How is the Pandemic Driving Digital Transformation in Account Opening?

Top 5 takeaways from FICO 's North American consumer survey on Digital Account Opening

The global pandemic is driving a digital-first mindset for account opening. To measure the impact of COVID-19 on digital transformation in financial services, FICO surveyed 14,000 consumers across 14 countries in 2021 to evaluate customer-willingness for digital account opening. Today, we’ll share the top-five takeaways from our NORAM survey results. And some of them may just surprise you.

#1: There is a voracious global appetite for digital-first account opening.

We found that the COVID-19 pandemic drove a digital-first mindset in financial services, with 71% of U.S. respondents willing to open an account digitally (via app or website). However, the U.S. had the lowest adoption willingness of all countries surveyed. The appetite for digital account opening is highest in growth economies, such as Brazil (95%), Thailand (93%), and Vietnam (92%), while developed economies like Australia (76%), Canada (79%), and the U.S. (71%) had lower appetite.

#2: Digital literacy IS NOT financial literacy.

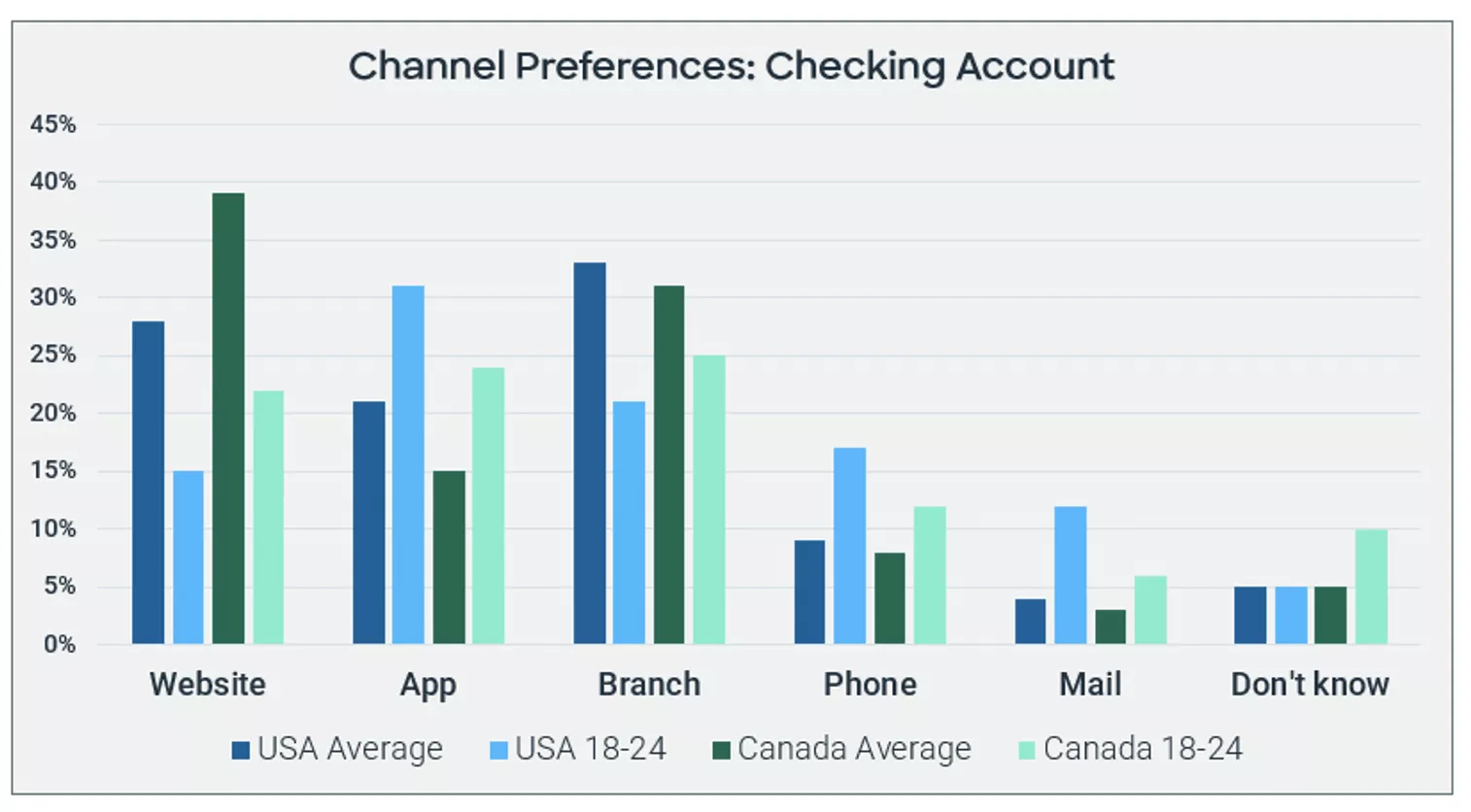

Particularly in the U.S., digital natives might not be who financial institutions think they are. The research uncovered that there is not a definitive preference for opening accounts digitally among young respondents (ages 18-24) as nearly a third (29%) prefer to use slower and friction-filled methods, such as phone call or mail to open a financial account. This trend is not apparent in older age groups (over 65) as only 8% of U.S. respondents in this older age group want to apply by phone call and less than 1% want to use the mail.

Many financial institutions focus on encouraging more senior customers to use digital services and while this is necessary, the research shows that younger customers who are digitally savvy may not be as financially literate.

Our researched showed that less than half of U.S. respondents (49%) under the age of 25 were comfortable downloading a financial institution’s app to open an account. Comparatively, more than half of those over 65 (54%) were comfortable downloading a provider’s app. However, when it came to preferences, collectively across age groups, the older the age group, particularly over 45, the stronger the preference for using a website rather than an app.

