How customer relationships impact credit risk

For banks that have made it their mission to deepen their product holdings with customers, here is some clear evidence that your relationship with a customer can influence their cr…

For banks that have made it their mission to deepen their product holdings with customers, here is some clear evidence that your relationship with a customer can influence their credit risk. FICO recently studied two Spanish clients’ loan performance, and the results indicated that the risk of a customer on a new loan varied by what other products the customer already had with that bank.

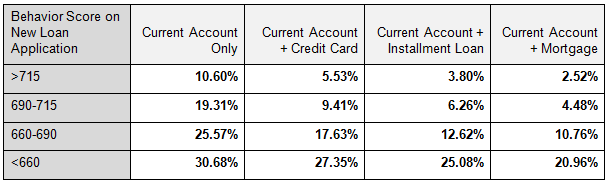

In the chart below, the column on the left indicates the behavior score (from the FICO® TRIAD® Customer Manager system) for customers seeking a new loan; the higher the score, the lower the risk. The row at the top indicates the products customers already held with the bank at the time of the application. The numbers in the cells indicate the bad rate over the life of the loans.

These results show a very strong correlation between product holdings and risk — one might even say a startling correlation. Customers who only had current accounts with the bank at the time the new loan was granted performed much worse on those loans than customers who already had a product with the bank. The highest-scoring customers who had only a current account with the bank had the same loan performance as customers scoring much lower (660-690) that had a current account and mortgage with the bank.

And risk further varied depending on which product the customer had. Of course, this can’t all be ascribed to customer loyalty — customers holding a mortgage will have gone through a more rigorous risk screen than other customers, for example, so their risk is more quantified and therefore better performance on other products would be expected.

Banks in many regions of the world are already prioritizing existing customers, where the risk is known. These results suggest that banks should dig further when cross-selling, and not presume that all existing customers are equally loyal — or risky.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.