FICO Resilience Index is Strong Predictor of Consumer Need for Loan Accommodations

Latest research underscores relationship of index to October 2020 reported payment accommodations

Early in the COVID-19 pandemic, FICO data scientists discovered that the FICO® Resilience Index was a strong predictor of the likelihood that consumers were receiving loan accommodations such as payment deferrals and forbearances following implementation of the CARES Act.

In the months following the early summer peak in loan accommodations, FICO analysts wondered whether the relationship still held given that the mix and volume of consumers in payment accommodations was shifting. By October 2020, consumers with accommodations were either in longer-term arrangements (for example, 6 to 12-month forbearance for their mortgage), or had freshly-granted accommodations reflecting that they were finally starting to feel the financial stress brought on by the pandemic.

We examined a large, nationally representative sample of millions of consumers from October 2020 to test the ability of FICO® Resilience Index (calculated before the COVID-19 crisis started, as of January 2020) to rank order the likelihood of currently-in-force creditor accommodations.

We found that FICO® Resilience Index continues to be a strong predictor of the presence of loan accommodations in place as of October 2020 – representing a mix of “long haul” accommodations by mortgage lenders and newer short-term accommodations allowed on bankcard, auto finance and personal loan accounts. Our analysis excluded student loan accommodations given the wide prevalence of automatically granted accommodations in that industry.

