How Guided AI Helps FICO Detect 59% More Scams in the UK

Guided AI is akin to the nervous system in the Corpus AI

The problems we use machine learning (ML) to solve are often multi-faceted. For example, building fraud detection models for payment cards requires understanding that fraud is multi-modal and probabilistic – there are many ways it can occur, and in many different modes. Moreover, not all fraud types carry the same business impact; some modes may not incur financial liability for banks. Others may be well solved with rules in a decision strategy, and still others may occur very rarely, but businesses need to be alerted when they happen. This points to a deeper need to separate signal from noise by guiding Artificial Intelligence (AI) toward the modes the business wants to solve. To optimize fraud prevention efficacy, we need new specialized methods to guide AI models down the paths of meeting associated business objectives. This is Guided Artificial Intelligence.

Guiding Machine Learning to Solve the Right Problems

Machine learning models typically are not designed to address specific sub-problems. In fraud detection models with multiple different fraud representations, the optimization algorithm behind training these models will be strongly influenced by the majority fraud mode tag, and less so for minority modes of fraud. Without specialized approaches, the traditional algorithms will merely keep fitting on the majority representative of modes and may not be appropriate for targeted sub-objectives.

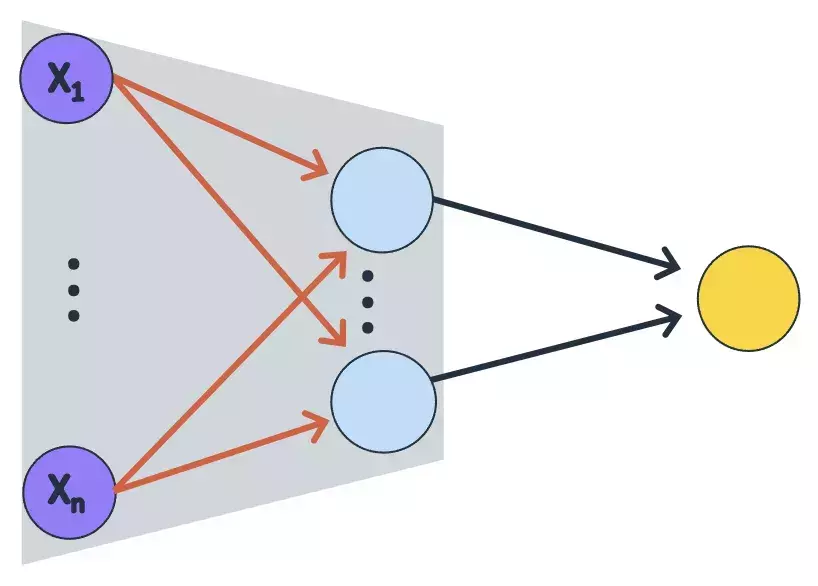

The AI Innovation Development team at FICO has developed a method for guiding a neural network model to learn specific concepts that are meaningful to the business. Our approach, called Guided AI, works by learning the latent features on subtask problems that satisfy the desired business objectives. These subtask problems are expressed as modes and behaviors. Figure 1 shows a schematic representation of an attribute subtask. For fraud detection the desired attributes could be, for example, high velocity of card not present transactions, unusual time of activity on a favorite device, or whether the transaction pattern resembles low-dollar testing behavior.

Fig. 1. A small network to detect the desired attribute.