The idea of the digitally native Generation Z does not extend to financial services. It is easy to jump to the conclusion that younger people are ready to self-serve and get onboard with digital banking and that older generations need help and education. This survey suggests that it is not that straightforward. Financial services providers should not presume that older age groups aren’t ready to use digital services or that younger customers automatically can.

There may be a case for changing tactics and paying more attention to helping younger customers become more confident with digital financial services. They may be very good with selfies and social networking apps, but they may find banking difficult, intimidating, or unapproachable. There is an untapped opportunity to build financial literacy, empower those just beginning their banking lives, incentive or gamify good behaviors to promote financial wellness, and engage this demographic with value-added services. Capturing this youth market could be a tangible competitive advantage for any bank that develops a compelling way to address their needs.

Intuitive but flexible customer journeys are required. People’s abilities and preferences for carrying out the tasks associated with opening a financial account varies. Some are happy to provide selfies, others can scan documents, while some are more than ready to provide biometric authentication. There is an opportunity to engage and teach. Customers want to master their financial lives. They want content that will teach them how, but they have very high standards. The usual financial literacy webpages just won’t cut it.

#3: DAO Cannot Be Faked: 10 Questions or Less & Delightful Omni-Channel Experiences.

For digital account openings, customer journeys must be intuitive yet flexible as individuals’ preferences and abilities can vary. For example, credit cards (71%), cell phone billing (64%) and personal financial accounts like checking and deposits (62%) were the top accounts that customers were prepared to open digitally. Conversely, hesitancy was present in opening mortgages (24%), personal loans (24%), or “buy now, pay later” accounts (23%) digitally.

When taking steps to open a digital account, for most online accounts, customers were prepared to answer up to 10 questions. If more than 10 questions were present, 50% of customers abandon the onboarding process. Digital mortgage applications were the only exception where 18% of U.S. respondents were prepared to answer 20+ questions, anticipating more rigor and “theatre of security” for mortgages.

