Expanding Access to Credit Through Alternative Data

The UltraFICO Score enables lenders to make more refined credit decisions than they can with the traditional FICO Score alone.

I recently had the opportunity to participate in a virtual event hosted by the Urban Institute entitled Financial Inclusion: Lessons Learned and What’s Next for Innovations in Alternative Credit Data.

While we are hopefully seeing light at the end of the tunnel after a year of a devastating pandemic, there is no doubt the economic impacts have been profound and uneven. The panel of experts assembled all agreed that an important part of upward economic mobility is access to credit, whether it’s to buy a car, own a home or start a business. That’s why FICO has been focused on finding new ways to demonstrate responsible financial behavior so that lenders can confidently extend credit to more consumers.

We’ve conducted research and developed frameworks that are used to assess many types of alternative data sources used in credit decisions (for more, see our recent white paper). Over the past several years, we’ve helped lenders develop on-ramps to mainstream credit using alternative data for those seeking financial inclusion.

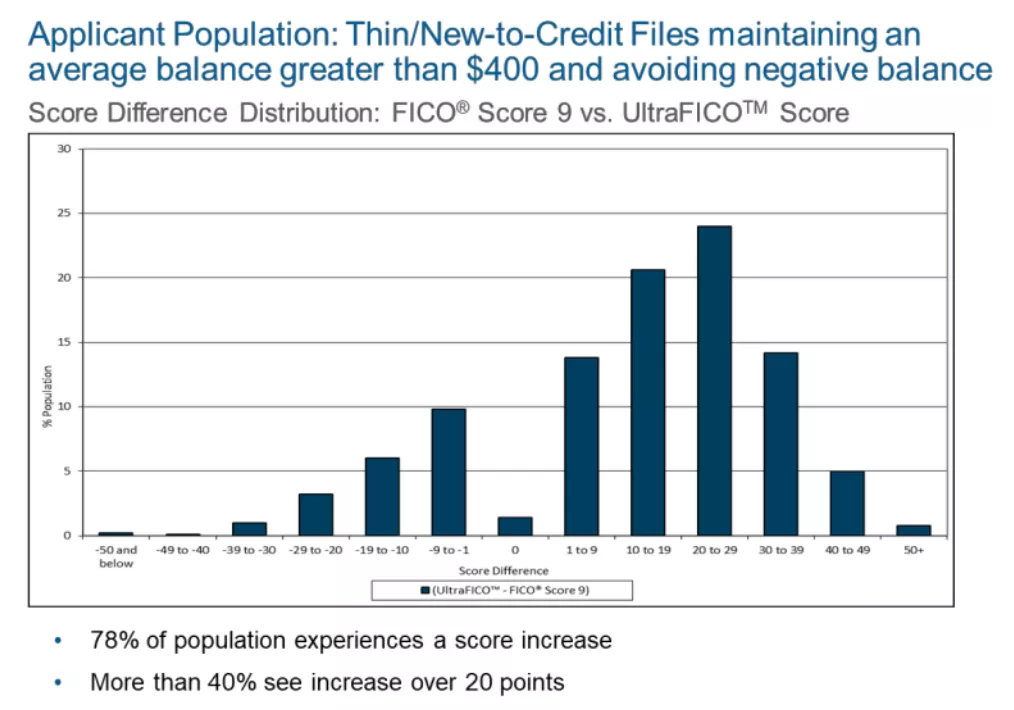

Our research finds that alternative data sources that demonstrate a consumer’s ability to manage their finances are predictive of consumer credit risk. One particularly useful example is checking and savings account data. Analysis of credit repayment trends on millions of de-identified checking and savings accounts shows that a consumer who has been actively maintaining a checking or savings account balance over time and steering clear of a negative account balance is likely to be a better credit risk than someone who has not. And while research into these types of alternative data sources is useful for gathering additional insights, FICO has also translated this information into an enhanced FICO® Score known as the UltraFICOTM Score.

Increasing Lender Confidence

The use of this type of alternative data for credit scoring and, ultimately, consumer lending is promising for several reasons. Studies conducted by the FDIC show that there are tens of millions of U.S. households that are “underbanked” – in other words, they have a checking or savings account but rely on some sort of alternative financial services provider, such as a payday lender, to meet their financial needs. This type of credit can be expensive compared to credit available through most mainstream banks. But by leveraging checking and savings account information -- data that is not found in consumers’ traditional credit bureau files – millions of consumers receive UltraFICOTM Scores, with many receiving scores of 620 or greater, reflecting a risk level that is acceptable to most mainstream lenders. The impact of alternative sources like checking and savings data is especially important for those consumers that have sparse credit, no credit or have had financial difficulty in the past but have been able to regain their financial footing.

The ability of FICO to integrate this type of alternative data into a FICO® Score is driven by a new breed of innovative technology which enables consumers to permission access to their data. Data aggregation services provided by companies such as Finicity create new opportunities to access consumer-permissioned data in an efficient, safe, and cost-effective manner. Consumers provide permission, and thus have control, over the financial information they choose to share. This approach to data acquisition – in which consumers have control over their personal data but enable companies like FICO to access it as an enhancement to traditional credit bureau data – opens the door for a whole host of new analytics using innovative new modeling techniques and data types that can facilitate new opportunities for millions of consumers to gain access to mainstream credit. This is particularly relevant when it comes to financial inclusion.

Positive Data Brings Predictive Value

As with any data source, the use of checking and savings account data will provoke questions with respect to potential data bias. In this case, given that a consumer is opting in to share their financial data, less favorable information might be omitted. In the case of checking or savings account history, that could take the form of excluding some accounts that contain negative balance information or those that have been opened more recently. So, if a consumer only shares positive data, does that understate the risk of default, and by extension, the potential of this data to broaden financial inclusion? Is a traditional FICO® Score enhanced with checking and savings account data used only to increase that score weaker than a traditional FICO® Score alone?

