Is “Enterprise Intelligence” an Oxymoron? Breaking the 5 Blockers

Enterprise intelligence that powers digital customer experiences has never been more advanced — so why are 70% of digital transformations floundering?

Banks and insurance companies are learning the hard way that the best way to stem customer defections is through better digital customer experiences, the result of a methodical digital transformation and customer retention strategy. But despite more than a trillion dollars spent, nearly three out of four companies have come up short, and that’s no laughing matter for banks, insurers, or their shareholders.

Back when Saturday Night Live was still funny, comedian George Carlin did a bit where he said, “The term ‘Jumbo Shrimp’ has always amazed me. What is a Jumbo Shrimp? I mean, it’s like ‘Military Intelligence’ – the words don’t go together, man.” Carlin was pointing out the humor in oxymorons, the conjoining of contradictory terms (it comes from Greek: "oxy" means "sharp or acute," and "moros" means "dumb or foolish”). Most people know an oxymoron when they hear one; like when your boss asks you to take a “working vacation,” because you’ve maxed out your accrued vacation hours, but things are too busy work for you to actually take time off.

How about “Enterprise Intelligence”… is that an oxymoron? Consider the case:

- Thus far, more than two-thirds of all digital transformation efforts failed to achieve their desired results, despite companies spending more than $1.3 trillion trying. This critical error means more than $910 billion missed the mark.

- Accenture says that 85% of companies have a digital transformation effort underway; IDC projects that companies will spend another $10 trillion between now and 2025. But here’s a startling through: if the current success rate holds at 30%, that $900 billion will quickly balloon by another $7 trillion in the coming years.

- Traditional banks and insurance companies are failing at customer retention. They have all of the advantages – huge customer bases, broad portfolios of offerings, and decades to detailed customer data – and yet, their customer defections are at an all-time high. Worse, smelling blood in the water, venture capitalist are pouring record amounts of investment into the next generation of fintechs and insurtechs.

So, where’s the “intelligence” in today’s “enterprises,” and the digital customer experiences digital transformation promised to deliver?

