European Bank Priorities for 2013: ROC, Cross-Selling and Big Data

With dark clouds still hanging over the European economic and banking landscape, what are risk managers’ priorities for 2013? That is a question we raised in the sixth European Cre…

With dark clouds still hanging over the European economic and banking landscape, what are risk managers’ priorities for 2013? That is a question we raised in the sixth European Credit Risk survey, conducted by FICO and Efma.

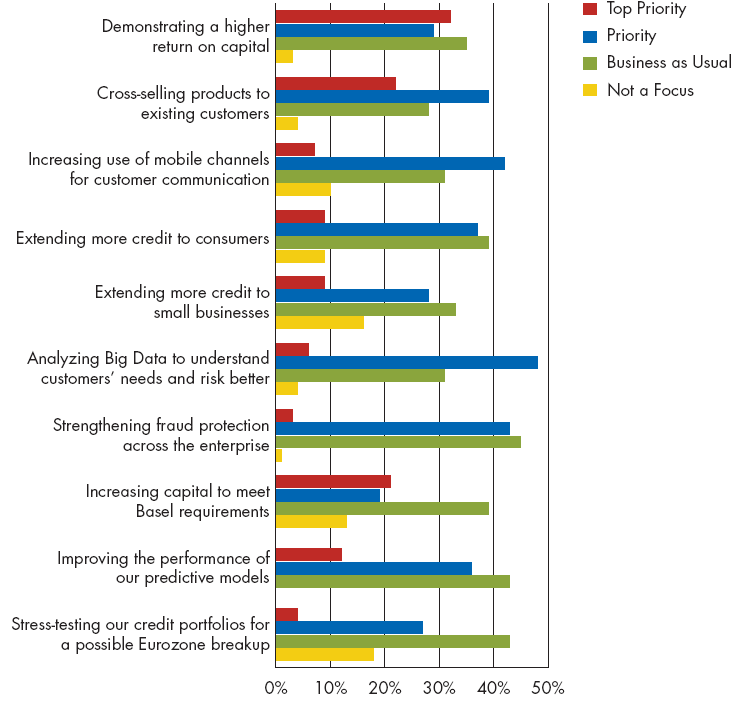

In the survey, 71 percent of respondents said demonstrating a higher return on capital is a priority for next year, making this the top priority for 2013. There are no surprises there.

The results also show the emphasis banks will put on achieving growth by selling more to their current customers. Not only did bankers say they will focus on cross-selling, 54% of risk managers said they will use Big Data to dig deeper into what customers want, and understand their risks.

This is a moment for creative thinking. The best risk manager is the one who reshapes the science and the practice to embrace new market moments and new methodologies. Is it time to reinvent? Not necessarily, but it is certainly time to secure existing practices with new points of view. Are analytics in place? Reshape them with Big Data and stress tests. Already have a strong fraud management practice? Strengthen it. Make the “business as usual” more efficient and pave the road for reinvention. The moment to reinvent the practice will come as soon as the economy turns the corner.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.