How Transactional Analytics for SME Lending Drive Greater Value

Access to the broadest datasets available, investment in the right technology and application of AI and automation can be a win-win for all parties

Even before the impact of the global pandemic started to bite, banks were being asked to help bridge an estimated US$3.4 trillion SME funding gap in unmet trade finance, with demand for funding of small businesses rapidly becoming an acute challenge. It’s a mind-boggling number largely driven by demand for unfilled or rejected trade finance applications tabled by small businesses in emerging markets. The UN in particular was aware of the challenge. Prior to the global pandemic, SME landing was estimated to equate to up to 10% of global merchandise trade.

But now that figure is likely to be far higher. As a result, banks and lenders are acutely reliant on access to the very best data, automation, and technology to help bridge the rapidly widening funding gap. One promising route is transactional analytics for SME lending.

Rejection rates have always been higher among micro-businesses, small and medium-sized enterprises, due to the higher costs of serving customers, higher risk profiles for banks, alongside a lack of traditional data to enable accurate evaluation. As a result, there's a tendency to over-compensate with risk management when lending to SMEs, due to a lack of viable application information, lack of industry knowledge, gaps in financial performance, or missing collateral guarantees.

Know-your-customer (KYC) concerns and the need for more comprehensive information about applicants are among the two top reasons for rejecting SME borrowing. But access to the broadest datasets available, investment in the right technology and application of AI and automation, can be a win-win for all parties.

Using Transaction Analytics to Increase SME Lending – Case Study

Adoption of top-performing transactional analytics for SME lending proved a winner for one Tier-1 bank. Using these analytics allowed the bank to extend up to US$4.8 billion more credit to existing SME customers, while helping further support originations by driving incremental lending of US$580 million to new customers.

The initiative was also achieved without significantly increasing exposure of its credit risk, as the performance of the bank’s credit risk models was increased by more than 10%, when compared to traditional risk models implemented as scorecards.

The lender increased the risk models' performance by combining transactional data and machine learning insights, which helped to drive a significant spike in new SME lending.

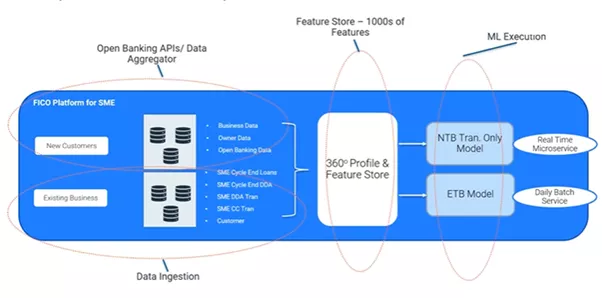

This global bank turned to FICO Platform to develop and deploy the powerful, transaction-based, machine learning predictive models, based on current account transaction data. The models also helped in originations. reducing ‘the time to yes’ for new customers.

The FICO analytic services team designed an automated digital lending solution for the bank using transaction data, driven by machine learning models. FICO Platform hosted the models and provided transaction profiling capabilities to enable real-time lending decisions based on sizeable volumes of data. It also drove the development of a micro-scoring service, which analyses transaction data from Open Banking APIs to assess new-to-bank customers.

How FICO Platform Can Help You Achieve Greater Returns from SME Lending

- Discover the power of FICO Platform to help you drive greater value from lending strategies.

- Learn more about balancing risk, opportunity and reward when it comes to SME lending.

- Find out how technology and transactional analytics can better inform SME risk assessments and process credit applications.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.