To answer this question, we took a large, de-identified, and nationally representative sample of consumer checking and savings accounts from multiple lenders and merged them with credit repayment information on those same consumers. This checking and savings account data was acquired through a large consortium so as not to reflect an opt-in bias. We then calculated both a traditional FICO® Score as well as an UltraFICOTM Score on the anonymized consumers represented in this sample.

We then looked at two scenarios: one in which the UltraFICOTM Score was used on all borrowers and a second in which the UltraFICOTM Score was used only if it was higher than the traditional FICO® Score. It’s important to note that while the addition of checking and savings account data through the UltraFICOTM Score more often results in a higher score for consumers, there are instances where consumers could have a lower UltraFICOTM Score than traditional FICO® Score (for example, if their checking and savings data shows recent and frequent negative balances or very limited account history).

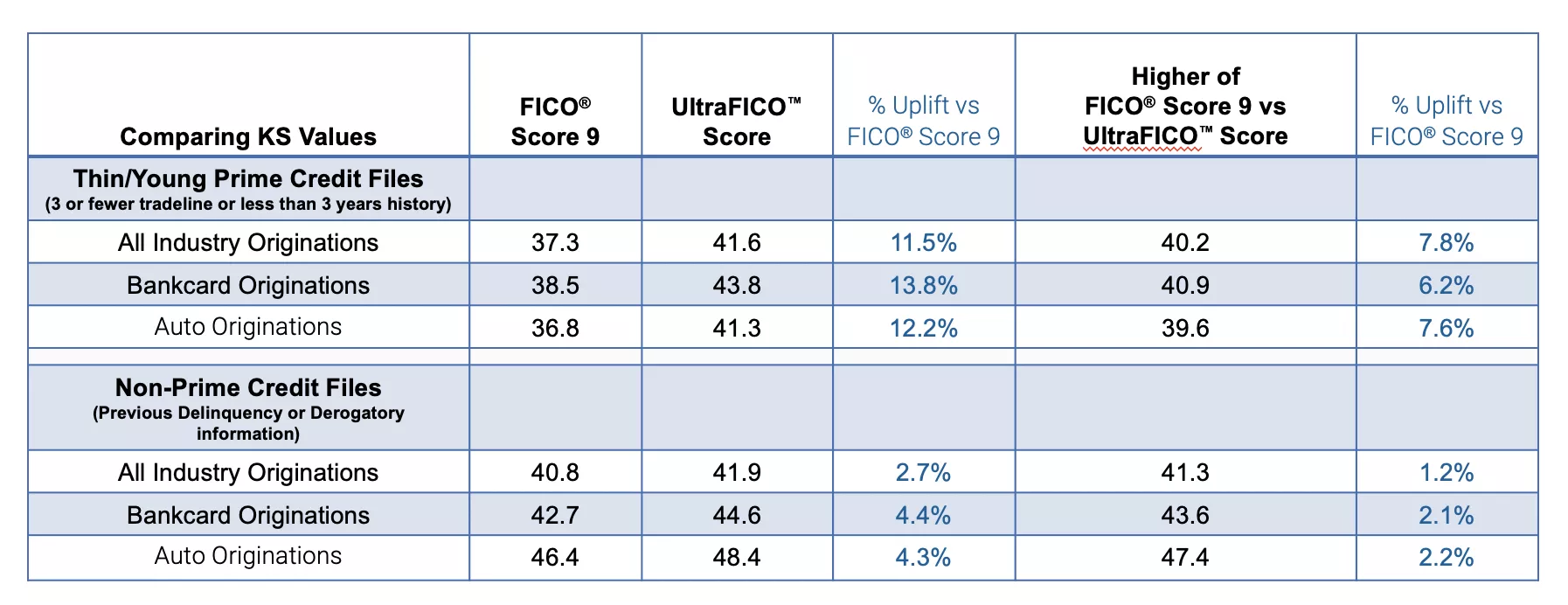

Our study focused on two populations of interest: those that had a new or sparse credit history, and those that had previous derogatory items on their credit file such as a severe delinquency or charged off account. We then looked at the repayment performance of these populations on newly originated credit obligations across all industries, as well as specifically on newly originated bankcard and auto loans. Our metric of interest is the Kolmogorov Smirnov value, which reflects the predictive power of the model.

As the chart demonstrates, our research shows that the addition of checking and savings account data as captured by the UltraFICOTM Score increases predictive power over the traditional FICO® Score 9. The greatest predictive gains are seen amongst the population with new or sparse credit files without any delinquency. We also see gains for those with previous delinquency or derogatory information on file. Note that even when filtering for the use of checking and savings data only in those instances where that additional information results in a higher UltraFICOTM Score relative to the traditional FICO® Score 9, the UltraFICOTM Score still provides demonstrable improvement in predictive strength, in some cases up to 8 percent.

Better Outcomes for Lenders and Consumers

The UltraFICOTM Score enables lenders to make more refined credit decisions than they can with the traditional FICO® Score alone, even if they only have access to the additional checking and savings account data in instances that yield a higher UltraFICOTM Score for the consumer. This example demonstrates why alternative data presents a win-win scenario with upside for both consumers and lenders: while retaining control of their data, consumers can expand what lenders see by showing responsible financial behavior that isn’t captured in the traditional credit bureau file. And lenders receive a more complete and predictive picture of a given consumer’s credit risk, helping them more confidently grant more credit to consumers and ultimately build a more inclusive financial system.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.