Debt Collection Predictive Analytics: Benefits, Types and Uses

Discover how debt collection predictive analytics boosts recovery, cuts costs, and personalizes strategies with AI-driven models and case studies

Debt collection teams today face an enormous challenge: deliver higher recovery rates with tighter budgets, fewer staff, and stricter regulatory scrutiny. Traditional approaches—relying on uniform treatment strategies or basic segmentation—are no longer sufficient. This is why more collections organizations are exploring debt collection predictive analytics, a powerful set of tools that helps collections organizations make smarter, faster, and more efficient decisions. By using data-driven insights, predictive analytics enables lenders, agencies, and financial institutions to optimize recovery, reduce costs, and enhance customer experience.

This article explores what collections analytics are, the different types of predictive models in use, how analytics improve collection strategies, and real-world examples of successful application. We’ll also examine how predictive analytics connects to prescriptive analytics, automation, and compliance.

What Are Collections Analytics?

Collections analytics refers to the analysis of data, statistical modeling, and machine learning to evaluate delinquent accounts and forecast each debtor’s likely behavior. Instead of treating every debtor the same, analytics enables organizations to:

- Segment customers by risk and behavior

- Forecast repayment likelihood

- Recommend the optimal collection treatment

- Automate decisions for speed and consistency

Collections analytics use the same underlying technologies as predictive analytics commonly used in risk management. However, they are custom-built to support decisions that are made in debt collection. For example, behavior scores used in risk management typically predict the propensity of a customer to default within the next 12 months. The 12-month outcome period is too long for a good segmentation of accounts new to collections, when 80% of customers cure within 30 days. In this case, a prediction of the customer curing within 30 days or a prediction of the customer missing the next payment as well and rolling into the next arrears bucket is much more useful. In late collections, the default prediction becomes irrelevant, as customers have already defaulted or are going to default at a very high propensity. Here, a model that forecasts the expected payment amount will be much more useful.

Types of Analytics in Debt Collection

Analytics in collections typically falls into four categories:

- Descriptive Analytics – Provides insight into what has happened. Example: delinquency rates by customer segment.

- Diagnostic Analytics – Explains why something happened. Example: identifying income or spending behavior shifts that led to missed payments.

- Predictive Analytics – Forecasts what is likely to happen. Example: predicting the probability a customer will self-cure or roll into a later delinquency stage.

- Prescriptive Analytics – Recommends the best course of action. Example: assigning a low-touch digital reminder versus a high-touch agent call, depending on customer risk.

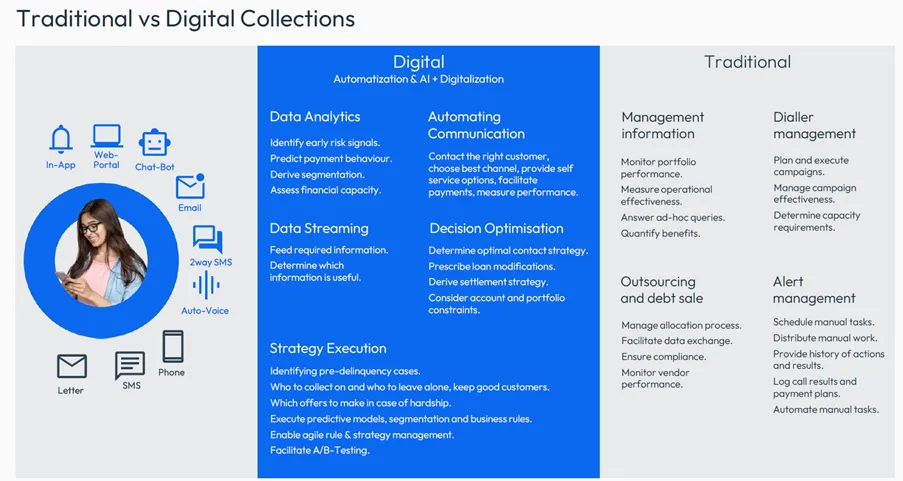

Most organizations begin with descriptive and diagnostic analytics but achieve the most significant value as they adopt predictive and prescriptive approaches. This marks a difference between traditional collections and digital collections.

Benefits of Predictive Analytics in Debt Collection

1. Segment Customers by Risk and Behavior

Instead of treating all overdue accounts the same, predictive models assess repayment likelihood. For example, a propensity-to-pay model can identify customers likely to self-cure, while a roll-rate model estimates the chance an account will move to higher delinquency levels.

2. Optimize Contact Strategies

Analytics helps determine when, how, and how often to contact a customer. Decision optimization also referred to as prescriptive analytics, can recommend whether to use phone, SMS, email, or digital self-service, and even tailor the tone of voice. Studies consistently show that customers who perceive respectful, personalized treatment are more likely to engage and repay.

3. Reduce Costs with Smarter Resource Allocation

By using less invasive communication on low-risk customers and prioritizing high-risk and high-balance accounts, organizations can use their capacity and expensive resources on those customers who matter most. High-cost interventions (like repeated phone calls or legal actions) are reserved for customers where analytics predicts the highest impact.

