European Card Fraud in 2021: Winners, Losers and Scams

The United Kingdom and the Nordic region continue to lead Europe in terms of digital transformation and fraud loss reduction - but non-card scams are rising fast

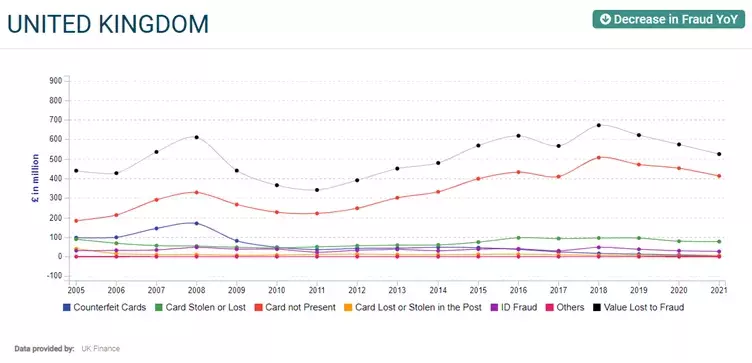

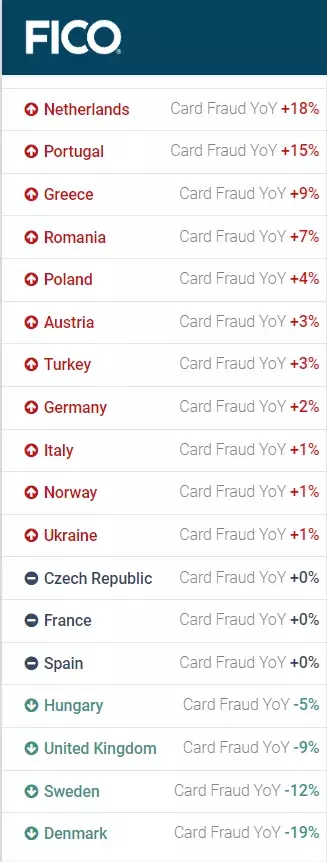

The European Fraud Map we produce each year, with data from Euromonitor International, Consumer Finance 2022 Edition and UK Finance, has some good news and bad news for last year when it comes to fraudulent activity. The United Kingdom and the Nordic region continue to lead Europe both in terms of digital transformation and fraud loss reduction. Denmark and Sweden achieved the highest percentage decreases in losses while the UK reduced card fraud losses by £49 million, the largest decline in the region.

Only four countries of the 18 we studied improved their card fraud performance in 2021. Reducing credit card fraud and unauthorized credit card usage during the pandemic was a great achievement. Unfortunately, many of these gains were wiped away by the “scamdemic” – the startling rise of scams fraud and transactions.

UK Posts Largest Reduction in Fraud Losses

In particular, the UK performed well, continuing a three-year reduction in credit card fraud losses. The UK achieved the largest net reduction of the 18 countries in this report for the third year running. This was done despite threat levels on credit cards, as measured by basis points, increasing by 32 percent in 2021.

The UK is an industry leader in both card fraud management and customer enablement. The majority of credit cards in the UK are protected by FICO® Falcon® Fraud Manager, which protects more than 2.6 billion payments cards worldwide.

Banks here have also championed the adoption of omnichannel customer communication strategies to create a frictionless and efficient customer banking experience.

The UK also has one of the highest fraudster attack rates in the region; new fraud trends often emerge in the UK before moving east across the rest of the continent. As such, the UK’s challenges and successes can be instructive for card issuers in other countries across Europe.

Throughout 2021, Payment Service Providers (PSPs) and merchants in the UK engaged in a collaborative effort to roll out and ramp up Strong Customer Authentication (SCA) controls on ecommerce transactions in advance of a 2022 implementation deadline.

Scams Fraud Overtaking Card Fraud

Payments fraud on digital channels emerged as the primary fraudulent threat within many countries, overtaking card fraud losses, often for the first time. In the UK, the downward trend in card fraud losses is mirrored by an upward trend in fraud P2P payments. In particular, there has been a sharp rise in Authorised Push Payment (APP) fraud. UK Finance’s latest fraud report shows a 39% year-on-year rise in APP losses. The report revealed £583.2m was stolen across 195,996 cases, underlining the significant threat and liability to business and personal finances. We expect that Central and Eastern Europe could see similar trends in the coming years as more payment providers and real-time payment platforms are introduced across the region.

Card Fraud Ups and Downs

Here are some of the other gains and losses across the region. Countries such as Netherlands (+18) and Portugal (+15) saw the highest rises in card fraud. France, the Czech Republic and Spain saw stable levels, and the largest percentage decreases in card fraud were in Denmark (-19) and Sweden (-12).

For more details on individual countries credit card fraud and losses including multi-year trends, explore the European Fraud Map.

How FICO’s Fraud Solutions Reduce Losses

- Read Fraud Trends for 2022: Top 5 Includes ‘Scamdemic’ and Bad Bots.

- Listen to the recent FICO Fraud Matters Podcasts “Around the World in Scams”; Episode 5 focuses on scams in the EMEA and APAC regions, while Episode 6 focuses on scams in NORAM and LAC.

- Read this post to learn more about the role of data in managing fraud and financial crime today

- Explore our payments fraud solutions

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.