If You Are Reacting to Digital Disruption You May Already Be Too Late

As digital disruption bears down on financial services providers, companies are wise to quickly formulate their customer centricity and decisioning strategies. History is filled w…

As digital disruption bears down on financial services providers, companies are wise to quickly formulate their customer centricity and decisioning strategies.

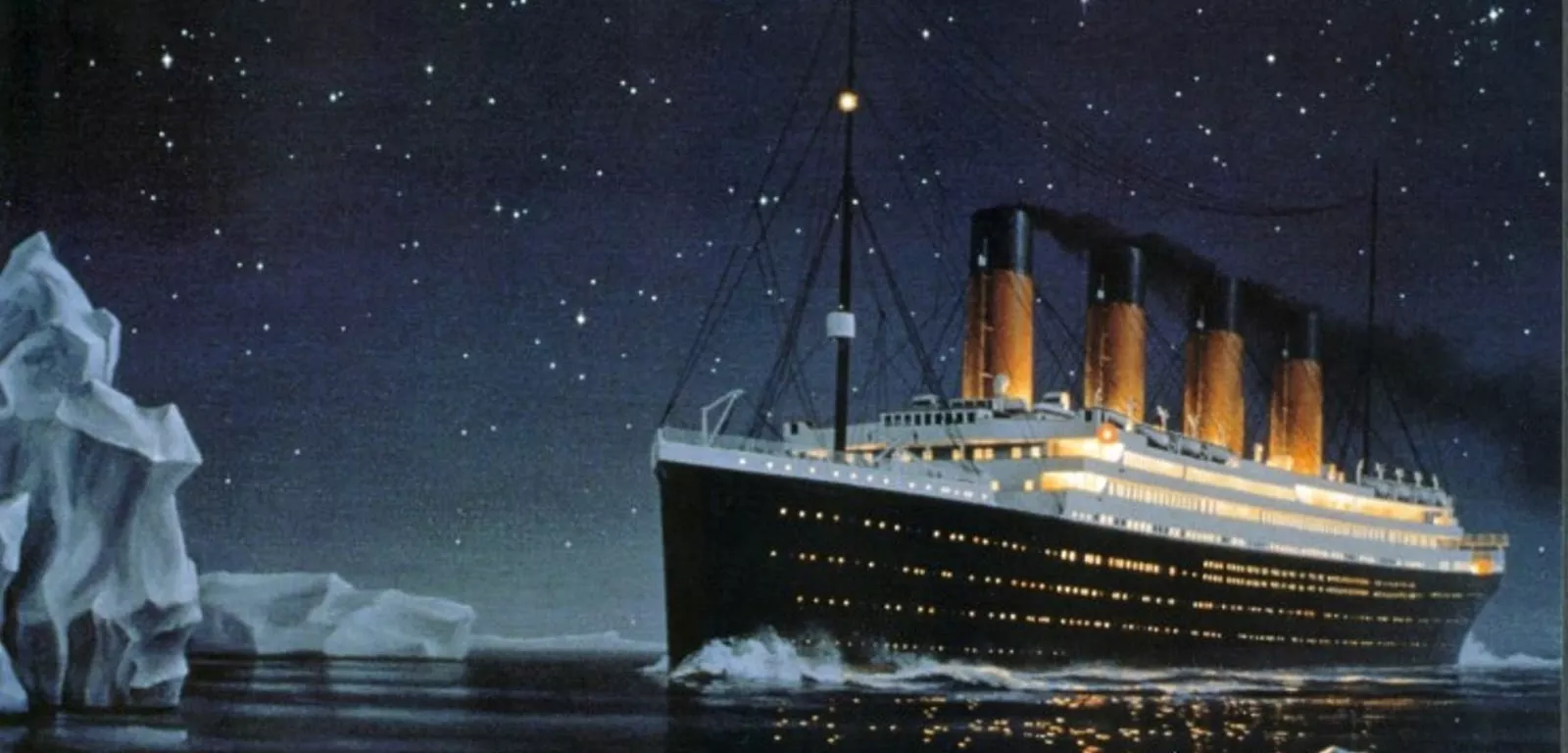

History is filled with calamities and failed responses caused by delayed warnings, ignored alerts, and tragic misunderstandings caused by missed, errant, and too-little-too-late information.