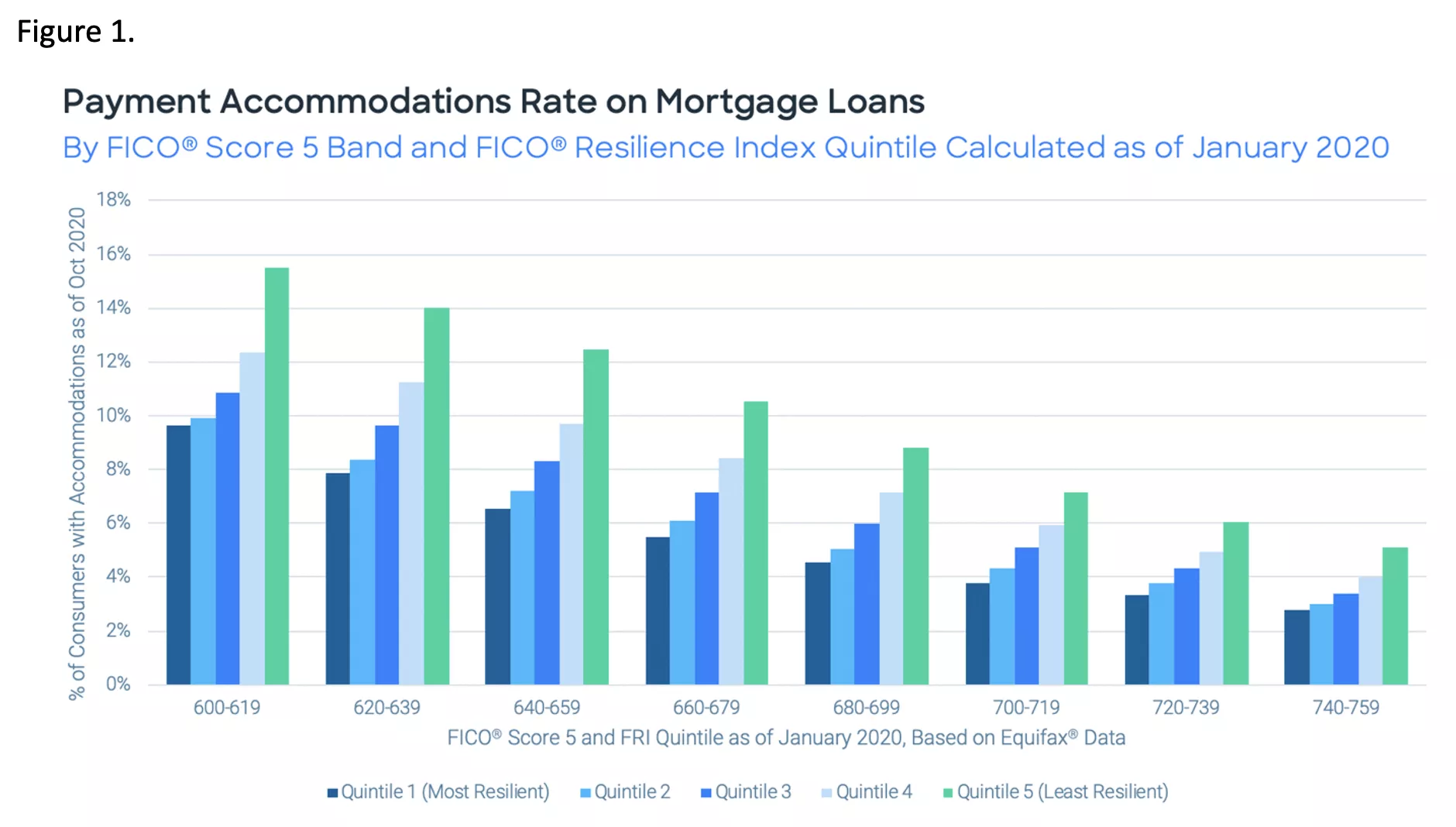

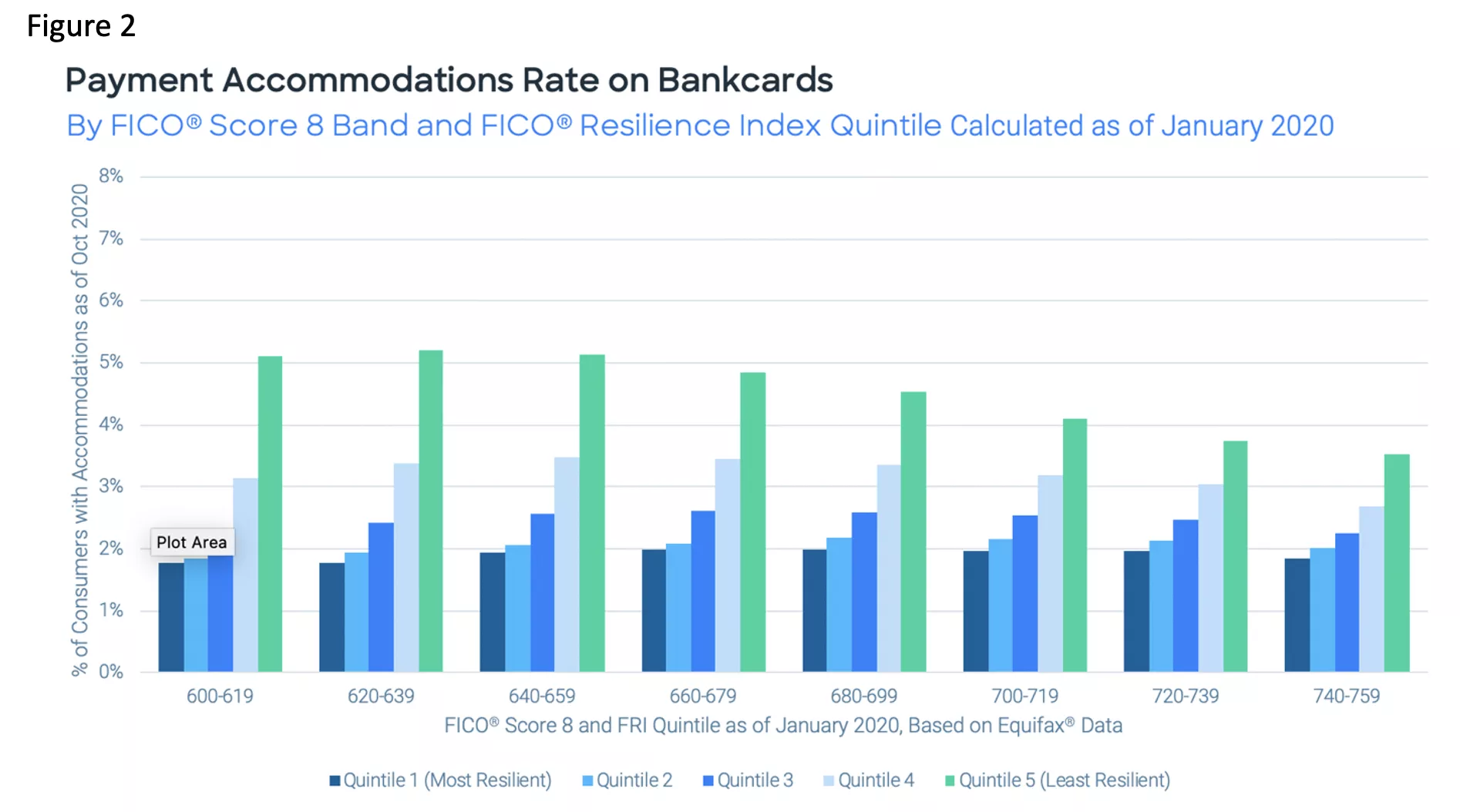

Figure 1 demonstrates that within narrow FICO® Score bands, FICO® Resilience Index consistently rank orders the likelihood a consumer is in some form of mortgage loan accommodation. This pattern holds across other industries tested, including bankcards, where overall accommodation rates were very modest (as shown in figure 2).

In the midst of continuing economic uncertainty, some may wonder why we’re not focused on delinquency in highlighting FICO® Resilience Index industry-level results amidst the current pandemic.

The simple answer is that we have not seen serious delinquencies materialize to any significant degree. Delinquency levels remain well below pre-COVID levels as of January 2021, with record lows in mortgage delinquency rates. While our analysis demonstrates that FICO® Resilience Index is reliably rank-ordering an indicator of the current financial stress that consumers are experiencing (the presence of loan accommodations), we do not yet expect to see the index provide meaningful differentiation of serious delinquency rates that have thus far been held at bay.

It’s worth noting that meaningful FICO® Resilience Index validations based on delinquency definitions should focus on those with serious delinquency or defaults as opposed to borrowers that are one or two cycles delinquent, which can include “sloppy payer” behavior. FICO research has shown that resilient borrowers at a given FICO® Score may be more likely to go mildly delinquent regardless of the economic environment, but less likely to go seriously delinquent during a severe economic downturn.

