More Than 232 Million US Consumers Can Be Scored by the FICO Score Suite

Using alternative data, FICO® Score suite delivers more reliable credit scores

Based on the 2020 US Census, the US credit-eligible population (those over 18 years of age) is 258 million people. But how many of those consumers can obtain a FICO® Score?

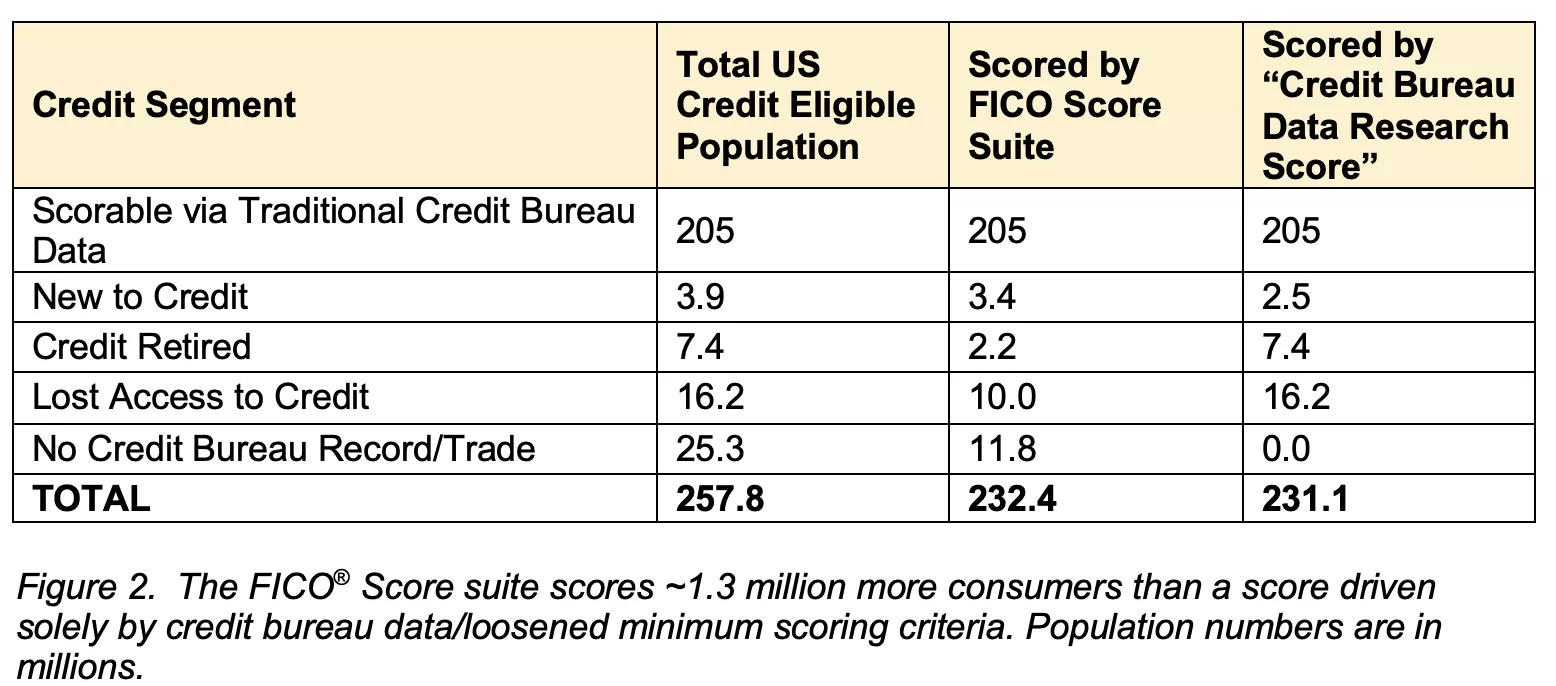

Calculations by FICO data scientists indicate that more than 232 million US consumers can be scored by the FICO® Score suite. That is 90% of the credit-eligible US population.