4. Improve Compliance and Customer Outcomes

With regulations such as IFRS 9 shaping how risk is measured and reported, predictive analytics ensures collections strategies align with compliance requirements. Analytics-driven forbearance programs, for example, can identify customers suitable for payment holidays or restructuring.

Types of Collections Models

Organizations can use multiple models across the collections lifecycle:

- Cure Models – Predict whether an account will return to good standing.

- Propensity to Roll Models – Forecast progression to the next or a higher delinquency bucket, e.g. from 1 day past due to 31 or 61 days past due.

- Propensity-to-Pay Models – Estimate the likelihood of a payment under different scenarios.

- Payment Projection Models – Estimate the expected payment stream over time, guiding whether a certain pay plan modification is expected to be sustainable or whether to collect in-house, outsource, or sell the debt.

- Contact Models – determine the probability of contact for a given channel and time and determine the best time and channel for customer engagement.

- Re-Default Models – Forecast whether a customer is going to redefault after a restructure.

Using these kinds of models enables you to build and execute customer-specific treatment strategies that lead to more appropriate and better targeted treatments, are more efficient and lead both to better collection results and better customer experience.

Using Predictive Analytics in Debt Collections Strategies

Early-Stage Collections

In the 0–90-days past due window, predictive analytics helps determine whether a customer is likely to self-cure or roll forward. Early segmentation allows organizations to apply lighter, digital-first strategies where appropriate, reducing costs, improving customer satisfaction and collection results.

Late-Stage Collections

Beyond 90 days, most accounts show lower cure rates. Payment projection models enable identification of customers whose debt can likely be successfully restructured, help with the selection of the appropriate forbearance tool and can highlight when a case is a “lost cause” and should no longer consume resources.

Personalization in Customer Journeys

Collections analytics enables hyper-personalized journeys, from a gentle SMS reminder to an immediate outbound call. For example:

- Low-risk customers may be directed to self-service payment portals.

- Medium-risk customers may be contacted via multi-channel campaigns.

- High-risk customers may require intensive agent involvement from day one.

Case Studies and Real-World Applications

Faster Rehabilitation of Customers

Traditionally, financial institutions wrote off customers after 120 days past due. Today, analytics reveals that many customers can return to financial health within six months. By identifying these customers early, lenders avoid unnecessary charge-offs and preserve valuable long-term relationships.

Using Transactional Data for Early Warning

Shifts in spending patterns — such as increased cash spending, higher credit limit utilisation or a shift between different spending types — can signal financial distress before delinquency occurs. Predictive models leveraging transactional data help collections teams and customer management teams intervene earlier with appropriate solutions.