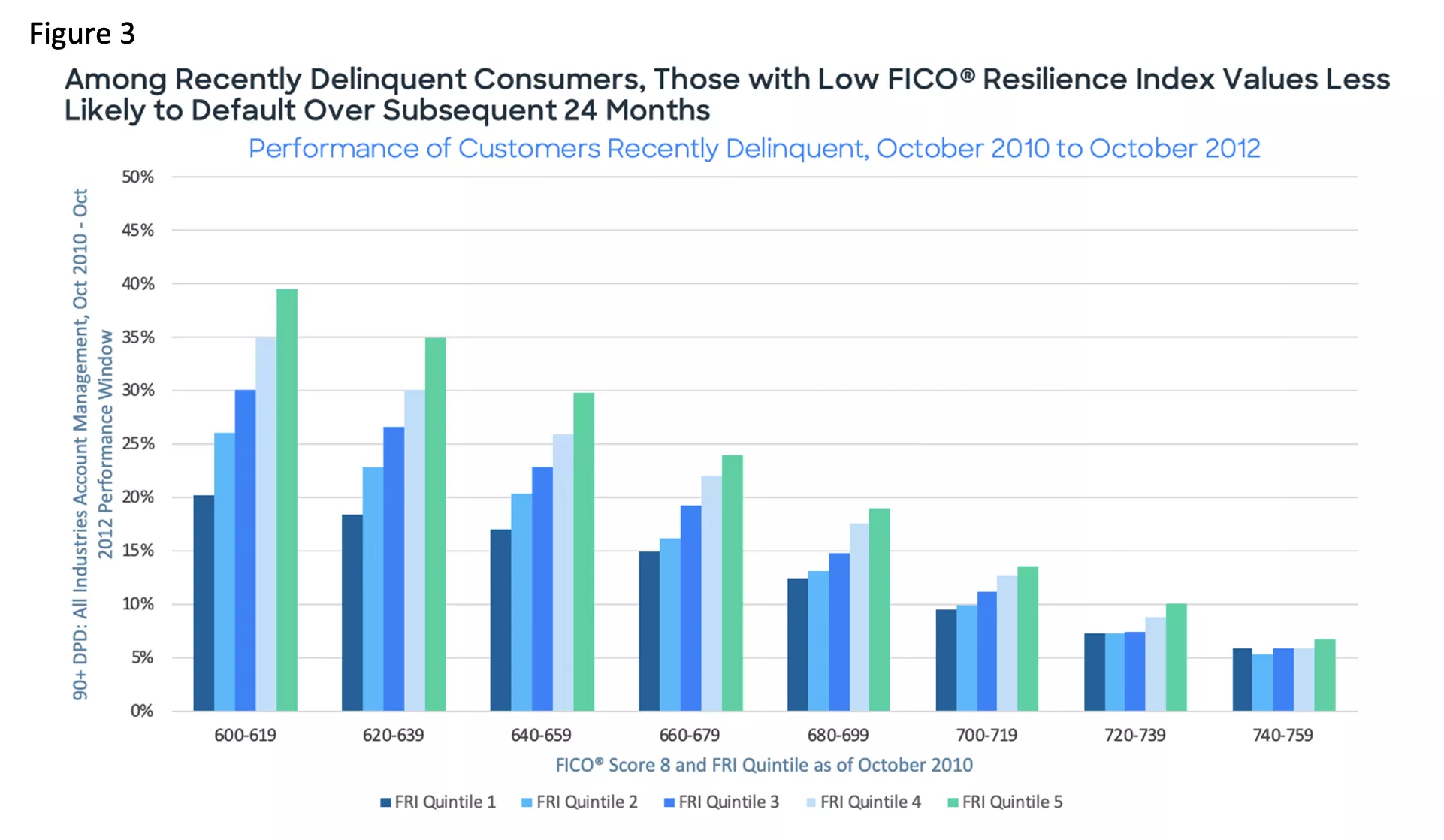

With an eye toward our post-pandemic recovery, clients have inquired as to whether FICO® Resilience Index may offer insights into consumers’ credit behavior as they emerge from recent delinquency. Looking back at consumer credit behavior in the years immediately following the Great Recession, we discovered an intuitive result: consumers’ ability to “bounce back” from serious delinquencies was predicted by lower (more resilient) FICO® Resilience Index values.

Figure 3 looks at a large sample of consumers who were recently (and not currently) delinquent[1] as of October 2010 – two years into the Great Recession - tracking their serious delinquency performance (90+ days past due) for two years after the score date. The consistent rank ordering of default rates within narrow FICO® Score bands shows that more resilient consumers were much less likely to default over the next two years, as the U.S. emerged from the recession.

With additional stimulus spending and COVID relief programs anticipated in 2021, lenders and borrowers will hopefully avert the kind of spiking default rates and credit tightening that we experienced during the Great Recession. Whatever the length and severity of our current recession, FICO is here to support our clients’ efforts to better understand their customers’ resilience levels, put new strategies in place to keep credit flowing (taking resilience into account), and gradually build portfolio resilience over time.

[1] Defined as 30+ days past due within the previous year.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.