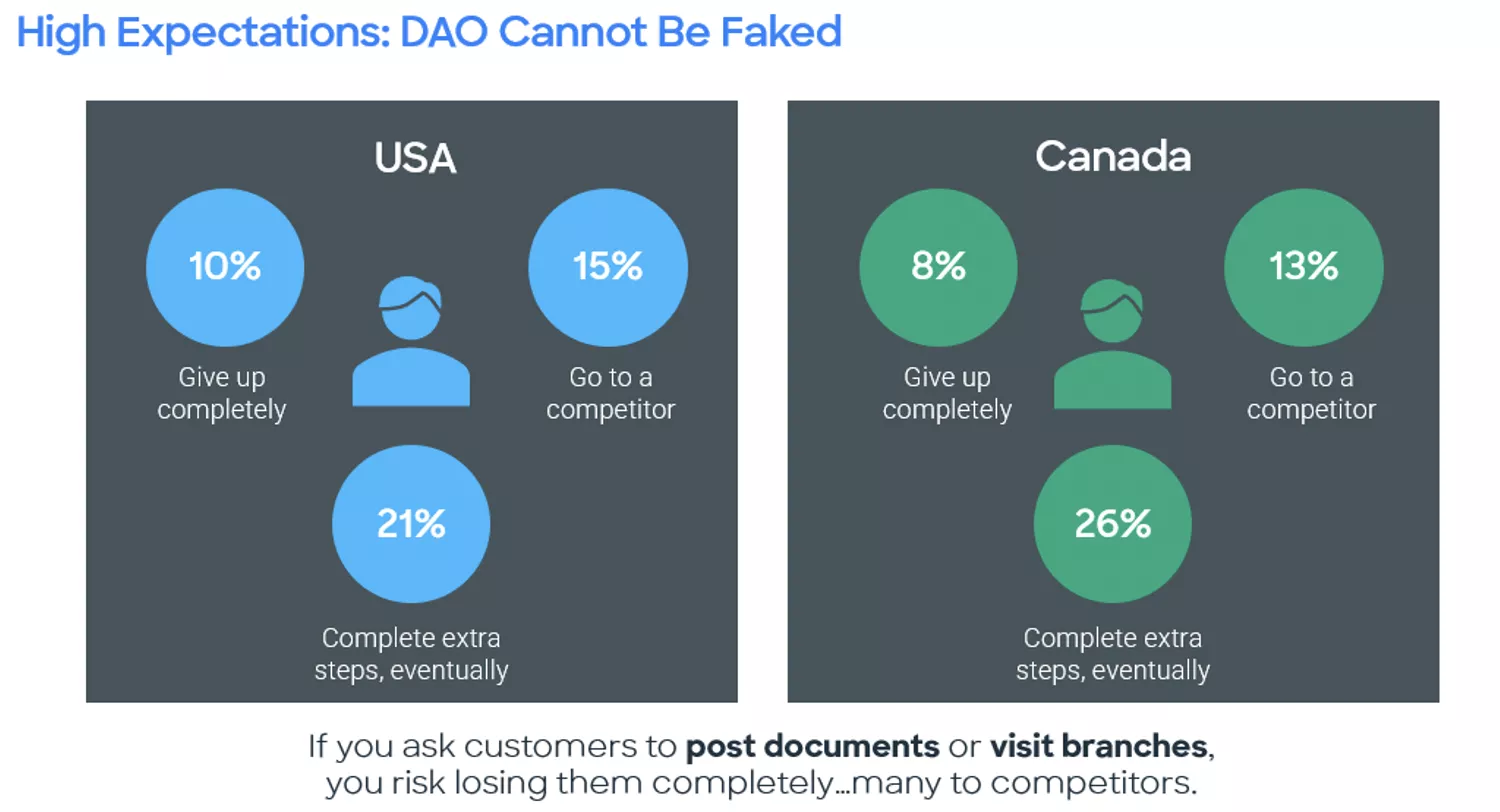

Customers also have high expectations of being able to complete all related tasks for digital account opening via digital channels with 62% of respondents expecting to prove their identity digitally. If asked to move out of digital channels, such as posting documents or visiting branches to complete an application, 10% of respondents give up completely on an application and 15% go to a competitor. Only 21% complete the extra steps, eventually, on a much slower timeline. The friction and disruption results in lost customers—and once they’re gone, they’re often gone for good.

#4: Not All Friction is Bad

While frustrations like too many questions can mean abandoned digital applications, not all friction is bad, as thoughtfully designed points of friction can be extremely valuable for managing risk and making customers feel safe.