Drowning in Data, but Thirsting for Actionable Insights

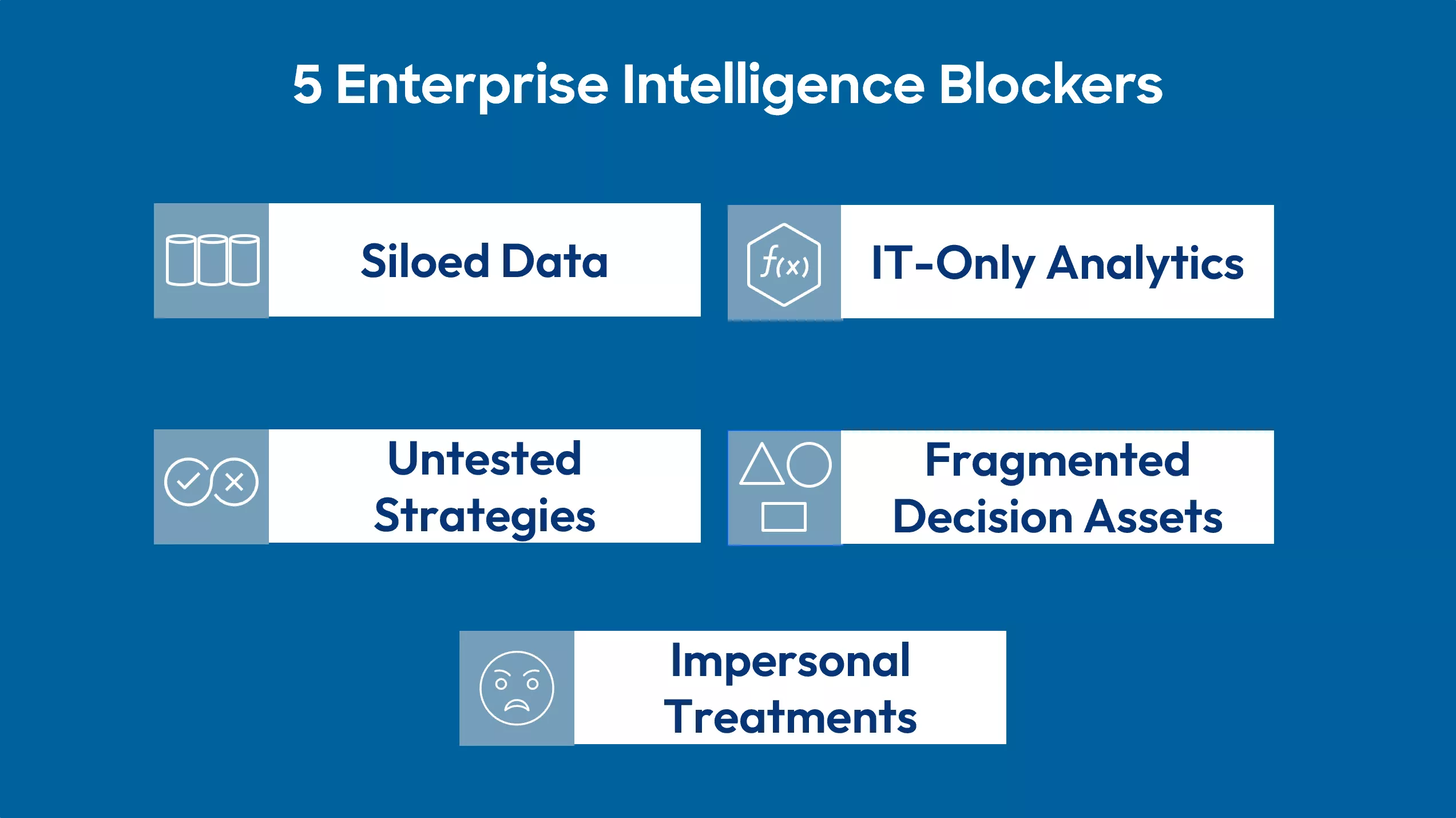

It is generally held that most traditional companies have all the information they need to make smarter customer decisions that will improve customer loyalty and increase revenue, but it’s sitting in silos scattered across the organization, and management just can’t figure out how to make it all work together and across all channels. This is because of five enterprise intelligence "blockers".

Insight 1: Siloed data

For decades, businesses automated individual departments or deployed specific uses cases, not foreseeing that their data would ever need to be interchangeable and interoperable as part of a comprehensive digital strategy. Those disassociated silos create risky blind spots that prevent companies from having all the facts needed to make optimal decisions and business processes.

Enterprise intelligence solutions optimize and monetize the use of people, data and analytics across the company. By connecting the dots and filling in the blanks in your enterprise customer information, it identifies new opportunities and ensures better decisions at every point of customer actions across the lifecycle, improving over time.

Insight 2: IT-only analytics

Organizations that fail to build synergy between their IT and business users – enhancing “book smarts” with business-savvy “street smarts” – are fighting with one arm tied behind their backs. When business users lack the tools to test even simple new analytics strategies, it forces IT to carry the full load, at the expense of their other work. As a result, it takes a longer time to pursue fewer ideas, many of which are already stale upon delivery.

Disruptive companies with new technologies bring the heat of the marketplace into their planning: they empower business users to create and manage the strategies, rules and analytics that drive decisions and actions – without dependence on IT. By effectively doubling the manpower able to test and build analytics strategies, enterprise intelligence solutions help companies foster a market-driven approach to digital decisioning, and can cost-effectively pursue a wider range of scenarios, faster than ever before.

Insight 3: Fragmented decision assets

Though individual lines of business may have invested in point solutions designed for their specific needs – and may have even found valuable connections between data for their own department’s needs – those decision assets are frequently not integrated into a unified, enterprise-wide solution. This means that potentially vital information that could provide a breakthrough in companywide planning is never discovered outside of the department where it resides.

Aggregating decision assets from across the enterprise and integrating them into a common decisioning platform allows companies to leverage and re-use them in perpetuity. Enterprise intelligence technology solutions help companies create an upward spiral in both the quality and return on decisions across the entire customer lifecycle; it also gives them the ability to create customized, targeted decisioning strategies that are consistent, transparent, explainable, and expandable as needed over time.

Insight 4: Not pre-validating strategies<

The carpenter’s adage, “measure twice, cut once,” is intended to prevent mistakes on a $5 two-by-four. And yet when it comes to multimillion-dollar customer strategies – with potentially billions of dollars of revenue hanging in the balance – many companies are astonishingly laissez-faire about rigorous simulation, testing, and optimization. This poses a huge missed opportunity, as such studies are easy to perform, and can tremendously improve the outcomes and ROI of fielded projects.

Simulation and optimization work together to generate highly accurate predictions about programs’ prospects for success, with dashboards displaying predicted and compared-to results. Enterprise intelligence solutions help organizations maximize the success rate and ROI of their decisions, by iteratively simulating, fine-tuning, and perfecting them prior to launch to ensure optimal outcomes. Thus, companies attain highest possible degree of certainty that new programs will perform as desired before putting them into production.

Insight 5: Impersonal customer treatments

Customer defections are at all-time highs in many industries, because customers believe personal service is lacking or inconsistent. 84% of customers say “being treated like a person, not a number” is very important to keeping their business, and yet only 22% believe that the companies with which they do business tailor their customer experiences effectively. Traditional business, by and large, fail to create compelling, portfolio-wide user experiences that span their full portfolio products and services.

By providing an all-encompassing customer view, enterprise intelligence solutions empower companies to offer their clients tailored experiences that are reached by, and infused with, deep customer intelligence. By creating such personalized customer retention strategies that span all channels, companies are able to effectively serve their clients’ immediate needs and accurately predict future needs. This is the secret formula to ensuring customer satisfaction, loyalty, retention, and share-of-wallet for the entire customer journey.

How FICO Can Help You Build True Enterprise Intelligence

- Read how we advance enterprise intelligence and digital transformation at fico.com/EnterpriseIntelligence, fico.com/DigitalTransformation and fico.com/DTeducation.

- Read special reports from American Banker and Digital Insurance to see how industry leaders – Bank of Montreal and Banco Bradesco in banking, and Mercury Insurance and Reinsurance Group of America – are using FICO Platform to make gains in their customer centricity and management strategies.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.