How Decision Optimization Improves Credit Line Management

Action-effect models and prescriptive analytics make credit limit increase optimization a powerful tool to improve portfolio performance

Credit line management is regarded as a key driver to profitable portfolios. But despite this, many issuers fail to apply advanced prescriptive analytics to a crucially important process, or if they have, it may often be without a framework or infrastructure to maximise the effectiveness of the insights it can bring. Credit limit increase optimization is a powerful tool to achieve portfolio goals.

Among the underlying elements to optimizing credit limits is a need to have a detailed understanding of the impacts of any actions the issuer takes on their customers. Understanding the action-effect relationship is crucial to creating a solution that enables you to assess the likely impact of multiple alternative scenarios on key performance metrics, including balances and bad debt.

It enables decision-makers to define the best strategy easily and quickly for their credit line management campaign, while supporting critical business objectives. It’s achieved by configuring a decision impact model, which includes and can leverage action-effect modelling.

Action-effect models are analytics that accurately predict how a customer will react to any offer brings great flexibility, but also drive vital insight into potential difficulties in managing the many dimensions of customer behaviour.

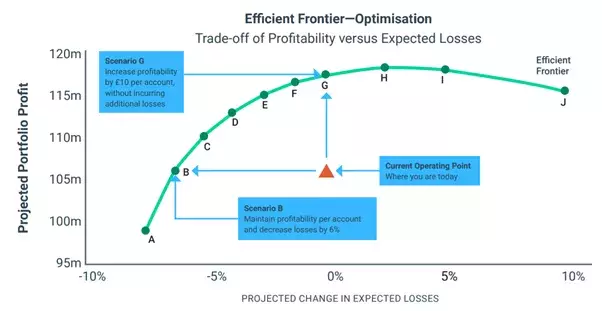

Among the crucial elements to understanding the art of the possible and potential value of credit limit increase optimization is the so-called ‘efficient frontier’, which enables issuers to compare differing scenarios and opt for the one that meets their growth objectives and market conditions at the time, while maximising profitability.

Managing Profitability and Exposure

Credit line management optimization helps you manage more than just profit. Overall exposure can also be managed by balancing income and exposure, with risk level typically used as a constraint. The critical value is knowing how, where, and when accepting a slightly higher level of losses will drive an overall increase in the average profit per account — and crucially by how much.

At the same time, CLI campaigns need to ensure they are compliant and don’t offer customers unrealistic or unacceptable limit increases. Constraints can be applied to ensure that strategies are compliant and that they are treating customers fairly.

The Power of FICO Credit Limit Increase Optimization

Hundreds of FICO clients across the globe already benefit from optimization to deliver decisions that generate tens of millions of dollars — at speed and at scale. It’s already well-established as a core analytics technology and proves optimal decisions can be consistently applied to help drive growth and improve financial performance across multiple industries and sectors.

FICO recently delivered a credit limit increase optimization project for a UK high-street card company, with a potential yield of +£2 million (US$3 million) in annual profit improvement. Other benefits include:

- Speed — With direct access to data, value can be delivered in as little as eight weeks, subject to agreed project scope.

- No IT involvement — The solution requires little to no IT support. Credit limit strategies can be easily and quickly deployed to best suit client systems.

- Cost savings — Our approach, including all licence and professional services costs, typically delivers in-year return on investment.

- No long-term reliance on FICO — Beyond the initial solution development and software configuration, FICO provides detailed knowledge sharing and staff training to ensure all ongoing inhouse management and maintenance of the solution.

Many FICO customers are achieving tremendous results using credit line optimization. Here are videos from Akbank and HSBC, both of which won FICO Decision Awards for their projects.

Note: This is an update of a post originally published in February 2022.

How FICO Can Help You Optimize Credit Card Profitability

- Download our paper featuring Agile Credit Card Limit Management.

- Explore our customer management solutions

- Explore the optimization and decision management capabilities in FICO Platform

- Read our executive brief on enterprise optimization

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.