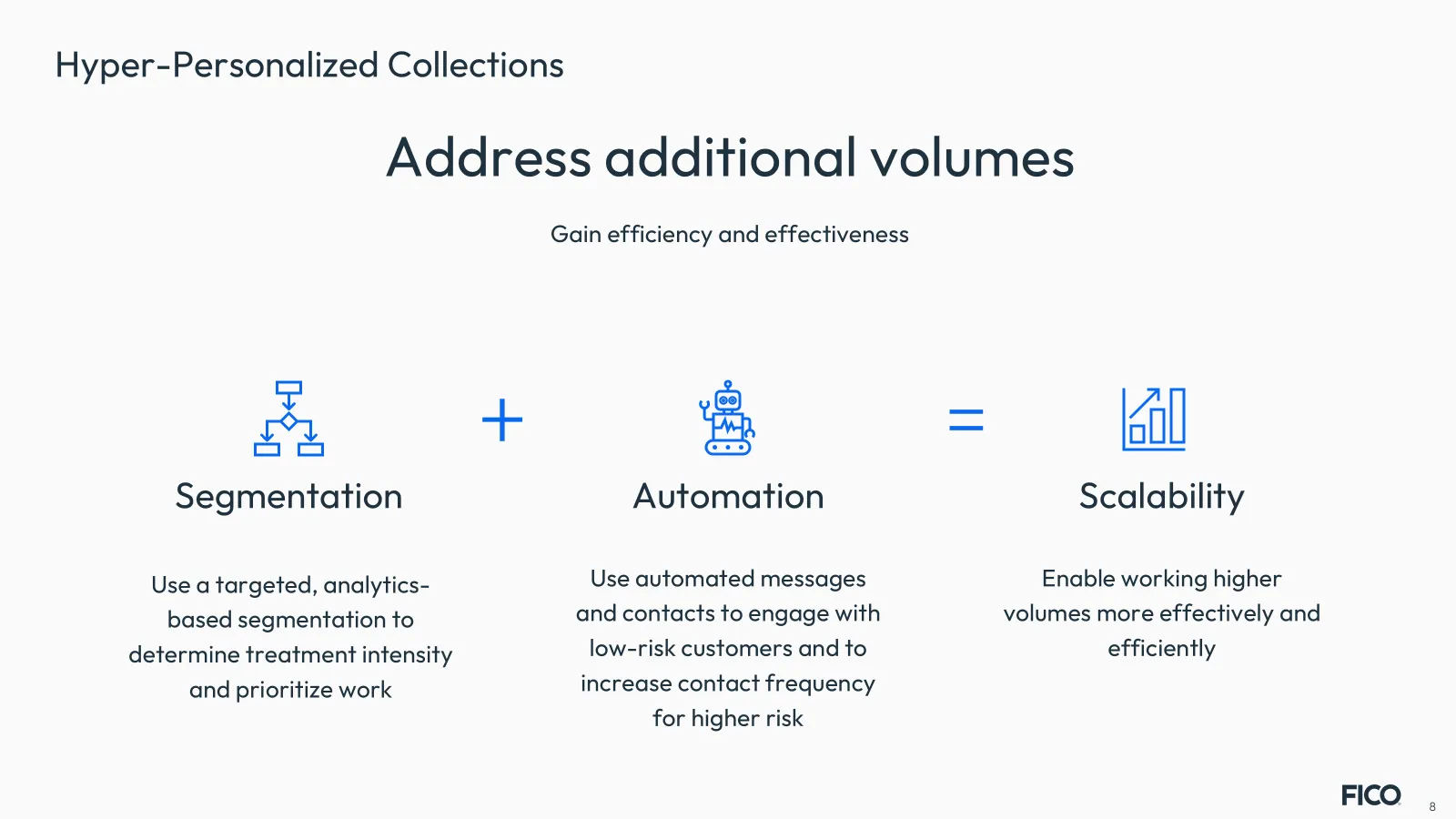

Smarter Segmentation and Targeting

By segmenting portfolios into exception groups (e.g., deceased, insolvent, fraud, the organisation’s own employees) and applying predictive models to the remainder, lenders achieve significant efficiency gains. Instead of a linear effort-to-impact ratio, predictive segmentation allows teams to collect more with less effort.

Regulatory Alignment

Analytics-driven collections strategies help financial institutions to appropriately assess and consider the financial circumstances of customers under financial stress and hence help to comply with fair outcome regulation and the desire to treat customers fairly and appropriate to their financial capacity.

Predictive analytics enable organisations to meet IFRS 9 requirements by aligning provisioning, loss forecasting, and customer treatment strategies.

Predictive Analytics, Prescriptive Analytics and Decision Strategies

Predictive analytics are just one technology that can be used to:

- Automate routine decisions (e.g., sending a payment reminder)

- Reduce human error and bias

- Scale operations without increasing headcount

- Deliver consistent, compliant treatments

- Detect shifts in customer behavior

- Make better and more efficient use of available resources.

These analytics will deliver the most value when they are deployed within advanced decision management systems alongside rules management, omnichannel communications and decision optimization.

Decision optimization, also known as prescriptive analytics, take this even further by looking across an entire business process to find the single strategy, or group of strategies, that are likely to result in the highest level of success. Goals can be simple such as maximising balances cured within a set timeframe and given a certain operational capacity and cost budget. Optimization algorithms also allow a detailed quantitative understanding of trade-offs between competing targets such as balances cured, cash collected, impairment charges, loss rates and operational costs.

Prescriptive analytics allows organisations to balance staff against their respective workloads. They can highlight the opportunity cost of moving staff between specific workloads, or specific activities on cases. Specifically in scenarios with volatile workloads due to seasonality or macroeconomic circumstances, Optimization allows to appropriately re-allocate resources based on analytic insights and avoids ad-hoc decisions driven by gut-feeling.

Prescriptive analytics can use a learning loop to continually ensure results are fed back into collections models, allowing automated fine-tuning of strategies. If customer behaviour, or economic circumstances abruptly change, models can be re-calibrated to stay consistent over time.

Looking Ahead: The Future of Debt Collection Predictive Analytics

As more organizations embrace digital-first operations, predictive analytics will continue to evolve. Key trends include:

- Open banking data and alternative data sets to power analytics, enabling adjustments of credit limits that can be triggered by a customer’s behavioral trends.

- Integration with real-time data streams for more relevant and timely decision-making.

- Ethical AI in collections, ensuring fairness, transparency, and compliance.

Debt collection predictive analytics is no longer optional: it is essential for organizations aiming to improve recovery, reduce costs, and deliver better customer outcomes. By leveraging advanced models, segmentation strategies, and automation, collections teams can move from reactive recovery efforts to proactive, data-driven engagement.

The winners in this new landscape will be those who combine the power of predictive and prescriptive analytics with human judgment, regulatory compliance, and a commitment to customer fairness.

How FICO Can Help You Improve Debt Collection with Analytics

- Watch the video Customer-Centric Debt Collection Is Critical

- Read Nine Steps to Improving Contact Data For Debt Collection.

- See our solutions for debt collection and recovery

- Read Collections Analytics: Are We Missing the Credit Risk Revolution?

- Discover How Loan Restructure Optimization Works

- Understand how to operationalize Analytics for Debt Collections on FICO Platform

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.