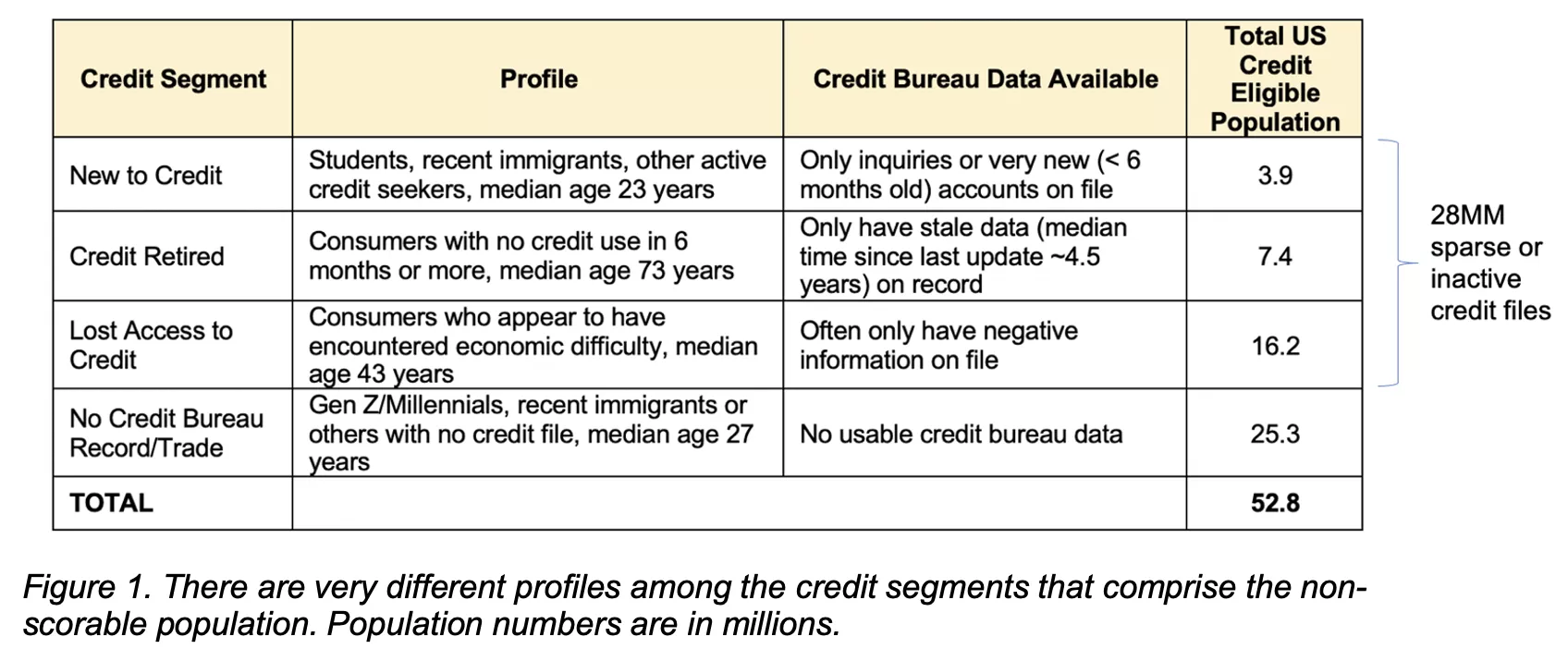

For most of the credit-eligible US population there is sufficient traditional credit bureau data available for calculating a FICO® Score. However, some 28 million consumers have minimal data available in their traditional credit bureau files, and another 25 million are considered ‘credit invisible’ and have no traditional credit bureau data at all. As shown in Figure 1, the profiles of these consumers that lack sufficient traditional credit bureau data can be quite varied.

To responsibly and reliably score consumers with sparse or no traditional credit bureau data requires a novel approach to credit scoring. Over the past decade, FICO has been developing innovative new scores – like FICO® Score XD and the UltraFICO® Score – which augment traditional credit bureau data with rich alternative data, such as telecom, utilities, public record, and checking account data.

With the introduction of these scores, the FICO Score Suite can now deliver reliable credit scores for more than 27 million additional people!

For comparison, we created a benchmark score that was built using only credit bureau data but that scored more people by loosening the FICO minimum scoring criteria (which results in scores being calculated even when the only data available is very sparse or stale). We refer to this benchmark score as the “Credit Bureau Data Research Score.” When we compared the suite of FICO® Scores to the “Credit Bureau Data Research Score” we found that FICO scores more people. Over one million more, to be precise.

FICO scores more people, and we do so by responsibly leveraging additional, powerful alternative data sources. There’s more to the story, though. As seen in Figure 2, not only does the FICO® Score suite deliver scores on more consumers, but the consumers we do score (relative to the “Credit Bureau Data Research Score”) are more likely to fall in the “new to credit” and “no credit bureau record/trade” segments. These segments tend to be early in their credit journey, with a strong appetite and need for credit.

By contrast, our findings show that the “Credit Bureau Data Research Score” disproportionately scores more consumers in the “credit retired” segment, which are typically individuals that are far along in their credit journey and have less interest in obtaining credit.

The “Credit Bureau Data Research Score” also disproportionately scores more consumers in the “lost access to credit” segment. This segment is unlikely to benefit from having a credit score based solely on traditional credit data, which consists largely of past blemished credit. Without positive alternative data flowing into their files to offset the negative data in their traditional credit files, these consumers will likely score too low to obtain credit. To illustrate this point, only 3% of the “lost access to credit” segment would be assigned a “Credit Bureau Data Research Score” above 620. These consumers are stuck in a catch-22. To obtain credit, they have to be using credit, but without a reliable way to assess credit readiness, lenders may turn them away. This is where FICO’s approach to scoring over 27 million additional consumers sets us apart.

By leveraging powerful and relevant alternative data that provides a more complete picture of borrower credit risk, the FICO® Score Suite helps to identify those previously non-scorable consumers who are both ready and able to take the next step in their credit journey.

For more information, visit: https://www.fico.com/en/latest-thinking/infographic/expanding-credit-access-alternative-data-fico-scores-more

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.