Improving Predictive Power with the FICO Score 10 Suite

Analysis showed that the FICO Score 10 suite outperformed the version of FICO Score currently in use.

In 2020, FICO released two new versions of its FICO® Score in the United States — the FICO® Score 10 suite — to help lenders predict and manage credit risk:

- FICO® Score 10 leverages the latest data and modeling methodologies, while remaining backward compatible with previous versions of the FICO® Score

- FICO® Score 10T builds on the FICO® Score 10 framework and incorporates powerful new characteristics (including trended data that captures consumer behavior dynamics over time)

The FICO® Score 10 suite provides lenders with market-leading risk management capabilities for a wide variety of business applications, with more flexibility than ever before.

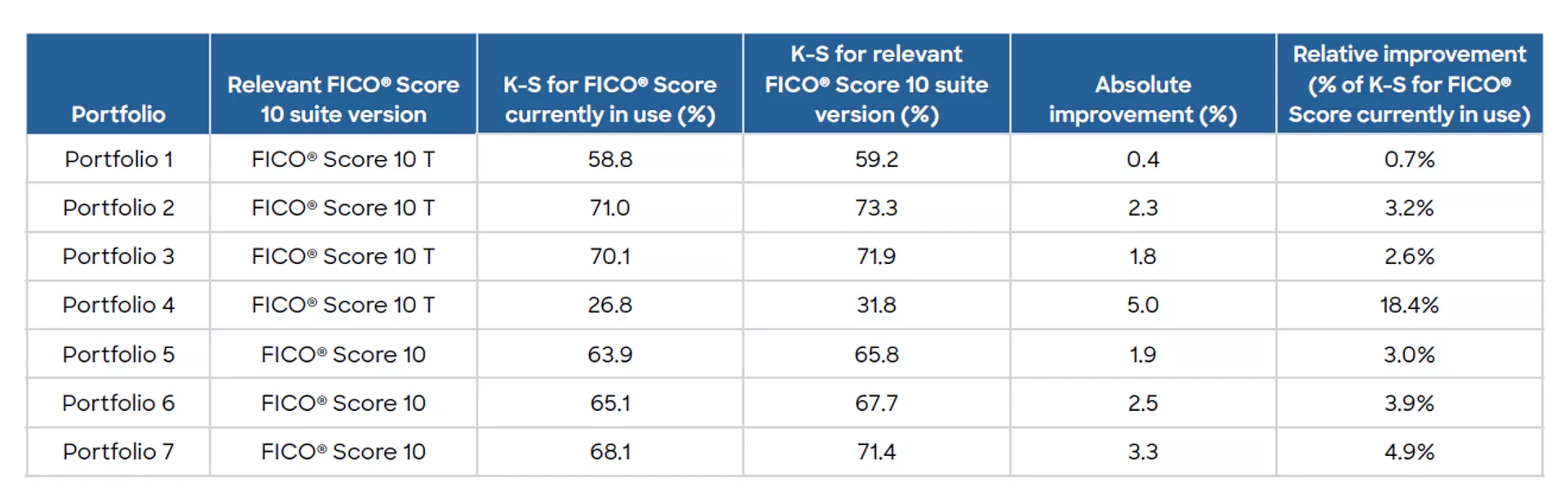

Upon development of the FICO® Score 10 suite, FICO partnered with five lenders to perform retrospective validation analyses on seven of their consumer portfolios, with compelling results. In all cases, our analysis showed that the FICO Score 10 suite outperformed the version of FICO® Score currently in use.

Approach

We evaluated the ability of FICO® Score 10 and FICO® Score 10T to differentiate between borrowers who paid as agreed and those who became delinquent, based on both statistical measures and “swap set” analyses across the full range of FICO® Scores.

Statistical performance

The Kolmogorov-Smirnov statistic (K-S) for each portfolio shows that the relevant FICO® Score 10 version outperforms the FICO® Score currently in use. The improvement varies across portfolios, with one portfolio seeing an improvement in K-S of 18%.

Gini index performance similarly confirms that the FICO® Score 10 suite models provide stronger rank ordering of future individuals who will pay as agreed for all of the portfolios we analyzed.

Swap set performance

FICO® Scores are considered more effective when riskier borrowers have lower scores and less risky borrowers have higher scores.

We performed “swap set” analysis across each portfolio and confirmed consistently improved scoring of individuals near FICO® Score cutoffs commonly used in credit decisions, such as 680 and 740. Borrowers whose FICO Score moved from below to above the chosen cutoff by changing model versions consistently had better repayment odds than those whose FICO Score moved from above to below the same cutoff.

Conclusion

The FICO® Score 10 suite supports more predictive consumer credit risk management. All portfolios we analyzed observed performance lift from use of the relevant FICO Score 10 suite version over its respective FICO® Score currently in use. By adopting FICO® Score 10 or FICO® Score 10T, which both leverage FICO’s latest techniques and technology, lenders have better opportunities than ever to optimize credit risk decisions across their consumer lending portfolios.

Please see the complete results of our analysis in our white paper, “FICO® Score 10 Suite Performance Results from Five Lenders Across Seven Consumer Credit Portfolios."

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.