Insurance Microservices Provide Needed Agility Today

Monolithic architecture hinders the evolution of cloud-hosted platforms — microservices are proving more effective at meeting insurers' demands for agility

Agility is everything right now for insurers. Rising risk exposure, changing personal circumstances and a continually evolving financial picture mean they need to adapt at speed, at scale, as their market dictates - or even quicker.

But many firms are already constrained by siloed insights, data and conventional thinking. Instead, it’s time to embrace new ways of working and doing business, to flex and adapt with changing global markets and customer expectations.

There’s been a lot of talk around adoption of bespoke platforms in insurance – but are they already too restrictive, monolithic, or even fit for purpose? Do they meet the needs of anything other than mass-markets, or on the flip side, the specific niche-uses they were designed for?

Why Insurance Microservices Count in a World of Monoliths

Microservices are precisely segmented processes adopted to replace large legacy applications typically developed to meet the needs of a mass market. The reason for microservices’ growing adoption is the need to build more flexible, independently deployable insurance systems.

Applications are easier to build and maintain when they are broken down into smaller, composable pieces that all work seamlessly together. While each component is continuously developed and separately maintained, the overall application then becomes the greater sum of all these constituent and interactive parts. It flies in the face of more traditional, monolithic insurance applications which were developed, deployed and are maintained as one giant operating system.

By their nature microservices are dynamic, agile, scalable, portable, reusable and more. They are at odds with the insurance industry's reputation for being static and sluggish when it comes to responding to customer demand. Insurers today know they need more flexibility, are hungry to adapt and win a greater market share.

Systems that also support multi-channel distribution and integration with agents and aggregators will typically offer faster times to market, real-time insight, streaming data and analytics, or faster response times for better customer experience.

Any innovations that help disrupt the typical insurance value chain — with new business models, new products, or routes to improved billing, faster claims processing and subsequent pay-outs — are likely to drive growth, while keeping customers happy and loyal.

Insurers Must Balance Rapidly Evolving Market Forces and Emerging Technology

A quickly changing economic picture coupled with the need for increasingly agile back-office systems is driving significant disruption. In fact, many are now obliged to play catch-up to meet the needs and expectations of today’s customers. It means chasing ever-faster times-to-market, resulting in missed opportunities and lost business to more agile peers.

Those that have already invested in predictive analytics to make faster decisions, straight-through processing, integrated design and systems that enhance customer experiences, are already on the front foot.

Monolithic architecture is now deemed a major hinderance to the evolution of new generation cloud-hosted platforms, particularly when microservices are proving more effective at meeting the ever-increasing demands of insurers.

In fact, our strategic clients are increasingly seeing the benefits and advantages of putting more control in the hands of their key business users. Many noted that out-the-box solutions simply failed to offer the flexibility needed to meet their specific industry sector requirements.

Having more control over underwriting models, without the level of restrictions imposed by legacy IT systems, was also a huge area of appeal. Clearly, with fewer IT restrictions, staff are empowered to directly tackle business-specific issues and deliver change in agile manner — at speed and at scale.

At the same time, having a cloud-based technology platform that could grow with them while delivering critical benefits across all business lines and channels offers a significant competitive advantage.

Fractured Customer Experiences Can Be Fixed

More and more insurers are now attempting to decompose their monolithic core into more loosely coupled and manageable components, especially when it comes to rating, underwriting or defining business rules and product models.

But they should also look at the way modern banking architectures and real-time data have become key lynchpins to success in financial services. Top performers are able to scrutinise the value of every consumer, enabling analytics teams to increase revenue by incorporating disparate data sources via digital decisioning, and get a more comprehensive picture of the potential each customer offers.

It’s a route that’s likely to be a win-win for insurers as they will also be able to make the most of improved agility, speed-to-market, automation and scalability.

Cloud-Hosted Platforms Are Empowering Businesses

FICO Platform is already helping firms augment their legacy systems, consume new data sources and rapidly deploy new and emerging use cases to meet changing market requirements.

It’s fair to say digital decisioning has already revolutionized customer experiences for millions across the world, all thanks to a platform approach that lends itself to innovation, agility and interchangeable microservices. FICO Platform empowers teams to readily develop data streaming pipelines alongside new analytically powered applications, which in turn rapidly and cost-effectively deliver the right customer outcomes and a clear return on investment.

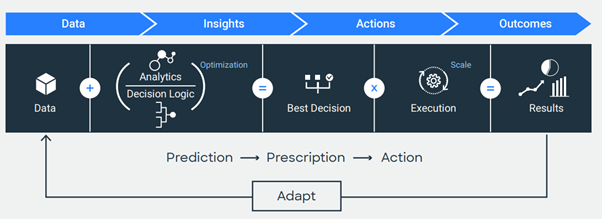

At the heart of FICO Platform are our enterprise capabilities. They're organized into sets of related functionalities that span Data to Insights to Actions to Outcomes — together they enable you to quickly deliver applied intelligence solutions at speed and scale, across the customer lifecycle - regardless of your use case.

How FICO Is Helping Insurers Increase Agility

- Visit the FICO industry-specific Insurance webpage here.

- Read the industry report FICO Enterprise Intelligence Network for Insurance.

- Read the blog Optimization and Automation Point the Way for Insurance Claims.

- Read the report Digital Insurance Special Report: Hastening the Speed of Change.

- Accelerating The March Towards Digitization in the Insurance Industry: Part I.

- Accelerating The March Towards Digitization in the Insurance Industry: Part II.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.