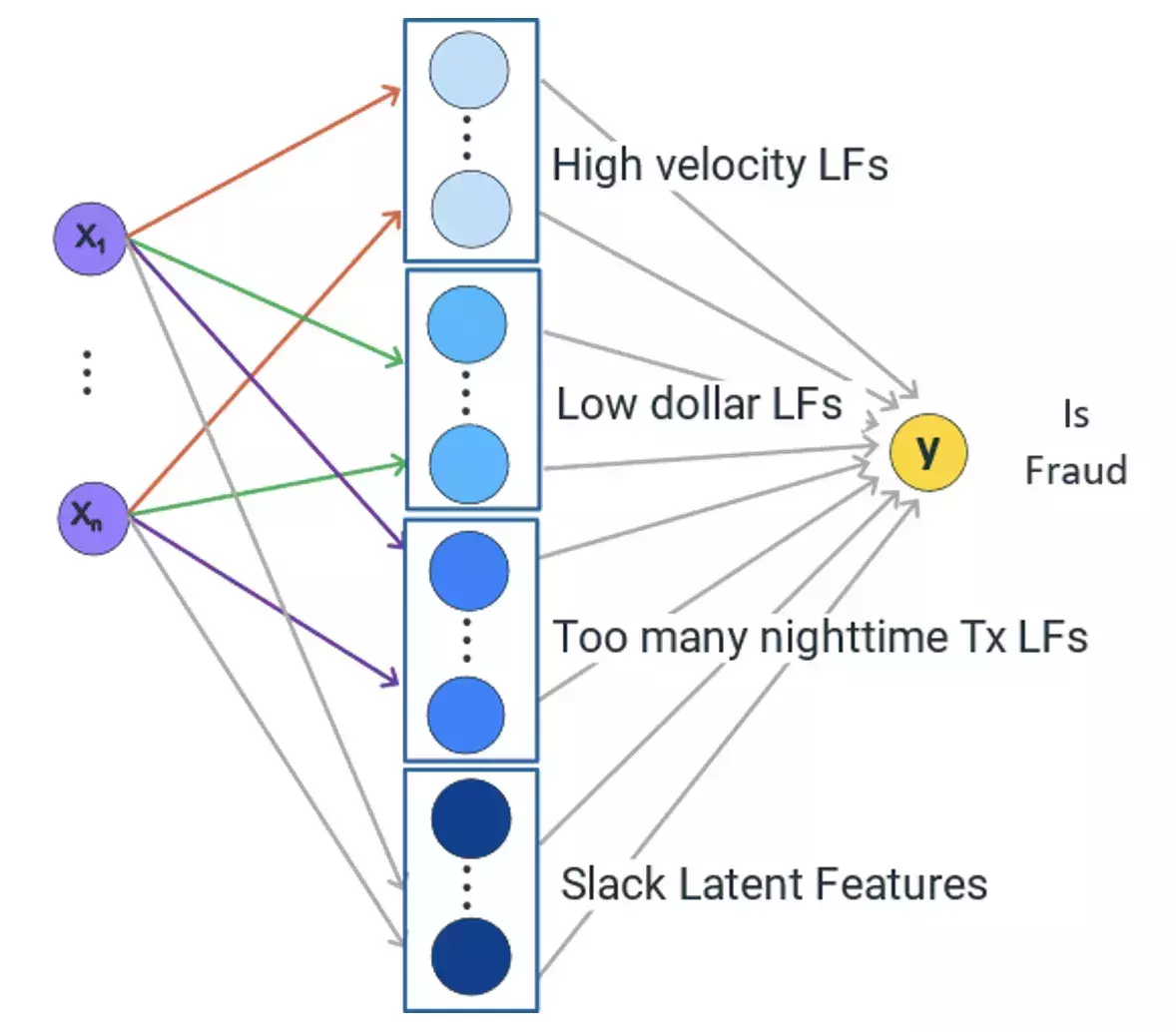

Once these subtask neural networks are developed, we extract the latent features from each of the subtask attribute models and the latent features are transferred and aggregated in a constrained model trained on all models of the fraud problem. Using this approach, we preserve and fix the latent features from the subtask attribute models of interest, and add slack latent features to learn other behaviors in a constrained fashion. While training the final model, we keep the transferred subtask latent features fixed; only the slack latent features are allowed to change, learning from the data with a constrained representation in the final model weights. Figure 2 shows the transfer of the derived latent features from attribute tasks to the final model.

Fig. 2. The final model architecture, based on Guided AI, includes the derived fixed latent features (LFs) transferred from attribute subtasks, along with slack latent features that can learn additional concepts.

FICO Detects 59% More Scams with Guided Artificial Intelligence

Recently we applied this approach to improve scam detection in the UK market without compromising the quality of fraud detection. Scams are an enormous criminal problem. In the UK alone, scams have accounted for more than £1.3 billion in losses in a single year, and these fraudulent behaviors continue to grow.

Scams can take many forms such as romance scams, CEO scams and impersonation of bank officials, to name just a few. To incorporate these concepts into our fraud detection model, FICO’s AI Innovation Development team:

- Trained subtask neural networks to learn latent features tuned to detect specific scam subtask objectives.

- Trained subtask neural networks to learn latent features to detect specific fraud subtask objectives.

- Transferred the latent features of these learned attributes using Guided AI, with a goal of maintaining the fraud detection performance while improving model performance on scam detection subtasks.

Using Guided AI, we allowed the slack latent features contribution to be 10% of the final model while imposing approximately a 50% contribution to be based on the scams’ fixed latent features, and another 40% based on fraud fixed latent features. We met our objective to improve scam detection performance: the resulting model had the same fraud detection performance as the past outstanding fraud detection model, and in addition, Guided AI improved the model’s scam detection by 59%.

The application of Guided AI, of course, goes far beyond scam detection and fraud prevention. We now have a mechanism to guide a neural network model to focus machine learning to learn concepts that are specified by the business and the larger Corpus AI. This is important, as it allows models to be designed around finer-grained business objectives and more focused business value, which is the promise of Corpus AI.

An Integral Part of the Corpus Artificial Intelligence

Guided AI is akin to the nervous system in the Corpus AI; check out my LinkedIn Live episode on Guided AI, a conversation with Jun Zhang, Chief Data Scientist at ThreatMetrix, LexisNexis Risk Solutions. Finally, if you’re wondering exactly what the Corpus AI is, here’s how I think of it:

- Over the past five years or so I’ve been evangelizing the need for Responsible AI practices, which guide us how to properly use data science tools to build AI decisioning systems that are explainable, ethical and auditable. These principles are at the heart of an organization’s metaphorical analytic body. But they are not enough. This analytic body, which I call the Corpus AI, is where Responsible AI and Practical AI must be supported by the equivalents of a biological circulatory system, skeletal system, connective tissue and more.

Follow me on LinkedIn and on Twitter @ScottZoldi to keep up with my latest thoughts on AI innovation and Responsible AI.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.