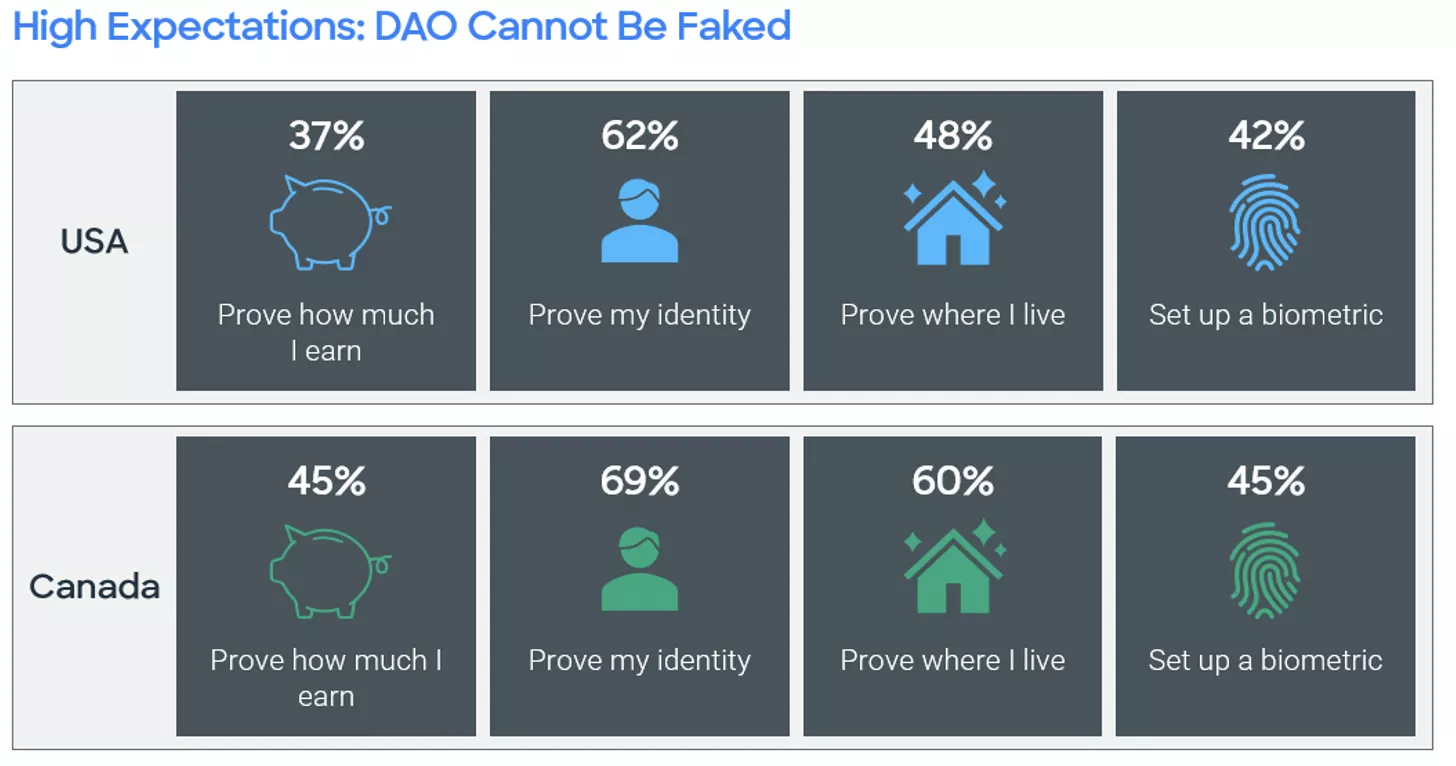

U.S. respondents have high expectations for necessary identity verification. Nearly two-thirds (62%) expect to have to prove their identity when opening an account digitally with more than half (54%) across all age groups confident in their ability to use a cell phone to scan identity verification documents, such as a passport or driving license. Respondents also expected to have to prove where they live (48%), set up biometric identification (42%), and prove how much they earn (37%).

Unintentional friction in the customer experience is always bad. People have a low tolerance for processes that interrupt account openings, and all too often frustrations lead to application abandonment. Assume that customers are impatient and will move on if you make them wait. Save them time by importing data and using pre-fill whenever possible. Your prospects (new-to-bank) are different from your existing customers. Your existing customers expect (and deserve) VIP treatment. Keep learning and improving—compare yourself to your peers AND Apple, UBER, and Amazon.

#5: Digital “lift-and-shift” is NOT a winning strategy.

Digital is an opportunity to build something fundamentally new. Do not carry over analogue assumptions or digitize a legacy, paper-based process. Remember to start with “first” guiding principles. Rebuild how you think about financial services and avoid getting bogged down by technology stacks and risk committees.

The pandemic has drastically accelerated digital transformation. Digital account opening services are “table stakes” for financial institutions to attract new customers or build more robust offerings for existing ones—DAO is a necessity, not a nicety. The focus really should be on providing an engaging, educational, and adaptive customer experience. Customers of all ages want to master their financial lives, and banks can help them do that by meeting them where they are with the value-added services at every financial life stage and opportunity.

Learn more about the North American research findings at:

US FINDINGS:

https://www.fico.com/en/latest-thinking/infographic/us-consumer-survey-digital-account-opening

CANADA FINDINGS:

https://www.fico.com/en/latest-thinking/infographic/canada-consumer-survey-digital-account-opening

11 COMMANDMENTS FOR DIGITAL BANKING:

For more guidance on effective digital transformation in financial services, check out FICO’s 11 Commandments for Digital Banking: https://www.fico.com/en/latest-thinking/ebook/11-commandments-digital-banking

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.