FICO Survey Shows How UK Fraud Teams Struggled in Pandemic

Nearly four out of five respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention

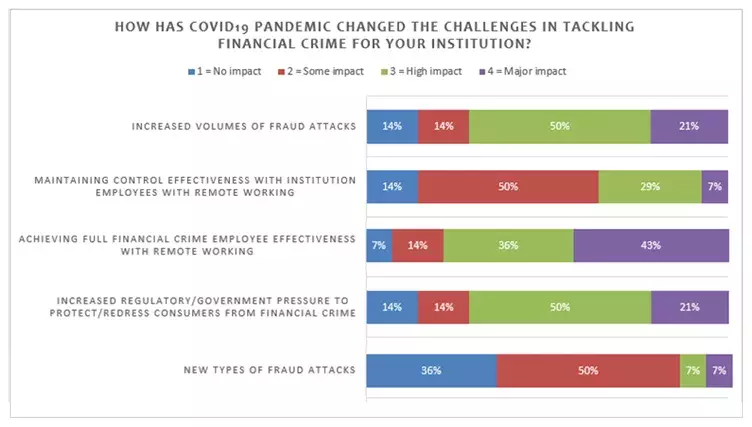

Just as the pandemic put huge stresses on the health care system, it put huge stresses on fraud and financial crime management teams. Teams that collaborate in person and work with large software systems that have restricted access found that working from home hurt their productivity. This was compounded as the volume of fraud attacks rose.

Our latest survey of fraud management professionals, conducted with independent research firm OMDIA, shows this clearly. Nearly four out of five respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

Challenges with Technology

The impact of having multiple software systems for fraud management and financial crime compliance was also cited by UK respondents. This was the top technology challenge for 21 percent of UK respondents, which puts it at the top of the challenges. Almost half – 49 percent – of respondents ranked it first, second or third among their technology challenges, the most of any challenge.

Banks are feeling the pain of having fragmented software for managing fraud and financial crime. Even though some 80 percent of the functions between fraud prevention software and AML software are the same, the systems are nearly always separate, and the teams are usually separate too. In our survey, 64 percent of UK respondents said these teams don’t even report to the same person at the bank. The latest systems, such as our FICO Falcon X, provide these technologies in a single platform, which can catalyze an integrated approach at a bank.

For more details regarding the survey results, join the upcoming keynote session during the FICO Virtual Event session, Fraud and Financial Crime: The Covid-19 Impact.

For full survey results, view the report.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.