How Student Loan Borrowers Improve their FICO Scores

Student loan debt in the United States has reached an all-time high. Student loan debt can also be a part of a consumer’s financial journey as they look at buying a car, a hou…

Student loan debt in the United States has reached an all-time high. Student loan debt can also be a part of a consumer’s financial journey as they look at buying a car, a house and even into retirement. With April being Financial Literacy month, FICO is exploring the credit behavior of young people with a student loan actively in repayment to determine the behaviors that are driving FICO® Score increases and decreases. How many are exhibiting positive behaviors and driving score increases? How many are exhibiting less favorable behaviors, leading to score decreases?

Using a nationally representative sample, we identified 10 million scorable consumers age 18 to 30 who had a student loan actively in repayment as of October 2016.

Among those within this profile, we found 22% had a significant increase in their FICO® Score 9 between October 2016 and October 2017. We defined a "significant increase" as those with a 40+ point change in score, and termed this group the “score increasers.” Another 15% had a decrease in their score of 40 or more points (“score decreasers”), and the remaining 63% had a relatively stable score change of less than 40 points between the two periods.

To better understand and quantify the financial actions driving consumers with FICO Score increases and those with FICO Score decreases, we looked at the credit behaviors of these two groups of consumers across a variety of dimensions such as amounts owed, on-time payments, and searches for new credit.

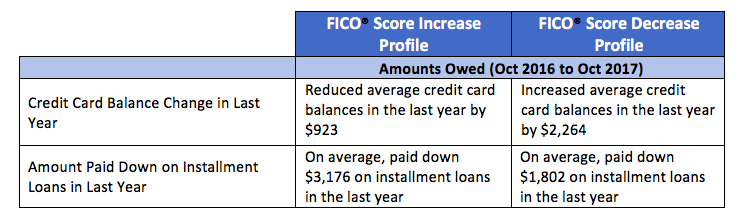

Our analysis found that consumers with score increases were more likely to reduce their amounts owed than those that experienced a decrease in their score. “Amounts owed” makes up about 30% of the FICO score calculation; not having high revolving balances and paying down installment debt are two indicators of a healthy credit profile. On average, consumers who had scores increase reduced credit card balances by 28%, while those whose scores dropped had increased their credit card balances by 78%. Over the course of a year, the average amount consumers who had score increases paid down on installment loans was 76% higher than that of consumers that had a decrease in score.

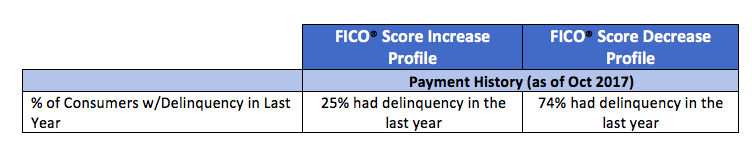

We also found that as of October 2017, consumers whose scores decreased were three times more likely to have had a missed payment in the past year compared to those who had score increases. “Payment history” is the most important category within the FICO score, comprising ~35% of the total score calculation. The FICO score rewards on-time payment behavior, and reflects the risk of those who have frequent missed payments.

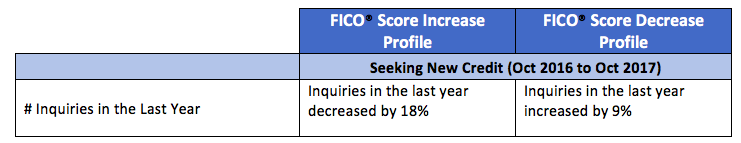

Consumers who saw a score decrease also tended to apply for more new credit during the period evaluated. The number of inquiries associated with a consumer applying for credit increased 9% for them, while inquiries from those who had increased scores decreased by 18%.

FICO research has found that opening several credit accounts in a short period of time represents greater risk of future missed payments- especially for people who don't have a long credit history. The amount of “new credit” a borrower has makes up about 10% of the overall FICO score calculation.

As the data and research have shown, young consumers with active student loans who showed significant score improvement tended to pay their bills on time, pay down debt and apply for credit less frequently. Those whose score decreased tended to have delinquency and to take on more debt.

To successfully manage student financial health, it is helpful to keep three things in mind: pay bills on time, reduce amounts owed, and apply for new credit only as needed. It can seem overwhelming to those burdened with student loans, but the goal of an improved or high FICO® Score is achievable. To learn more about the five factors that make up your FICO® Score, and review educational tools and resources to help you improve your FICO® Score, go to myFICO.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.