Mobile to the Max

Protecting Customers from Fraud

Welcome to another instalment of “Confessions of a Payments Professional.” This week’s reveal: prior to March 2020, I had never used the mobile deposit feature of the banking app on my phone. Since then, I’ve deposited nearly a dozen checks using this nifty capability. What does it mean? First, I still get a lot of paper checks. Second, after I figured out how to use mobile deposit the first time, I asked myself, “Why did I ever go to the bank? Mobile deposits are so easy!”

I’m not alone. Mobile banking and payments activity has surged globally since March 2020, driven by factors including temporary bank branch closures and a rise in contactless payments. For example, in May 2020, 50% of U.S. consumers reported using contactless payment methods at least four times, with 69% agreeing contactless payments were more convenient than cash. Many stores are encouraging customers to use contactless as much as possible to reduce the spread of coronavirus.

With consumers now transacting so much more through their phones, how can banks protect their customers from fraud and help their customers to protect themselves? In this mobile-centric “newfound normal,” both parties must monitor inflows and outflows. Below are some strategies and tips.

How Banks Can Protect — and Please — Customers

Let me get back to my mobile deposit revelation. After I made the deposit I got an acknowledgement message through my banking app, letting me know the deposit would need to be validated before crediting my account and making the funds available. To be honest, that was a little disappointing. The deposit experience was so magical that I expected using the funds to be as quick and easy. But I had to wait until the next day.

Given the instant gratification consumers (including me) have become accustomed to when transacting on their phones, banks need to balance the immediate availability of funds with the customer’s overall risk profile. In deciding when to make funds available, banks must take into considering all of the customer’s different types of transactions and activity:

- What other inflows are there?

- What are the outflows and transfers between the customers’ accounts?

- What other activity is there from the mobile app — are there failed logins?

- Is the customer logging in from a new device?

And so on and so forth. The point is that banks need the flexibility to look at all of these activities and make a decision on funds availability in a time frame that matches the customer expectations. Many consumers probably have the same reaction I did: if I just scanned and deposited my check, why can’t I immediately pay someone?

Monitoring mobile outflows and inflows is best accomplished with a fully integrated solution. Mobile deposit should be just one of the transaction types; ideally, all banking interactions—including credit applications, card transactions, P2P payments, retail banking and non-monetary transactions—should be monitored, to assemble a complete and more contextual view of customer behavior. In this way, transaction patterns can be used to make real-time decisions on funds' availability and potential fraud in the context of all customer behaviors.

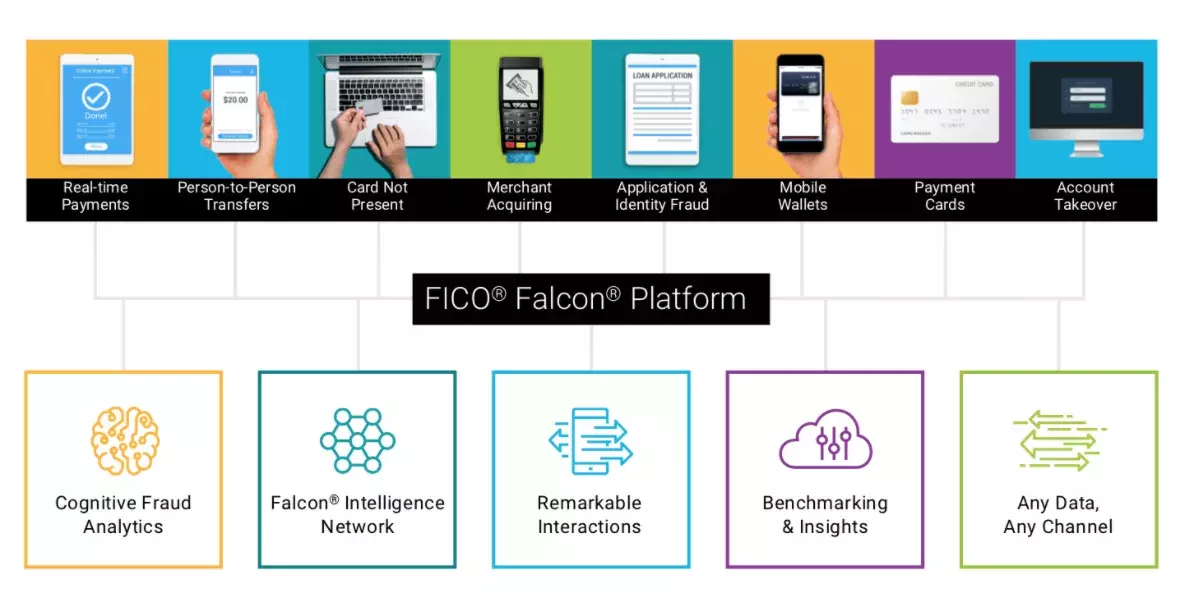

Contextual decision-making capabilities are already in place at banks that use the FICO® Falcon® Platform for fraud management, which comes with built-in functionality for real-time payments, person-to-person payments, card not present transactions, application and identity fraud, mobile wallets, payment cards account takeover and more.

Leading banks worldwide use the FICO® Falcon® Platform to gain a contextual, 360-degree view into customer activity.

Beyond the Falcon Platform’s core decisioning capabilities, many institutions are adding a frictionless layer of security to mobile transaction with behavioral, biometric and multi-factor authentication. Keystroke analysis and device telemetry offer frictionless verification of legitimate customers, while machine learning-driven risk scores trigger step-up actions based on an organization’s fraud detection thresholds. The FICO® Falcon® Authentication Suite includes all of these capabilities, as well as tokens, one time passwords, facial recognition and voice biometrics.

How Consumers Can Protect Themselves

As new consumers flock to online deposits and real-time P2P payments, they should take extra care to protect themselves when using unfamiliar technology. A case in point: last year a friend started using Square Cash to pay for her daughter’s participation in soccer tournaments, sending a payment of $1,000. When the team mom — let’s call her Jennifer Wilson — asked my friend why she hadn’t yet paid, my friend discovered that she’d sent the money to the wrong Jennifer Wilson! Since there was no way to reach customer service at Square Cash about this issue, my friend had to file a fraud claim with her bank. Eventually she got the money back.

Here are some easy ways that consumers can protect themselves from mobile fraud.

- Take a few minutes and check activity every day on your mobile banking app. Report any suspicious transactions immediately.

- While you’re there, set up alerts on your banking app. Take advantage of notification features in mobile banking apps to keep on top of checking account activity. You can set your preferences to be notified of all manner of transactions, including online and mobile payments made, balance alerts and notifications of transactions over a certain threshold. For more information on how to avoid fraud in the real-time payments world, read my recent post.

Consumers are having to confront all manner of changes to their daily lives, not the least of which is how they move money in and out of their bank accounts. With so many customers new to mobile banking and transacting, banks should remind consumers about the different features and protections that are available. At the same time, banks should review their fraud strategies and make sure that all mobile transactions are seamlessly protected with advanced fraud detection. It’s all possible as consumers worldwide take “mobile to the max.”

Keep up with my latest fraud-fighting thoughts on Twitter @FraudBird. And, to learn more about FICO’s secure solutions for identity proofing and authentication, read my colleague Liz Lasher’s post on this topic.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.