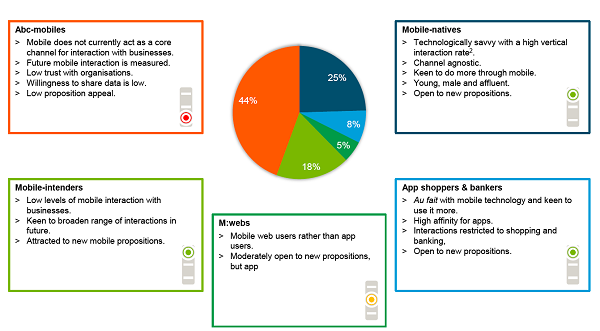

Five Categories of Mobile Users Worldwide

Our survey segmented respondents into five categories. “Mobile-natives” tend to be technologically savvy. They are typically young (under 34 years of age), affluent males who consider themselves early adopters of technology. “App Shoppers and Bankers” are frequent app users, but they typically use their devices for the limited purposes of banking or retail shopping.

More than half of consumers globally have yet to embrace mobile business apps even though they have smartphones. They prefer traditional channels such as the Internet or in-person interactions. These consumers make up the final three categories of consumers: “M:webs” have adopted mobile technology but are not accustomed to using mobile apps. “Mobile-intenders” plan to do more mobile interactions in the future. Finally, “Abc-mobiles” use mobile phones but don’t typically interact with organizations via mobile devices; this is often due to an unwillingness to share personal data and a low level of trust with online businesses.

It’s clear that businesses have barely scratched the surface of what is possible in the mobile channel. Mobile-based customer service and revenue-generating transactions seem to be in the very early stages, particularly in some of the world’s largest economies, such as Japan and the US.

Of course, this is somewhat predictable. With countless billions of dollars having been invested in more traditional business channels over the past century, it would actually be more surprising if the older economic powerhouses were on the leading edge of the mobile revolution.

When asked about their most common types of mobile business interactions, our survey respondents said they are most likely to use their mobile devices to interact with retailers, followed by banks, then insurers. Government agencies and healthcare providers were further down the list. Customers of retailers also have the highest expectation of mobile interactions, the survey found.

It makes sense that retailers are leading the way in leveraging the mobile channel. Retailers live and die based on how attuned they are to the slightest changes in consumer preferences and attitudes. This explains why the survey found that retailers are quick to respond to consumer pressure to interact through mobile channels.

Our survey was conducted online in mid-2013 across 14 countries: Australia, Brazil, China, France, Germany, India, Italy, Japan, Korea, Mexico, Russia, Turkey, the UK, and the US.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.