FICO Fights Prepaid Card Fraud with AI and Machine Learning

Collaborative Profiling is one of the advanced techniques in our fraud models for prepaid card fraud

For a while now, it seems that every drugstore in the U.S. has become a prepaid card store, with rows and rows of gift and other prepaid debit cards on display. It’s no illusion––prepaid services are one of the fastest-growing segments of the financial payments industry. In April 2019 The Wall Street Journal reported, “The total amount loaded on general-use prepaid cards in the U.S. grew to $324 billion in 2017 from $208 billion in 2012, according to Mercator Advisory Group, a research and consulting firm. It projects the market to grow at an annual rate of around 10%, reaching $428 billion in 2021.”

Beyond the ubiquitous gift cards, which are loaded once for a fixed amount, other types are reloadable and are used for applications such as payroll, government benefits, and health savings account (HSA) spending cards.

Even though prepaid cards share common functions with regular debit cards, including making payments and receiving direct deposits, prepaid card transactions may show intrinsically different characteristics. For instance, HSA cards are rarely used to get cash from ATM machines, while ATM withdrawals can be common behavior for payroll cards.

This heterogeneity calls for a prepaid fraud analytic model that can identify what is usual (or unusual) behavior for a prepaid card user based on their behavior, taking into account the distinct nature of the prepaid card and its restrictions. As the popularity of prepaid cards has grown, clients using the FICO® Falcon® Platform have expressed a strong interest in fraud models built specifically for prepaid card fraud.

In 2019, we released our first consortium prepaid card fraud models for the US market, as well as the international market. Our timing was right on. Starting in April 2019, prepaid debit card users have been better protected thanks to a ruling by the Consumer Financial Protection Bureau. Its provisions include:

- If the card is a payroll card or a certain type of government benefit card, or if the consumer receives federal payments onto their card, certain error resolution rights are available to protect consumers from unauthorized transactions.

- For other types of cards, issuers must reimburse users for all fraudulent transactions over $50 (withdrawals or purchases) made while their card was lost or stolen. This is almost identical to the existing fraud protection provisions for credit cards.

AI- and ML-Enhanced Fraud Detection Models

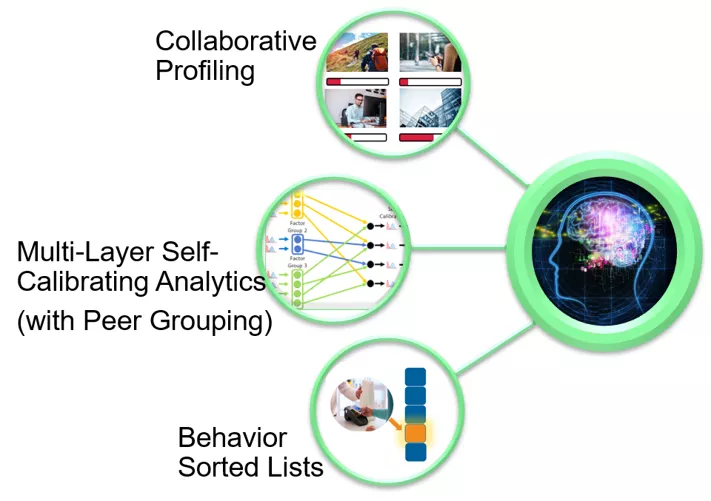

FICO’s Prepaid V1.0 models incorporate three main artificial intelligence (AI) and machine learning (ML) technologies to enhance the fraud model’s detection capability. These cutting-edge, patented techniques are Behavior Sorted Lists (BLIST), Multi-Layer Self-Calibrating (MLSC) analytics and Collaborative Profiling (CP). (Figure 1) Here’s how they work in conjunction with each other:

- While the individual cardholder’s behavior can be well tracked by BLIST (which tracks recurrences of behaviors for the cardholder), MLSC with peer-grouping will pick up usual or unusual characteristics, compared to similar cards, by adjusting in real time to the behavior of multiple similar card holders.

- Collaborative Profiling uses the global-scale behavior of these customers within archetypes (explained below) to determine likely future transactions (including those that a cardholder has never shown in the past), thereby reducing significantly false positives.

Let’s dive into Collaborative Profiling.

How Collaborative Profiling Works

The Collaborative Profiling technology is a model that learns a prepaid cardholder’s archetypes of behavior based on the cardholder’s transaction activity. An archetype is a probability distribution over events based on similar cardholders and their combined transaction history. A customer is represented by a multi-dimensional archetype vector (a mixture of archetypes), allowing the model to capture and predict a wide variety of payment card behavior across different cardholders, as well as enabling comparison of similarly transacting customers.

Figure 1: Fraud Analytics Innovations

The process of training the collaborative profiles incorporates data from the FICO® Falcon® Intelligence Network to find very similar customers based on their transaction behavior. This allows a strong assessment of a cardholder’s new behavior given this learned grouping of similar customers, even if the behavior in question has never been observed in this specific customer’s past history.

In production, FICO’s collaborative profiling technology adjusts the customer’s mixture of archetypes in real time with each new transaction, providing important real-time updates to their archetypes to provide context for sub-second payment card decisions. When cardholder behavior suddenly deviates from the individual’s usual patterns, as well as the shared archetypes with other cardholders, that is an indication of fraud. That being said, it’s important to note that the goal of Collaborative Profiling is not to learn transient and constantly evolving patterns of fraud; instead, it focuses on the more stable and persistent behavior of non-fraud activity that defines normal and typical transaction patterns for similar groupings of customers.

Simply put, knowing what is usual for individual customers, and their transaction behavior “twins,” allows the model to better identify unusual behavior on entirely new transaction types.

High Impact on Prepaid Card Fraud Models

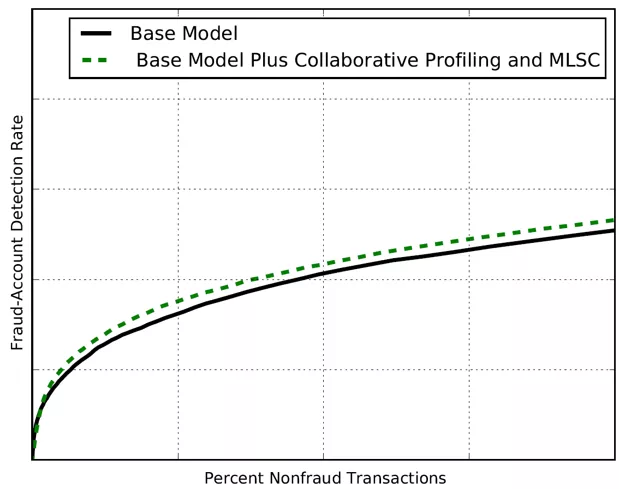

FICO’s use of innovative technologies such as Collaborative Profiling and MLSC in prepaid consortium fraud models has led to significant improvements: a more than 20% reduction in false positives, while boosting both real-time value detection rate and account-detection rate at a typical non-fraud threshold (Figure 2).

Figure 2: Improving Fraud Detection

The upshot: The significant performance improvements indicate that FICO has successfully applied collaborative profiling in prepaid consortium fraud detection models, offering a clear value proposition for prepaid card portfolios and differentiated from that of more generic debt card fraud models.

Stay tuned for my next blog, a deeper dive into the role of MLSC in prepaid consortium fraud detection models. In the meantime, follow me on Twitter @ScottZoldi.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.