The Importance of a Healthy FICO Score in Retirement

Older consumers are less likely to need new credit for purchases such as a new home, or to have unpaid student loans. So why is it important to keep a good FICO Score?

Older consumers, particularly retirees, are less likely to need new credit for purchases such as a new home or car, and are less likely to have unpaid student loans. So why is it important for those consumers to still have a good FICO® Score?

A good FICO® Score can keep the door open for low-cost credit options in case the need for credit does arise. Furthermore, a consumer’s credit profile and FICO® Score may impact a number of areas beyond credit, such as determining how much of a deposit you have to pay for utilities, and eligibility for certain cell phone plans.

If consumers don’t have some form of credit activity, their credit reports can become stale, with no open and active accounts contributing updated information. When they no longer have at least one account that has been updated within the past six months, a credit-retired consumer will no longer meet the minimum requirements to receive a FICO® Score.

To examine further, FICO conducted research on credit trends in the population at or near retirement age. We used a representative sample of US consumers with at least one account on their bureau file and who had no deceased indicator on file.

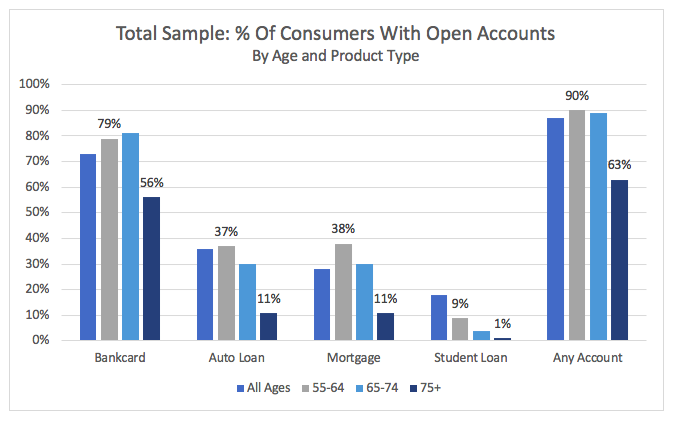

We broke down the percentage of consumers with accounts of various types and across different age groups to identify what types of accounts older consumers tend to maintain. As shown in figure 1, when comparing consumers age 55-64 with those age 75 and older, we found that the proportion that have open accounts decreases from 90% to just 63%. By age 75, fewer consumers have auto loans and mortgages; the percent of consumers with one of these loans falls from the high 30s for age 55-64 consumers to 11% for those 75 and older. Bankcards, while more prevalent, also see a substantial drop: 79% of age 55-64 consumers have at least one active card, compared to 56% of those 75 and older.

Figure 1: % of all consumers in analysis sample with an open account by type and age group

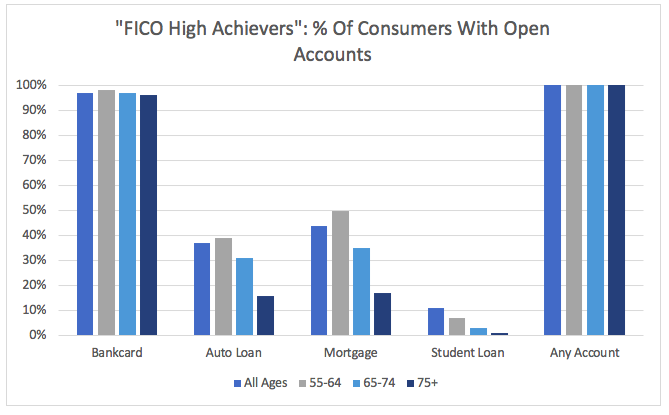

For contrast, we conducted the same analysis focused only on “high achievers”: consumers with a FICO® Score 8 of at least 750. The results, shown in figure 2, highlight the importance of keeping open, active accounts. All consumers in the high achiever group, regardless of age, have at least one open account. Of course, this is not to say that you should apply for an auto loan that you don’t need just to have an account reporting on your credit report. But credit cards, used responsibly, can be a low/no cost way to maintain accounts needed to meet the minimum scoring requirements for a FICO® Score into retirement. As seen in figure 2, while at age 75+ we observe a pronounced decline in the usage of most credit products even among FICO high achievers, there is virtually no decline in open bankcards as consumers age. This suggests that keeping an open credit card is a key strategy used by FICO high achievers to maintain a strong credit profile as they enter and progress through their retirement years.

Figure 2: % of FICO high achiever consumers with an open account by type and age group

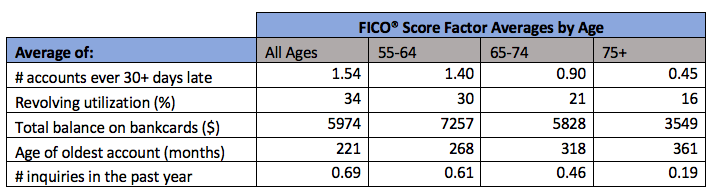

We’ve seen that FICO high achievers are more likely to have open accounts than the general population. Now, let’s explore some of the other characteristics of consumers with high FICO® scores in retirement. Table 3 below contains average values representing a few of the key categories considered by the FICO® Score:

- Number of accounts ever 30+ days late is a reflection of payment history. Failing to pay your bills on time represents higher risk and thus can lower your score.

- Revolving utilization and total balance on bankcards are measures of amounts owed. Having debt burdens that are too high may indicate that you are overextended and therefore higher risk, lowering your score.

- Age of oldest account is one facet of length of credit history. Consumers with a longer credit history are generally lower risk and tend to score higher.

- Number of inquiries in the past year is an indicator of searching for new credit. Opening or seeking a lot of new credit in a short period of time can represent greater risk, and thus result in a lower score.

As we’ve seen in prior research, older consumers tend to score higher than younger consumers, and the figures below reflect this. They typically do better not only on the length of credit history category, but demonstrate lower risk across most others as well, earning them higher FICO® Scores. The statistics in Table 3 support this, as older consumers look better than younger consumers on all dimensions, with fewer late accounts, a lower debt burden, a longer credit history, and fewer inquiries.

Figure 3: Averages on key dimensions, full analysis sample

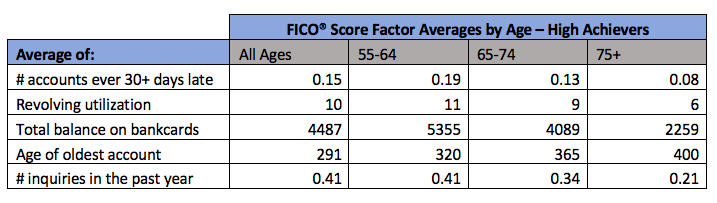

For comparison, Table 4 has the same averages on just the high achiever population. These consumers are better than the broader population on each dimension, but especially notable are average # accounts ever 30+ days late and average revolving utilization. Average # accounts ever 30+ days late falls from 1.54 across all ages to just 0.15, and from 0.45 in the oldest age group to just 0.08. Average revolving utilization drops dramatically as well, from 34% to 10% across all ages, and 16% to 6% for the oldest age group. The degree of improvement in both payment history and amounts owed are consistent with the fact that these are the most important categories of information in a FICO® Score.

Figure 4: Averages on key dimensions, high achiever consumers[

It’s important that all consumers (not just older consumers) use the credit they have responsibly and make timely payments, and avoid overextending by running up too much debt. But for retirees who may rely on retirement savings or fixed income sources, being prudent in credit usage is especially important.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.