Hyper-Personalization Survey Highlights Boardrooms' Blind Spots

New study from Forrester shows the value of hyper-personalization and the gaps businesses face today

Hyper-personalization is now front-of-mind among banking’s boardrooms. It’s also a minimum mandatory expectation among bank customers. Everyone is talking about it, and everyone is doing it — at some level.

The way we all bank has undergone a huge transformation — driven in part through technological innovation and in part through a post-pandemic cultural shift. Customers expect personalized engagement from all businesses they transact with, including financial services.

There's little patience for a one-size-fits-all approach. At the same time consumers are getting far more data-savvy. They know their personal information is valuable and many are reluctant to share it without getting something back in return, be it personalized offers, competitively priced deals, or tailored service.

But are hyper-personalization efforts effective? And more importantly, are customers convinced? Boardrooms know that an inability to deliver is costing in lost businesses — and it has emerged very few are satisfied with their institutions’ performance.

The findings are revealed in Unlocking Hyper-Personalization at Hyper-Scale. It’s a commissioned study conducted by Forrester Consulting on behalf of FICO. Feedback was analyzed from more than 300 senior decision-makers responsible for personalization of customer experience at banks across North America, Brazil, South Africa, UK and Thailand. The results yielded a mass of interesting findings and highlight where critical investments look set to be made within the next 12 months.

More than half of all decision-makers readily admit that hyper-personalization is the critical route to driving improved customer engagement, loyalty and reputation. A significant number also see it as a key building block to culture change, breaking down internal siloes and ensuring informed real-time insights from their deep investments in data.

But gaining a comprehensive 360-degree customer view continues to pose a challenge for many.

Acknowledging Poor Performance and Legacy Systems’ Impact on Personalization

More than one in three (+33%) respondents are dissatisfied with their firms’ abilities to successfully attract, engage, originate, on-board, nurture, or manage new and existing customers.

In fact, accurately understanding or anticipating customers’ needs, managing risk and detecting fraud, are all proving to be critical challenges for more than half (~55%) of all decision-makers polled.

The impact of legacy systems, the continued inability to hire or retain skilled talent, wrestling with compliance and regulatory demands — these are also hampering the ability to meet customer expectations for nearly half of respondents (~45%).

All of these are directly hitting banks' financial performance, competitive edge and their ability to deliver good customer experiences.

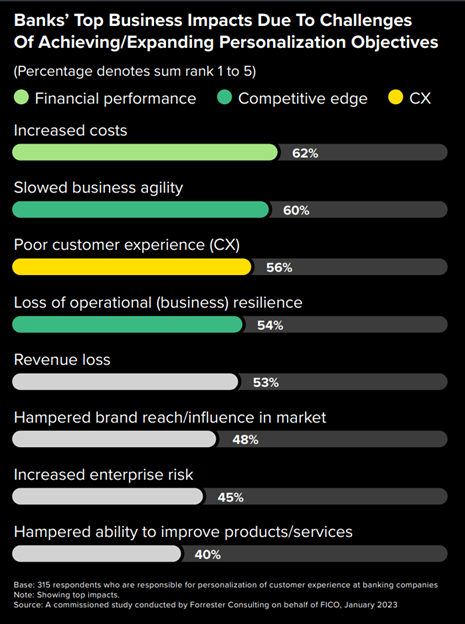

The impacts of failing to meet personalization challenges resonate right across the business, reflected by a mix of direct financial consequences, blunted competitive edge, and poor customer experience. Respondents who failed to fully meet their personalization demands reported seeing increased costs for nearly two-thirds (62%), poor agility (60%), inadequate customer experience (56%), loss of operational resilience (54%) and declining revenue (53%).

Many also admit to being hamstrung by a combination of legacy systems, lack of agility, talent retention and the day-to-day demands of regulatory compliance. As a result, firms are seeing rising operating costs, loss of market share and continued poor customer experience.

Key Impacts Driving Critical Investments

Analysis showed the top priorities for the year ahead among more than a third of the banks polled include ongoing simulation and testing of hyper-personalization strategies on customer data (42%). A similar number (40%), are set to enhance customer engagement through real-time decisioning, while 38% also plan to incorporate more third-party data and services.

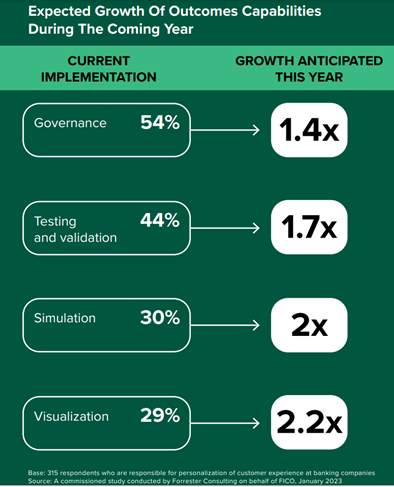

Around a third of all banks are also keen to fill existing gaps in their toolkits. This includes investment in observability tools, execution and asset repository tools, while event management tools to support real-time data streaming and persistence tools, are all key areas of investment. Most notably, these are in simulation, visualization, optimization, contextual processing, composition and orchestration.

Step-Changes in Personalization Programs

Within the next 12 months, the vast majority of banks polled are set to significantly step-up their hyper-personalization programs. Research reveals nearly all (88%) plan to support personalization priorities through the deployment of analytics / machine learning to gather insights.

More than four out of five (82%) will be also supporting personalization programs through achievement of a single view of the customer through accurate and accessible data. At the same time, more than three-quarters (78%) plan to support personalization priorities through enhancement of customer engagement through real-time decisioning. A similar number (70%) plan to support personalization priorities through simulation and testing of personalization strategies on customer data.

Delivering Great Expectations

The impact of better data, insights, action, and outcomes capabilities is expected to make a significant improvement to KPIs. For instance, nearly three-quarters (71%) predict reduced costs, a similar number (69%) expect to see a spike in customer satisfaction, while more than half (+58%) anticipate improved loyalty and retention.

But it’s worth noting that more than half (+50%) of all business leaders surveyed also admit they continue to be hampered by siloed processes and siloed thinking. It’s a trend most prevalent in feature management, external data access and dataflow, contextual processing, decisions, plus the more critical predictive disciplines of governance, testing, visualization and simulation. It’s a near-uniform viewpoint. Significantly, around three-quarters (~76%) of all firms say they plan to invest in and implement all of these areas within the next 12 months.

Read the New Study

This is simply a brief glimpse of what your peers and fellow professionals are telling us. There is a mass of insights readily available in Unlocking Hyper-Personalization at Hyper-Scale.

How FICO Can Help You Unlock the Value of Hyper-Personalization

Contact us today to discuss how FICO can help you assign hyper-personalized offers to each client or consumer in real-time to maximize your sales and improve your customer loyalty and experience. Cloud-based or on-premises FICO AI-powered analytics solutions enable you to fully automate your marketing campaign, quickly respond to business requests, continuously improve marketing processes and develop hyper-personalized marketing strategies.

- Read Unlocking Hyper-Personalization at Hyper-Scale.

- Find out more about How to Unlock the Power of Hyper-Personalization.

- Read Hyper-Personalization and Prescriptive Analytics for Customer Offers.

- Read more on hyper-personalization in the Top 5 2023 Trends Redefining Banking Today.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.