What if the helmsman on the Titanic veered away from the iceberg when he was first alerted, instead of waiting crucial 30 seconds? Or if the workers at Chernobyl aborted their training exercise after seeing the first anomaly in their readings, 32 minutes before the tipping point? Or if a 1914 German-to-Czech translation error between drivers hadn’t caused Austrian Archduke Franz Ferdinand’s motorcade to make a wrong turn… accidentally steering him directly into the path of an assassin, plunging the world into 40 years of world war?

Incorrect and missing data – and worse, information that a company has in its possession, but doesn’t factor into decision making – frequently results in erroneous conclusions, which in turn create blind spots in decisioning. In decisioning, the trick is to keep your ear to the track for incoming threats and opportunities, while staying safely out of path of an approaching train; but limits in visibility can have dire consequences for companies, like a pedestrian stepping off a train platform without first looking both ways.

Sounding the Alarm

In the modern business world, information technology experts are warning their banking and financial services clients about a new threat: digital disruption. Digital disruption occurs when a principally digital service, like Uber, comes along and displaces existing businesses that had dominated the market up to that point. Throughout multiple industries, some formerly very high flyers have had the wax in their wings melted by that unforgiving sun, digital disruption and the disintermediation that follows:

- In consumer products, consider the impact app-rich smart phones have had on electronics manufacturers like Blackberry, Kodak, Garmin, TomTom, Zune, etc.

- In retail, think about the role Amazon and Netflix have had on Borders, Sears, Blockbuster, etc.

- In services industries, ponder what Internet-based services like Uber, AirBnB, and have had on taxi companies, hotels, and travel agents.

Seeing the impact digital disruption has had on other industries, leading analysts like Forrester, Gartner, and IDC – as well as top consulting firms like Accenture, Deloitte, E&Y, and McKinsey – are all sounding the alarm to their financial services clients, advising them to preempt digital disruption and preclude customer defections by self-disrupting: that is, rebuilding their entire businesses to achieve what they call “customer centricity.”

Circling the Wagons

Customer centricity requires companies to transform themselves, their information assets, and their internal processes to achieve a 360-degree historical and forward-looking view of their customers; many experts call this digital transformation, digital disruption’s alter ego. After this transformation occurs, every single customer touch – across the entire product and services portfolio – is optimized to create a customer experience that exceeds expectations for the duration of the customer lifecycle.

The logic behind customer centricity – or, as FICO calls it, Centralized Decisioning – is simple and straightforward:

- Better customer services – made possible by smarter, data-driven engagement strategies – translate to higher customer satisfaction;

- Higher customer satisfaction leads to higher retention, and increased revenue over the lifecycle of the customer’s extended relationship with the financial institution;

- By satisfying and retaining customers, financial services providers can sharply reduce customer defections… and thus, mitigate the threat digital disruption poses by creating a class of customers so loyal, that they don’t see the benefit of defecting.

Getting Started

Implementing a customer centricity strategy begins with six key ingredients:

- Unifying all information across the enterprise, with a scalable decision platform

- Delivering compelling, personalized customer treatments at every touch

- Having strategies, rules and analytics placed in the hands of business users whenever possible

- Make decisions transparent and explainable by repurposing connected decision assets across the customer lifecycle

- Before decisions are put into production, validate and simulate them, using dashboards that display both predicted and compared-to results

- Get technologists and business SMEs on the same page, to operationalize analytics and solve vexing business challenges across the enterprise.

These steps help companies maximize the return-on-decisions across each customer’s lifecycle at all touchpoints across the enterprise. And because financial institutions can access the widest possible range of the freshest data available, they are able to glean actionable insights that can fuel winning customer strategies. By launching those strategies at the most opportune moment across all channels, companies can “strike while the iron is hot,” while maintaining unprecedented understanding of the effectiveness of decisions and actions.

As financial institutions look at their SWOT charts, it’s clear that Digital disruption looms large in the “Threat” column. Thankfully, in the “Opportunity” column, there’s Digital Transformation, and a golden opportunity to be the disruptor, and not the disruptee.

To read more about Centralized Decisioning, including case studies and whitepapers (registration may be required) please visit https://www.fico.com/CentralizedDecisioning

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.